In this article, we will discuss about one such credit card of Axis Bank which is in high demand these days. This credit card is Indian oil credit card of Axis Bank and in many cases it is considered a good credit card of Axis Bank. Now, as the name of this credit card suggests, it is a co-branded credit card of Axis Bank with Indian Oil and most of the benefits available in this credit card will be related to fuel.

Now you can guess yourself how much importance fuel has in our life. Now in today’s time, there will be very few houses which fall in the category below lower middle class, in which there is no vehicle running on petrol or diesel. We definitely consume fuel in our daily life, the only difference is that some use more and some use less. Therefore, in a way, we can say that this Axis Bank Indian Oil Credit Card is a credit card which is beneficial for everyone.

If you also want to know whether I should take this Indian Oil Credit Card or not, then you will get the answer before finishing this article. Because here we will answer all the common questions related to this credit card so that you can reach a final decision.

Quick Overview of Axis Bank Indian Oil Credit Card Features:

Axis Bank Indian Oil Credit Card  | |

Joining Fee | ₹500 |

Annual Fee | ₹500 from second year onwards |

Annual Fee Waived Off | Annual spends of ₹50,000 |

Reward Points |

|

Capping the amount of reward points | Maximum spend Rs. 5000/Month |

Benefits On IOCL Outlets | 4% value Back on fuel Trans. |

Maximum amount for reward points | Maximum spend Rs. 5000/Month |

Welcome Benefit | 100% Cashback upto Rs. 250 on Fuel |

Dining Benefits | Upto 15% discount on partner restaurants |

BookMyShow Benefits |

|

What is Benefits of Axis Indian Oil credit card: Detailed Overview

Welcome Benefit:

Whenever you get this Indian Oil Credit Card issued, you will get 100% cashback on the first fuel transaction you make at an Indian Oil pump with this credit card within 30 days. Now the term and condition for this offer is that you will get maximum cashback up to ₹ 250 only and you will get this cashback only on the first fuel transaction.

For example, if you do the first fuel transaction of ₹ 500 with this Axis Bank Indian Oil Credit Card within 30 days, then you will get a cashback of ₹ 250 only and if you do a fuel transaction of ₹ 100, then you will get a cashback of ₹ 100 only. .

Reward Points:

- In this credit card you get 4% value back on all IOCL Petrol Pumps. Now within 30 days you will get 100% cashback on your first fuel transaction and apart from that you will get 4% value back on your every fuel transaction forever. Now there is no validity of this 4% cashback, you will keep getting it for life time.

- Now there are some credit card terms and conditions for this benefit also. Through this credit card, you can avail this 4% cashback only on a maximum of ₹ 5000 in a month at all Indian Oil Petrol Pumps. This means that through this offer you can earn a maximum cashback of ₹ 200 in a month because 4% of ₹ 5000 is only ₹ 200.

- Now apart from this, this credit card provides you 1% cashback on all your online shopping. Now Axis Bank has not mentioned any maximum amount or maximum cashback for this, hence we will consider it as unlimited. And for this, a small term and condition of Axis Bank is that your transaction value should be between ₹ 100 to ₹ 5000, only then you will be eligible for this 1% cashback.

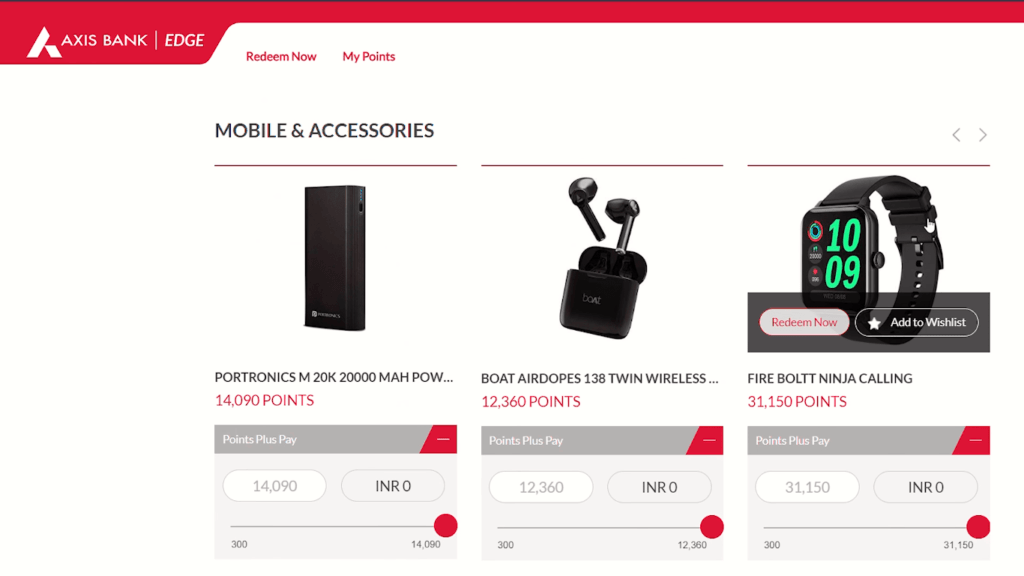

- You can also earn Edge Reward Points from Axis Bank with this credit card. Through this credit card you will get 1 Edge reward point per ₹100. In this way, your Edge Reward Points will be accumulated separately and to redeem these Edge Points, Axis Bank has created its own separate Edge Platform from where you can purchase anything in exchange for these Edge Points.

Joining Fee And Annual Fee:

Now there is a lot of confusion regarding the joining fee and annual fee of this Axis Bank Indian Oil Credit Card because sometimes Axis Bank makes this credit card lifetime free and sometimes starts charging money for it. Now at the time when we are writing this article, the joining fee of this credit card is ₹ 500 and you have to pay the annual fee of ₹ 500 from the second year onwards, the annual fee for the first year is waived off.

If you spend ₹ 50,000 on this credit card in 1 year, then your annual fee of ₹ 500 will also be waived off.

Apply Axis Indian Credit Card before the exclusive offer ends

Eligibility Criteria:

The primary cardholder must fall within the age bracket of 18 to 70 years, while an add-on cardholder should be at least 15 years old. The applicant must either be a resident of India or a Non-Resident Indian (NRI). It’s important to note that these qualifications serve as guidelines, and the final decision to approve or decline applications for the Indian Oil Axis Bank Credit Card rests with the bank.

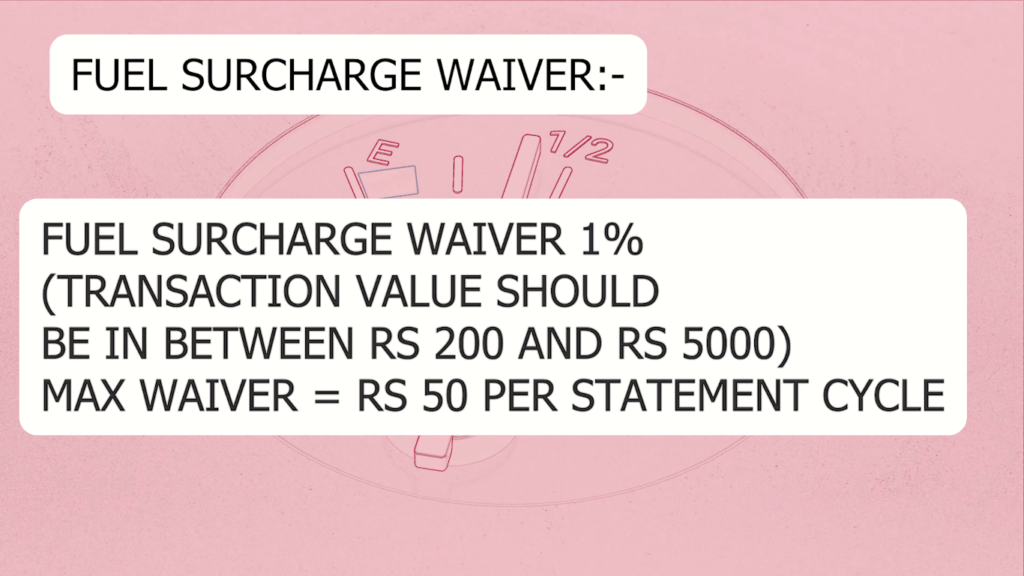

Fuel Surcharge Waiver:

In this credit card you also get 1% fuel surcharge waiver which you get in every credit card. Now this feature is not a feature that you get to see only in this credit card, but you will get to see it in every small credit card. For this, a small term and condition of Axis Bank is that for this your transaction value should be between ₹ 200 to ₹ 5000 and you can get a maximum fuel surcharge waiver of ₹ 50 in a month.

BookMyShow Benefit:

Through this Indian Oil Credit Card, you get up to 10% discount on your movie tickets on the BookMyShow app or website. But you get this offer only on BookMyShow. Now the term and condition for this is that you can get a maximum discount of ₹ 100 in a month and this 10% off offer will remain valid till 31st March 2024. You can access the full terms and conditions of this offer from here.

To avail this offer on BookMyShow, you will also see this credit card discount offer in the discount section above on the BookMyShow app or website or when you go to the check-out page of movie tickets, there you can select ‘Unlock Offer or Apply Promocodes’ and enter your credit card number to grab this offer.

Dining Benefits:

On this Indian Oil Credit Card also you get dining benefits like all the credit cards of Axis Bank. You get 15% discount on payment through this credit card at all partner restaurants of Axis Bank. But to avail this offer, you have to book your restaurants through EazyDiner only.

Now the terms and conditions of Axis Bank for this are that the minimum value of your order should be Rs 2500 and you can take a maximum of Rs 500 off in a month.

Apply Axis Indian Credit Card before the exclusive offer ends

Final Words:

In this article, we have discussed in detail almost all the features of Axis Bank Indian Oil Credit Card and by now you must have understood whether the credit card is beneficial for you or not. You do not get any premium features in this credit card, but according to its joining and annual fees, you get good cashback reward points in it. And it is certain that this credit card is very beneficial for the people with high fuel consumption. But in the end we would like to tell you that whatever credit card you take, you have to deal with it with high maturity and you must have financial literacy about credit cards.

FAQ:

- Who is eligible for Axis Indian Oil card?

Primary cardholder: Age 18 to 70, resident of India or Non-Resident Indian (NRI).

Add-on cardholder: Minimum 15 years old. Approval decision by the bank. - Does Axis Indian Oil Card have lounge access?

No, you are not given the facility of any Lounge Access in Axis Indian Oil Credit Card.

- Is it good to have a fuel credit card?

Yes, if you regularly spend on fuel, the card offers cashback, surcharge waivers, and rewards specifically for fuel expenses, making it beneficial.

- Can we use the Indian oil credit card for shopping?

Yes, it offers 1% cashback on online shopping within a specific transaction range.

- Is a fuel card cheaper?

The cost-effectiveness depends on your fuel spending habits and how you utilize the benefits against associated fees and charges.