If you deposit as much cash as you want in your bank account without any thought and that too without any schedule, then are you inviting a notice from the Income Tax Department? If you also do cash deposits or other unlimited transactions in your savings account without knowing its limit, then this article is going to be very useful for you. Because in this post we will discuss about Cash Deposit Limit In Saving Account and Other Essentials Limits which can save you from the notice of Income Tax Department.

After discussing UPI Transaction Limit, today we will discuss Savings Accounts Limits, Fixed deposit (FD) Limits and Cash Deposit Limit so that you can avoid Income Tax Scrutiny. We will talk about all these in detail one by one and try to make your Financial Literacy stronger.

Now here a question may come in your mind that how will I tell you about all these things and from where will I get all these data. So we would like to tell you that all the Cash Deposit Limit, FD Limit mentioned in this article will be available to you in this Understanding Statement of Financial Transaction Notice of the Income Tax Department. And all the information that I am going to give you in this article, you will get it in this notice.

But there are a lot of pages in this notice and it is a bit difficult to find all these limits, so we have presented all this for you in very simple language. Overall, I will cover all the topics included in this notice of our work in this article.

Understanding Required Limits in Savings Accounts:

Cash Deposit Limit In Saving Account:

According to this SFT notice of the Income Tax Department, if you want that you do not get any income tax notice, then you can deposit a maximum of Rs 10 lakh in your account in a year.

To avoid income tax notice, you can deposit a maximum of Rs 10 lakh in a year in your savings account and can withdraw a maximum of Rs 10 lakh only.

Now, instead of Rs 10 lakh, you can deposit Rs 20 lakh or Rs 30 lakh. But if you deposit more than Rs 10 lakh in your account in a year, then you may receive a notice from the income tax authorities after which you will have to tell them the source of your money and if all these money are your proper source of income then there is no need to worry.

If you are filing ITR (Income Tax Return) of Rs 25 lakh in a year and you are depositing Rs 20 lakh in your account, then you do not have any problem in this case but if you file ITR of Rs 5 lakh and you deposit Rs 15 lakh in your account, then in this case you may have to face penalty.

Single Transaction Limit in Saving Account:

Under the Income Tax Department, if any single transaction in your account is more than Rs 2 lakh, then you can declare its source as Income Tax.

Now here 10 lakh rupees does not mean that you can deposit 10 lakh rupees in your account at once, even if you do this, you may get Income Tax Notice. If you deposit this limit of Rs 10 lakh in one year in small pieces then there is no problem.

Maximum Balance Limit In Saving Account:

Now many people also have this question in their mind that what is the maximum balance I can keep in my savings account? So the answer is No Upper Limit. You can keep as much balance as you want in your savings account, but you must have a source of fund for this balance.

Now the thing to understand here is that if you have been saving Rs 2 lakh in your account every year for the last 10 years and today your balance with interest is Rs 22 lakh, then in this case you will not get any income tax notice because you have collected this amount little by little for a long time, but if you deposit Rs 22 lakh in your account in a single year, then you may have to answer for it.

On how old transactions can Income Tax Notice be issued?

Now if you are wondering on how many old transactions the Income Tax Department can send you a notice, then let us tell you that the Income Tax Authority can send you a notice on the transactions of 8 years in your account.

Therefore, if you do any higher limit transaction in your account today, the Income Tax Department can ask you about this transaction anytime for the next 8 years.

Maximum Saving Accounts Limits For No Income Tax Notice:

Now many banks keep offering 0 Balance accounts from time to time and when a single person opens his account in many different banks, then the question that comes in his mind is, what is the maximum number of Savings accounts I can open?

So the answer to this question is that Income Tax mentions that there is no upper limit on the number of savings accounts you can open. This means that you can open as many savings accounts as you want as long as you are not doing any wrong activity by opening these multiple accounts.

Now multiple accounts have some advantages and some disadvantages too, let us know about them –

Upsides of Multiple Bank Accounts:

- Advantage of Discounts offered by different Banks. Many times, while shopping, we keep receiving offers from different banks, so if we have multiple accounts from multiple banks, we can easily avail all these offers.

- Reduce dependency on one bank – Sometimes the bank server goes down. Many times our very important transactions get stopped due to our bank’s server being down. If we have an account with any other bank, then we can do that transaction through that account.

- Reduce risk of fraud – Many people keep Limited funds in one bank account. If we have only one bank account and we have saved all our money in it and if by mistake any fraud happens to that account, then all that money will be stolen. But if we have multiple bank accounts there and we deposit this money divided among all those accounts, so if any fraud happens with any bank account in the future, all our money will not be stolen at once.

- DICGC Benefit – The subsidiary body of RBI gives insurance of Rs 5 lakh to each bank customer. Now DICGC says that if tomorrow your bank goes bankrupt due to some reason then we will refund upto Rs 5 lakh of each customer as per the bank balance. Now if you have ₹ 10 lakh deposited in any bank account and that bank goes bankrupt, then you will get a maximum refund of ₹ 5 lakh only under DICGC. At the same time, if you divide your Rs 10 lakh and deposit it in multiple bank accounts and even if by mistake one of the banks goes bankrupt, then you will be refunded your entire money by DICGC.

Downsides of Multiple Bank Accounts:

- Maintain Minimum Bank Balance – if 0 balance then also you have to debit card annual fee. If you open multiple bank accounts, you will have to maintain minimum bank balance in all of them. But if you open a zero balance account then you will not have any problem in it. Along with this, you will also have to pay the annual fee for the debit cards of all these bank accounts.

- Trouble to track multiple bank accounts – One of the disadvantages of having more than one bank account is that we are not able to track them properly, how many transactions are done in which bank account and how many limits we have got in them.

- No control on Expenses – The drawback of multiple accounts is that we are not able to track our expenses properly.

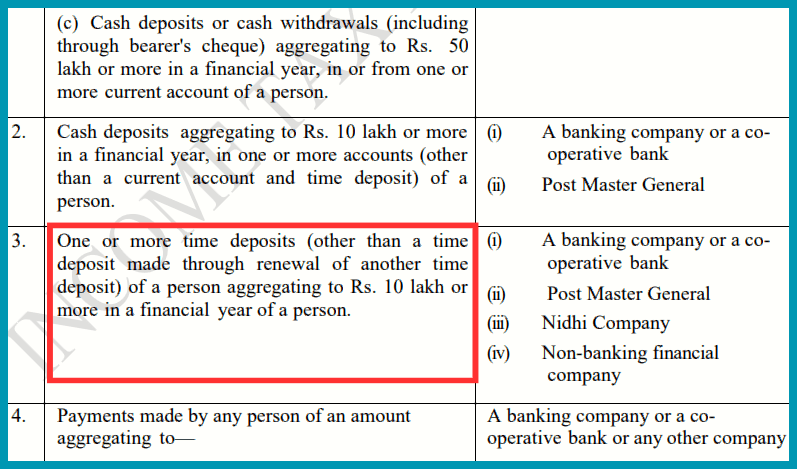

Maximum Fixed Deposits Limits For No Income Tax Notice:

Now here we will discuss the maximum number of fixed deposits we can make so that we do not get any notice from income tax.

Here, before knowing the limit of Maximum Fixed Deposit, you should know that if you earn more than Rs 40 thousand interest from FDs in a year, then the bank deducts 10% TDS from you. This 10% TDS is automatically deducted by the bank and deposited with the income tax authorities. Now you can get refund of this 10% TDS by filing your ITR.

Your TDS is deducted so that you can get your TDS back by filing your ITR and indicating your source of funds.

If you want to avoid Income Tax Notice, then never make an FD of Rs 10 lakh for the whole year. The number of FDs can be any number but the sum of them should not be more than Rs 10 lakh. If you fulfill this condition then you can avoid income tax notice.

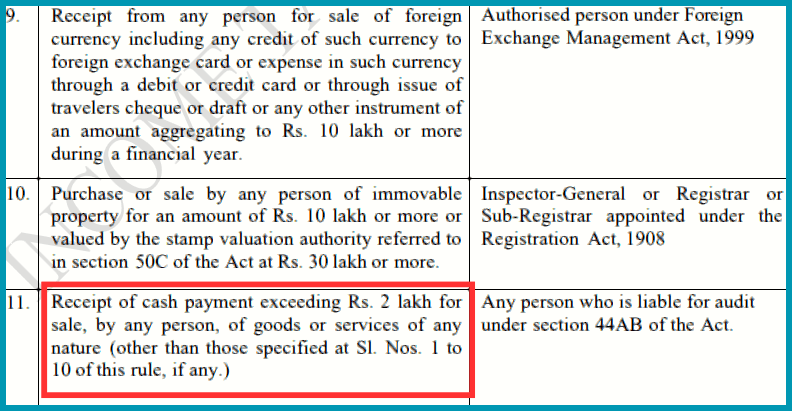

Credit Card Bill Payment Using Cash:

Even if we make our credit card payments incorrectly, we may receive an income tax notice. The Income Tax authority has issued some limits for paying your credit card bill, which are as follows –

If you make your credit card payment of Rs 1 lakh or more in cash throughout the year, then in that case also you may receive an income tax notice.

Along with this, if you make payment of Rs 10 lakh or more through online mode of your credit card in the whole year, then in that case also you may get income tax notice.

Now it was necessary to do this because many people buy things related to their business through credit cards, due to which they get more offers on it and get more profits. Now credit cards are not made for your business, credit cards are made for your individual use.

Final Words:

Staying within the specified Cash Deposit Limit In Saving Account and other financial limits set by the Income Tax Department is crucial to avoid scrutiny. Adhering to these limits and keeping detailed records is crucial. Being transparent in your financial transactions helps prevent unwanted attention from tax authorities. Stay informed, follow the rules, and reduce the risks related to Income Tax scrutiny for a safer financial journey.