If you have also applied for HDFC Bank credit card and till now you have not received any response to your application from the bank and if you want to check the status of your HDFC Credit Card application, then in this article we are going to tell you how to check HDFC credit card status? Many times we apply for a credit card but it takes a long time to get a reply whether our application has been approved or rejected.

Now whether you have applied for any credit card of HDFC, you can easily check the status of any of your credit cards from home by adopting any one of the different online and offline methods provided by HDFC Bank. Let us begin –

How To Check HDFC Credit Card Status Online?

You can also check the status of your credit card online through different methods and different details. Among these, you can use the method which is more convenient for you.

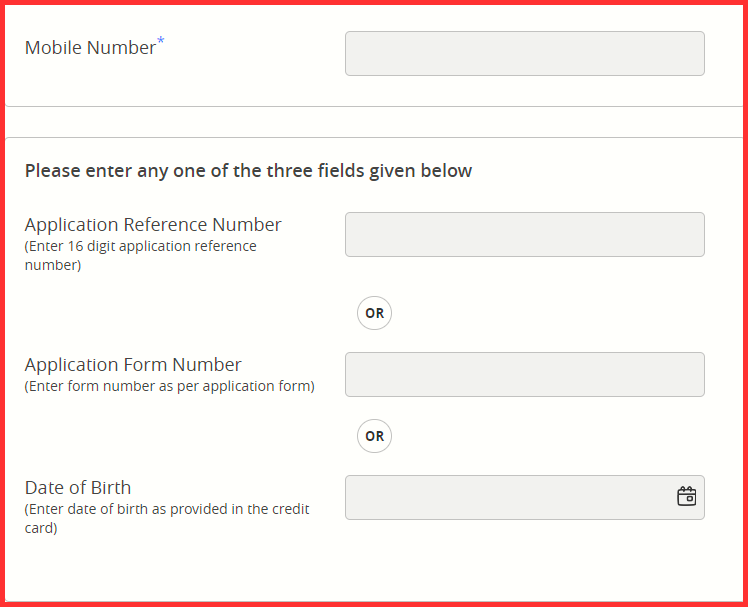

Using Your Application Reference & Application Form & Date of Birth:

- For this you have to first come to HDFCbank.com and then go to Pay – Cards – Credit Cards – Track Your Credit Card or you can also use this link.

- Now here you have to first enter your mobile number which you used while applying for your credit card.

- Below this you will see three different options: Application Reference Number, Application Form Number and Date Of Birth. You can check the status of your credit card using any one of these three.

➡ If you want to check the status of your credit card using your Application Reference Number, which is sent to your mobile number in the form of a text message shortly after you apply for a credit card, you can go to leads.hdfcbank.com and enter your mobile number and your Application Reference Number to check the status of your card.

If your credit card has been approved then you will see Approve status and if your card has been rejected then you will see Declined status and if your application is still pending then you will see Progress status.

➡ If you want to track the status of your card using your Application Form, then you can track the status of your card by visiting leads.hdfcbank.com and entering your mobile number and your application form number below.

➡ In addition, if you want to track the status of your HDFC Credit Card using your Date of Birth, you can do so by going to leads.hdfcbank.com and entering your registered mobile number and selecting your Date of Birth from the options below

Using Your Mobile Number:

You can also check the status of your HDFC credit card application using just your registered mobile number. For this

- You have to come to the Track Your Application page of HDFC.

- After this you have to enter your registered mobile number here and click on Proceed.

Using Your Air Way Bill Number:

If your credit card has been approved then you can also check the status of your HDFC Credit Card through your Airway Bill Number. But you can use this method only if your application is approved. We can say this in a way that in this way you can know the dispatched details of your credit card.

If you want to know the approved or rejected status of your card, then you can use any of the methods mentioned in this article except this method. And if your credit card is approved and you want to know when your card will be physically delivered to you, then you can use this method. After your application is approved, this Airway Bill Number is sent to you in the form of a message or by the post office. After this

- You have to come to the official page of HDFC Track your Credit Card online

- Now here you have to enter your Airway Bill Number and click on ‘View details’. After this, all the dispatched details of your card will be visible to you.

Using HDFC EVA Chatbot:

Apart from all this, you can also know the status of your credit card by using HDFC Bank’s EVA (Electrical Virtual Assistant) chat bot. With the help of HDFC’s EVA Chatbot, you can get very quick assistance related to all the products and services of HDFC and from here your query gets resolved very quickly. For this

- First of all, you have to go to the home page of HDFC Bank or go to any page of HDFC Bank website, you will find the option of EVA Chatbot at the bottom corner of every page. You need to click on it.

- After this, first of all you have to type “Check Credit card Status”. After this you have to click on Proceed.

- Now you have to enter your registered mobile number. Now a 4 digit OTP will be sent to your number, which you have to enter.

- Now you have to enter your date of birth.

- After this, it will pick the data from your bank records and tell you the status of your credit card.

Using WhatsApp Banking:

You can also know the status of your credit card by using HDFC Bank’s WhatsApp Banking. Like EVA Chatbot, with the help of WhatsApp Banking, you can solve queries related to all the products and services of HDFC Bank in a jiffy. To know the status of your HDFC Credit Card through WhatsApp –

- You have to add HDFC’s WhatsApp number 7070022222 to your WhatsApp contact.

- Keep in mind that you have to send the message from the same WhatsApp number which is linked to your credit card.

- Next, you have to type “Check Credit card Status” and send the message.

- Now it can ask you for some basic details like date of birth etc. and after that it will tell you the status of your credit card.

How To Check HDFC Credit Card Status Offline?

By Contact Customer Care:

You can also know the status of your credit card application by calling 24*7 customer support of your HDFC Bank. For this

- You have to call any of the numbers 1800 202 6161 / 1860 267 6161 (accessible across India) from your registered mobile number and by pressing the correct keys in the IVR, you can know the status of your credit card.

- To verify your identity, they may ask you for your name and date of birth. After this you can know the status of your credit card by providing your Application Number or Form Number.

By Visiting The Nearest Branch:

Apart from this, you can also know the status of your HDFC Credit Card by visiting your nearest HDFC branch. Therefore, he can ask you for your Application Number or Form Number. After verifying your identity, the executive will track the status of your card and inform you.

By SMS Alerts:

If you have enrolled in SMS Banking, you have the option to ask about the status of your current credit card application by sending an SMS to know the next steps.

Many banks regularly send SMS notifications after sending the credit card. You will receive information about the delivery agent or courier along with the airway bill (or tracking) number. In these cases, once your credit card is approved, it will be sent to your registered postal address.

FAQ:

- How many days does it take to deliver HDFC credit card?

Usually, your HDFC Credit Card arrives within 21 working days after applying. If your mobile number is registered with us, you’ll receive alerts about its dispatch.

Upon receiving the Airway Bill number alert on your mobile, you can track your shipment on the courier’s website. - How can I track my HDFC credit card application offline?

To track your HDFC credit card application offline, you have three options. First, call HDFC’s customer support at 1800 202 6161 or 1860 267 6161 and follow the IVR instructions. Alternatively, visit your nearest HDFC branch and an executive will help you. If you’re enrolled in SMS Banking, you can send an SMS to get updates on your application status, including dispatch details of your credit card.

- How do I know if my HDFC credit card is dispatched?

Check if your credit card application has been approved.

If approved, you will receive an Airway Bill Number via SMS or post.

Visit the HDFC Track your Credit Card online page.

Enter your Airway Bill Number.

Click ‘View details’ to see your credit card’s dispatch status and delivery information. - What happens if HDFC credit card is dispatched but not received?

The credit card delivery typically takes 3-4 working days. If you haven’t received your credit card within this timeframe, you can contact customer care to inquire about the reason for the delay.

- How can I complain about HDFC credit card delivery?

Give them a call: You can reach out to HDFC customer care by dialing 1800 202 6161 or 1860 267 6161 and express your concerns or register a complaint.

Write a message: Alternatively, you can compose a message to HDFC customer care by visiting their complaint form at https://leads.hdfcbank.com/applications/webforms/apply/complaint_form_new.asp and submit your complaint online.

Pay a visit: If you prefer a face-to-face interaction, you can visit a nearby HDFC Bank branch and have a conversation with a customer service representative to register your complaint in person.