In this article today we are going to talk about HDFC Easyshop Platinum Debit Card, one of the best debit cards of HDFC Bank. Despite being a debit card, you get many good features in this debit card which you probably get to see in credit cards. Today we will do a detailed analysis about this HDFC Platinum Debit Card in which we will see all the features, benefits and fees and charges of this debit card and tell you whether you should take this EasyShop Platinum Debit Card or not? Therefore, if you are thinking of getting this debit card, then you are requested to first read this article completely so that you can understand all its features thoroughly.

Key Features Of HDFC Easyshop Platinum Debit Card:

HDFC Easyshop Platinum Debit Card  | |

Joining Fee | Rs. 750 + applicable taxes |

Annual Fee | Rs. 750 + applicable taxes |

Add On Card Annual Fee | Rs. 750 + applicable taxes |

Card Reissuance/Replacement Fee | Rs. 200 + applicable taxes |

Eligibility | Customer must have one of the following accounts:

|

Daily Domestic Shopping limits | Rs. 5 lacs |

Daily Domestic ATM withdrawal limit | Rs. 1 lac |

lounge Access | 1 Domestic Airport lounge access per quarter |

Reward Points |

|

Maximum Cap of Cashback Points | 750 Per Month |

PayZapp & SmartBuy Offer | Earn Upto 5% CashBack |

Airport Lounge Access | 2 per Calendar Quarter |

Detailed Analysis Of HDFC Platinum Debit Card:

Fees and Charges:

If you want to get this debit card, then you have to pay a joining fee of ₹ 750 + Taxes and this ₹ 750 + Taxes is its annual fee. Along with this, the reissuance and replacement fee of this debit card is ₹ 200 + taxes. But if you have a premium account in HDFC Bank, then you will get this HDFC Platinum Debit Card absolutely lifetime free. But you will get this Debit Card lifetime free only if you fall in the category of HNW Customer (High Net Worth Customer). For example, if you have any of the Classic, Preferred & Imperia accounts in HDFC Bank, then you will get this HDFC Platinum Debit Card absolutely free.

Apart from this, you can see some other important fees and charges related to this debit card with the help of the table below –

HDFC Platinum Debit Card Charges

Fee And Charges Of Easyshop Platinum Debit Card | |

Joining Fee | Rs. 750 + applicable taxes |

Annual Fee | Rs. 750 + applicable taxes |

Add on Card Fee | Rs. 750 + applicable taxes |

Card Replacement Fee | Rs. 200 + applicable taxes |

Card Reissuance Fee | Rs. 200 + applicable taxes |

Charges on Railway Stations | Rs. 30 per ticket + 1.8% of the transaction |

Charges On IRCTC | 1.8% of the transaction amount |

Instant Pin Generation Fee | Free |

ATM PIN Generation | Free |

Cross-currency mark-up charges | 3.5% + applicable taxes on foreign currency transaction |

Cash Withdrawal Limit:

In this debit card you get higher cash withdrawal limits. With this debit card you can do daily domestic shopping up to ₹ 5 lakh. With this, you can withdraw cash up to ₹ 1 lakh daily from all domestic ATMs with this debit card.

But please note here that if you have a new account in HDFC Bank then some capping of cash withdrawal is imposed on you for the next 6 months, in which you can withdraw cash only up to ₹ 50,000 daily from any debit card of HDFC Bank. And in the whole month you can withdraw cash only up to a maximum of Rs 10 lakh.

And when your account is six months old in HDFC Bank, then you can withdraw a maximum of ₹ 2 lakh per day from any debit card of HDFC Bank and a maximum of ₹ 10 lakh in a month.

Now it depends on your debit card that how much daily withdrawal limit you get but you can use only the limits mentioned above at most. Apart from this, you can increase and decrease the daily limits of your debit card by logging in to HDFC Bank’s net banking. But you can increase and decrease your limit up to the maximum withdrawal limit provided to you in your debit card by logging into HDFC Net Banking.

Cashback points on HDFC Platinum Debit Card:

You get 1 cashback point per ₹ 100 spent on Telecom and Utilities bill payments on this HDFC Easyshop Platinum Debit Card. Apart from this, if you pay your credit card bill with this debit card, you also get one cashback point per ₹ 100. For this, you have to login to your HDFC net banking and go to Recharge & Bill Pay portal and pay your credit card bill, there you get 1 cashback point for every Rs 100.

Apart from this, you get 1 cashback point per ₹ 200 spent on categories like Groceries & Supermarket, Restaurant & Apparels, Entertainment on this debit card.

Including all the cashback points, you can earn maximum cashback points of Rs 750 in a month and apart from the categories mentioned above, you will not get any cashback points on any other spend.

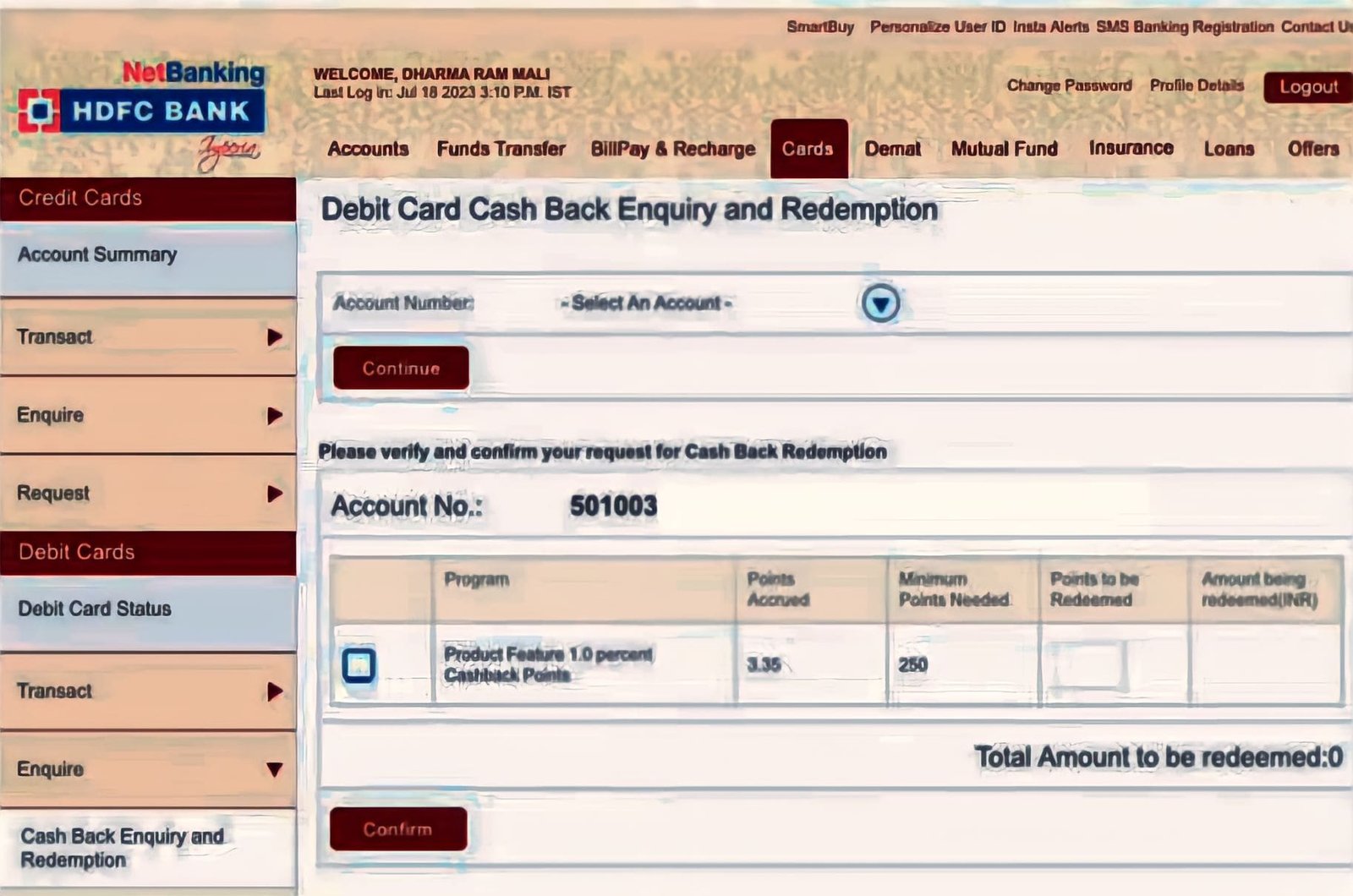

You can redeem all the cashback points you earn through this debit card by logging into HDFC Net Banking and to redeem, you should have minimum 250 cashback points. There is no upper limit for redeeming cashback points, that is, you can redeem as many cashback points as you want.

If we talk about the validity of these cashback points, then the validity of these cashback points is 12 months. That means, within 12 months, you have to redeem all the cashback points you have earned from this HDFC Platinum Debit Card, otherwise these points will expire.

Accelerated Cashback Points:

If you want to earn more cashback points from this HDFC Platinum Debit Card, then you can do it through HDFC’s SmartBuy platform and Payzapp application. If you do any transaction on HDFC SmartBuy and Payzapp application with this debit card, then you get cashback of up to 5%.

No Cost EMI:

You also get the option of No Cost EMI on this debit card. But to avail this feature, your minimum transaction should be ₹ 5000. You get this No Cost EMI facility on products like electronics, furniture, apparels and smart phones of many leading brands of HDFC Bank.

If you want to check whether this No Cost EMI option is available on your debit card or not, then for this you have to type ‘MYHDFC’ from your registered mobile number and send a text message to number 5676712. After this you will know whether this No Cost EMI offer is available on your debit card or not.

Experience the benefits of HDFC Bank’s premier credit card

ATM Transaction Charges Of HDFC Platinum Debit Card:

Whatever transactions you do in ATMs with this HDFC Easyshop Platinum Debit Card, you do not have to pay any charge on some transactions and you have to pay some charge on some transactions.

If you use this debit card in International ATMs, then you have to pay some extra charges in that case. And if you use this debit card on HDFC ATMs in INDIA then you have to pay less charges and if you use this card on Non HDFC ATMs then you have to pay slightly higher charges.

Now you can easily see all the ATM Transactions charges that we have talked about in the table below –

ATM Transaction Charges | |||

Charges at Domestic ATMs | |||

Account Type | HDFC Bank ATMs | Other Bank ATMs | Fees for exceeding the limit of free transactions |

Savings & Salary Account | Free Transactions - 5 |

|

|

Current Account (Flexi, Plus, Max, Apex, Ultima, Merchant Advantage Plus & Supreme Current Account) | Unlimited |

| Cash Withdrawal & Non-Financial Transaction - Rs 21/- plus applicable taxes |

Current Account (Regular, Premium, Trade, Agri, Current Account for Professionals, Ezee, Current Account for Hospitals /Nursing Homes/ Pathology labs, Merchant Advantage & TASC) | Unlimited | Charged from 1st transaction onwards | Cash Withdrawal & Non-Financial Transaction - Rs 21/- plus applicable taxes |

Charges at International ATMs | |||

Type of ATM | Charges | ||

ATM Charges - Usage outside India |

| ||

- At HDFC Bank ATMs, only cash withdrawal transactions will incur charges, while non-financial transactions such as balance enquiries, mini statements, and PIN changes will remain free of charge.

- Transactions at non-HDFC Bank ATMs will be subject to charges for both financial (cash withdrawal) and non-financial transactions (balance enquiry, mini statement, and PIN change).

- ATMs located in Mumbai, New Delhi, Chennai, Kolkata, Bengaluru, and Hyderabad will be categorized as Metro ATMs for transaction considerations.

Insurance Covers Of HDFC Platinum Debit Card:

You also get good insurance benefits in this HDFC Easyshop Platinum Debit Card –

- Extensive coverage for death during air, road, or rail travel, with a maximum sum insured of Rs. 12,00,000. But to avail this cover, any transaction should be done with your debit card within the last 30 days. For more information related to this you can click here.

- Enjoy an additional flat coverage of Rs 3 Crore for international air travel when you purchase your air ticket using your Debit Card. You can click here for more information related to international air coverage.

- Safeguard your purchases made with the Debit Card against fire and burglary for a period of up to 6 months, with a substantial sum assured of Rs 200,000. For more information about Fire and burglary coverage, click here.

- In the unfortunate event of losing checked baggage, receive compensation with a sum assured of Rs 2,00,000. To avail this coverage, there must be at least one purchase transaction through your debit card in the last 3 months. To know more details about Loss of checked baggage coverage, click here.

HDFC Platinum Debit Card Lounge Access:

On this HDFC Easyshop Platinum Debit Card, you also get the facility of Domestic Airport Lounge Access. In this debit card, you are given the facility of 2 domestic airport lounge access per calendar quarter. You can avail this facility only at some selected airport lounges.

Earlier, this airport lounge access was provided to you without any conditions, but now from January 2024, HDFC Bank has imposed some conditions on it. HDFC Bank has said that now you will be able to avail the lounge access only if you spend ₹ 5000 in a calendar quarter. Now, spending ₹5000 in a calendar quarter is not a big deal.

This is not the first card in which HDFC Bank has imposed a spending limit to avail lounge access. You will get to see this spending limit in every bank card. HDFC Bank is also making this change in all its cards.