You must have also heard about HDFC Deposit Machine and in this article we are going to talk about the same HDFC Recycler Machine. Today we will know how this machine works and what are its benefits to HDFC customers and non-HDFC customers, we will discuss all of them in this article.

How To Deposit Cash in HDFC Deposit Machine?

HDFC Deposit Machine, which we also call HDFC CDM Machine (Cash Deposit Machine), is such an ATM machine in which we can deposit money and also withdraw money. But only HDFC Bank customers can deposit cash in this machine, that means only those people who have accounts in HDFC Bank can avail the facility of cash deposit from this machine and those who are non-HDFC customers can only avail the facility of cash withdrawal from this machine.

Let us now know that if you are a customer of HDFC Bank then how you can deposit cash in your account with the help of this HDFC CDM Machine –

You can deposit money in this HDFC ATM machine in two ways. One is with the help of ATM card and the other is with the help of bank account. Now we will tell you about depositing money through both these methods and there is a difference in the limit of money in both these methods, which we will tell you simultaneously –

Card less Cash Deposit in HDFC Recycler Machine:

To deposit cash in this machine without ATM card, you can follow the following steps –

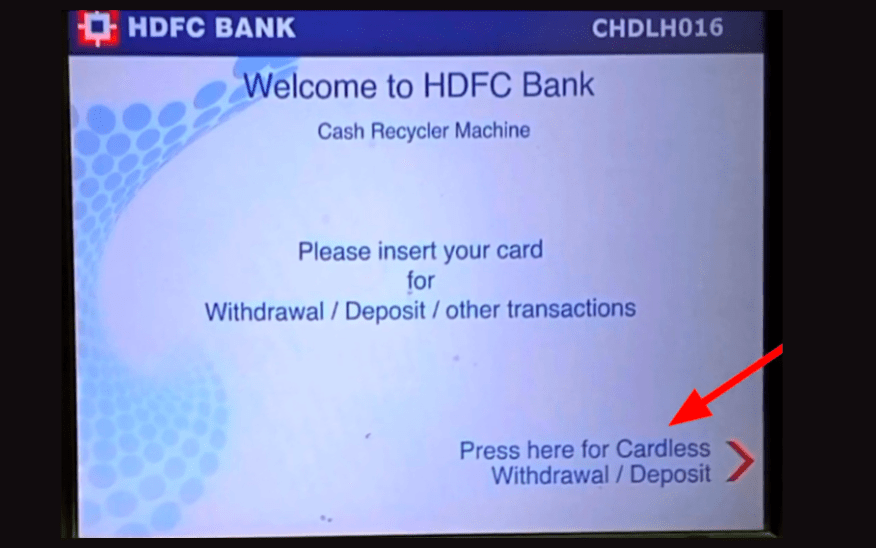

- First of all you have to click on the ‘Card less Deposit/Withdrawal’ button below in the HDFC Deposit Machine.

- Now you have to select your preferred language.

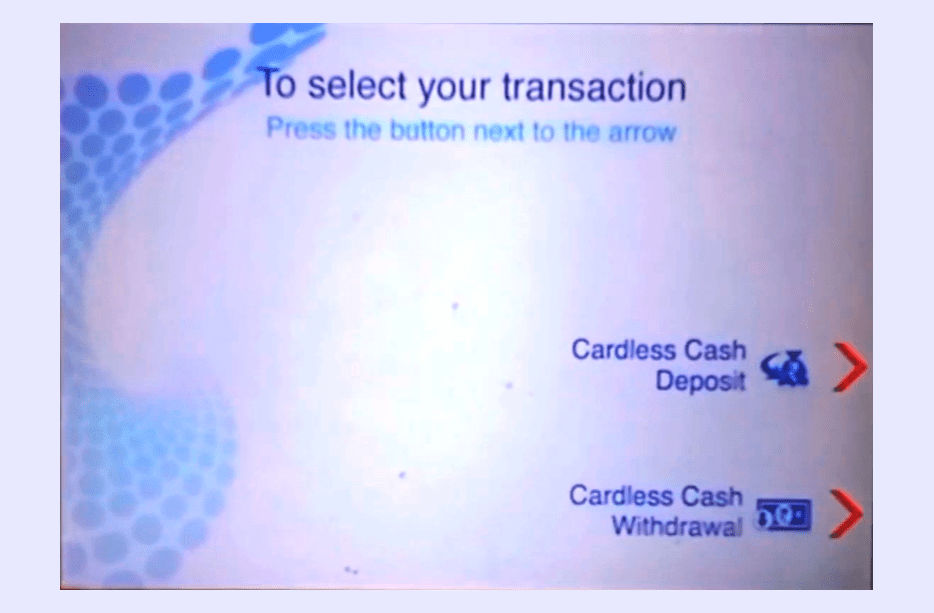

- Now you have to select your transaction in which you will select ‘Card less Cash Deposit’.

- Now you have to fill your 14 digit bank account number and then click on Correct.

- After this you have to re-enter this bank account number. Now the name of this account holder will appear in front of you, which you have to read and verify properly.

- In the next step you have to enter your mobile number and click on Correct.

- After this, some agreement notes will appear in front of you which you have to read once and after that you have to click on confirm.

- Now it will ask you the purpose of depositing your cash, which you have to select according to your choice. (If you select ‘other’ here then you will have to type your reason where you can also simply type Hi.)

- Now the cash slot of this HDFC CDM Machine will open in which you have to carefully place your cash in an organized manner and click on Continue on the screen.

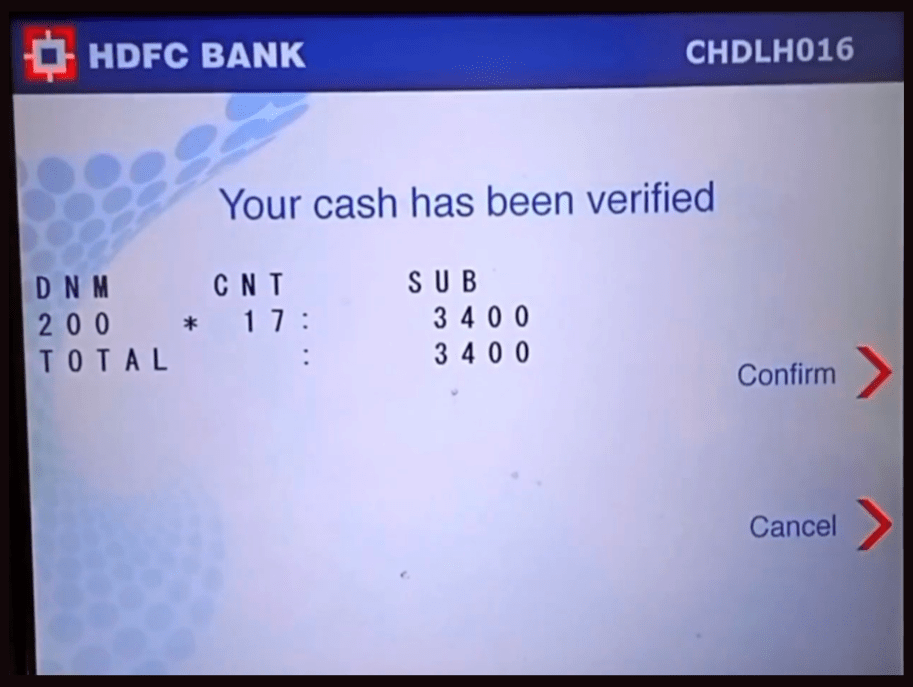

- Now you will see the number of notes and their value on the screen, if you agree with this then click on Confirm.

- As soon as you click on Confirm, money will be deposited in your bank account.

This service of HDFC Bank is very fast and money is deposited in your account immediately.

Deposit With Card in HDFC Recycler Machine:

Now we will know how we can deposit cash in our bank account with the help of our ATM card –

- For this, first of all you have to insert your HDFC Debit Card in the HDFC Deposit machine.

- After inserting the card, you have to select your language.

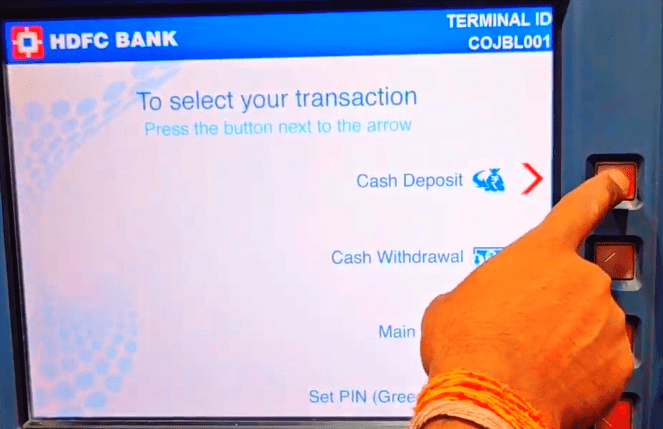

- In the next setup, many options will appear in front of you, out of which you have to select ‘Cash deposit’.

- Now you have to select your account type from Current Account and Saving Account.

- After this you have to enter the PIN of your debit card.

- As soon as you enter the PIN, the cash slot box for cash deposit will open in front of you, in which you have to place your cash properly and press Continue on the screen.

- If any of your notes is rejected for any reason, you can deposit another note in its place with the help of Add Cash button and even if you want to deposit more than Rs 25,000 cash, you can do so with the help of Add Cash button.

- Now the value of your cash will be shown in front of you, which you have to verify and click on confirm.

- After this you will see the message of Successful Cash Deposit on the screen.

By following all these steps, you can also deposit cash in your bank account using HDFC CDM machine with the help of your HDFC ATM card.

What Are The Advantages Of HDFC Deposit Machine?

Avoid long queues to deposit cash: Experience the convenience of avoiding long queues while depositing cash. With HDFC Bank’s streamlined process, you can save time and effort by depositing cash into your account faster without waiting in long lines at the bank.

Real-Time Fund Deposits: Enjoy the immediacy of funds being credited to your account in real-time. No more waiting for extended periods for cash deposits to reflect in your account. HDFC bank’s system ensures quick processing, allowing you to access and use the deposited funds instantly.

Wide ATM Transactions: HDFC ATMs offer a wide range of transactions for your convenience. From standard operations like cash withdrawal and balance enquiry, to providing mini statements and much more, HDFC ATMs cater to various banking needs quickly and efficiently.

Cash Withdrawal for Non-HDFC Bank Customers: HDFC Bank extends its cash withdrawal facility to non-HDFC Bank customers also. Even if you are not their customer, you can still access their ATMs and withdraw cash easily, increasing accessibility and convenience for all users.

Transaction Limit In HDFC CDM Machine:

For Saving Account Holders:

Deposit Mode | Per Transaction Limit | Per Day Limit |

Card Based Deposit | Rs. 1 Lac | Rs. 2 Lacs |

Card Less Deposit | Rs. 25,000 | Rs. 2 Lacs |

For Current Account Holders:

Deposit Mode | Per Transaction Limit | Per Day Limit |

Card Based Deposit | Rs. 1 Lacs | Rs. 6 Lacs |

Card Less Deposit | Rs. 1 Lacs | Rs. 6 Lacs |

Some Things To Remember While Using The HDFC CDM Machine:

- Avoid placing cash in the cash slot using rubber bands or stapler pins. Prior to depositing cash, ensure any stapler pins are removed.

- Should cash not be dispensed or a deposit fail to reflect in your account, promptly notify the bank.

- Refrain from conducting transactions if you notice any unfamiliar devices or attachments connected to the Cash Deposit Machine.