If you are also a fan of UPI (Unified payments Interface) and you also use UPI or UPI apps for every small to big transaction, then be careful because now if you do more UPI Transactions than the UPI Transaction Limit, then Income Tax Notice may also come to your house. We have become so dependent on UPI in our daily life that we do not keep track of our UPI transactions and we end up doing many unnecessary UPI transactions.

In this article, we will know in detail how many UPI transactions we can do in a year so that we do not get any income tax notice.

How to avoid income tax notices based on UPI transaction limit?

Now the Income Tax Department has not set any limit for UPI Transactions. They have not mentioned anywhere that if you transact this much amount through UPI, you will not receive any notice from Income Tax.

- The first mistake people make is that they do countless UPI transactions from their savings accounts. Most shopkeepers print the QR code of their savings account and paste it on their shop without opening their current account, so that all small to big transactions are done directly in their saving account.

- Now here the Income Tax Department says that if you have a current account then you can do any number of UPI transactions, we do not have any problem with it, but you must fill your ITR (Income Tax Return) at the end of the year.

- If you do a transaction of ₹ 10,000 in a day in your savings account, then you may get an Income Tax notice, but if you do the same transactions in your current account, then no notice will be sent to you.

- Even if you do UPI transactions worth more than your annual income, the Income Tax Department can question you about how you made transactions worth more than your annual income. Now if you have proper evidence of this at that time then you have no problem. But if you are not able to give any answer to this then penalty may be imposed on you.

- Now, many people do so many transactions from their savings account through UPI that when the Income Tax Department totals them, their turnover comes out to be in lakhs and crores. Now in such a situation you cannot even imagine how big a fine you may have to pay.

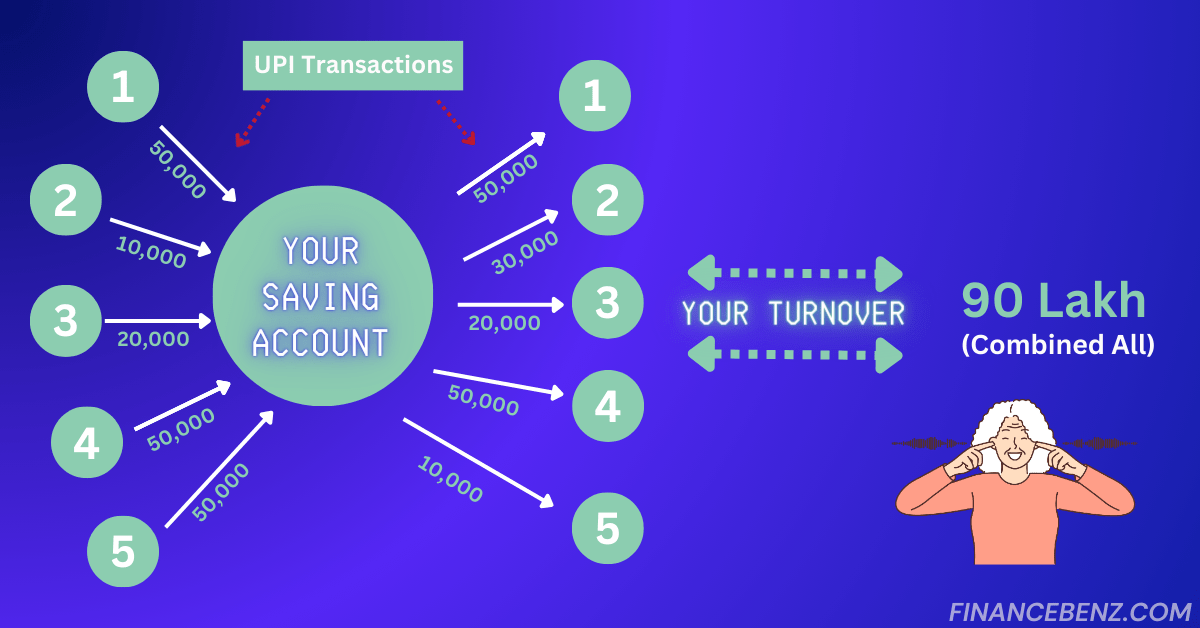

Now, for example, you got someone to deposit Rs 50,000 in your savings account through UPI and after some time you sent this money to someone else and you do this type of transactions every day. Now suppose in this way, throughout the year, you have taken Rs 50 lakh in your savings account and from this you have also kept a commission of 1% which is Rs 50,000 and sent Rs 49 lakh 50,000 to the other person.

Now in such a situation, if you took a total of Rs 50 lakh and sent back Rs 49 lakh 50 thousand to someone, then your turnover from the Income Tax Department by combining all these has become Rs 99 lakh 50 thousand. And here the Income Tax people say that if your turnover goes above Rs 40 lakh then it is necessary for you to get a GST number and if you are in professional business and your turnover goes above Rs 20 lakh then it is compulsory for you to get GST number.

- Now, if this above mentioned situation gets created with you and you neither have a current account nor a GST number, then in this case you get a notice from the Income Tax Department then it will clearly tell you that if your turnover is Rs 99 lakh 50 thousand, then you must have earned at least 8% profit and 8% of this is around Rs 8 lakh, so show the ITR of this Rs 8 lakh.

When should Current Account be opened?

If you do a lot of UPI transactions due to which your turnover goes above Rs 40 lakh, then you should open a current account, otherwise the Income Tax Department can take action against you at any time. And if you are a shopkeeper or businessman, then open a current account blindly and do not cross the UPI Transaction Limit in your savings account.

Final Words:

It’s crucial to keep track of UPI transactions, especially when using savings accounts. Opening a current account for business transactions is recommended to maintain clarity and prevent exceeding UPI transaction limits. Proper documentation and Income Tax Return filings help avoid potential Income Tax notices due to high turnovers. Stay informed and segregate transactions wisely to evade unnecessary tax-related issues.