If you also want to take a personal loan, then you must have seen some ad or post somewhere on the internet related to Money View Loan App. Now in the easy way they tell you in their ad that we provide you Instant Personal Loan in 10 minutes, then do they really provide you loan in 10 minutes and even if they do then should you take loan from these instant personal loan apps or not? Today we will talk about it. In this article, we will discuss in detail about Money View Loan App Real or Fake and will know how beneficial it is for us to take a loan from it?

In this post, we will know how much Money View Loan App can be trusted, which company works behind it or which company funds it, and is Money View Loan App RBI approved? Today we will discuss all this in detail with proof. Therefore, if you also want to take any kind of personal loan from Money View Loan App, then read this article once before that.

Now we will tell you further whether Money View Application is real or fake, but before that it is more important for you to know why we should check whether this loan application is real or fake before taking a loan?

Why Should You Confirm Legitimacy Before Taking out a loan?

Now earlier people used to go only to banks to take a loan, but today due to digitalization, many such instant loan apps have come in the market which promise to give you a personal loan in just 10 minutes. Now we believe that they also provide you loan within 10 minutes but if you apply for a loan from that application or company without checking the legitimacy of it, you cannot even imagine how harmful it can be for you.

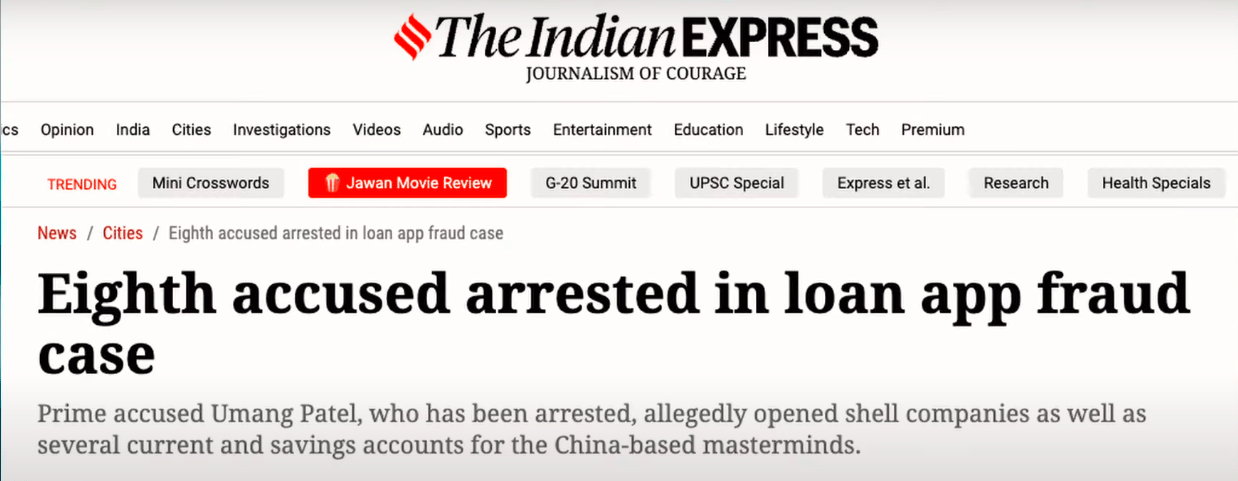

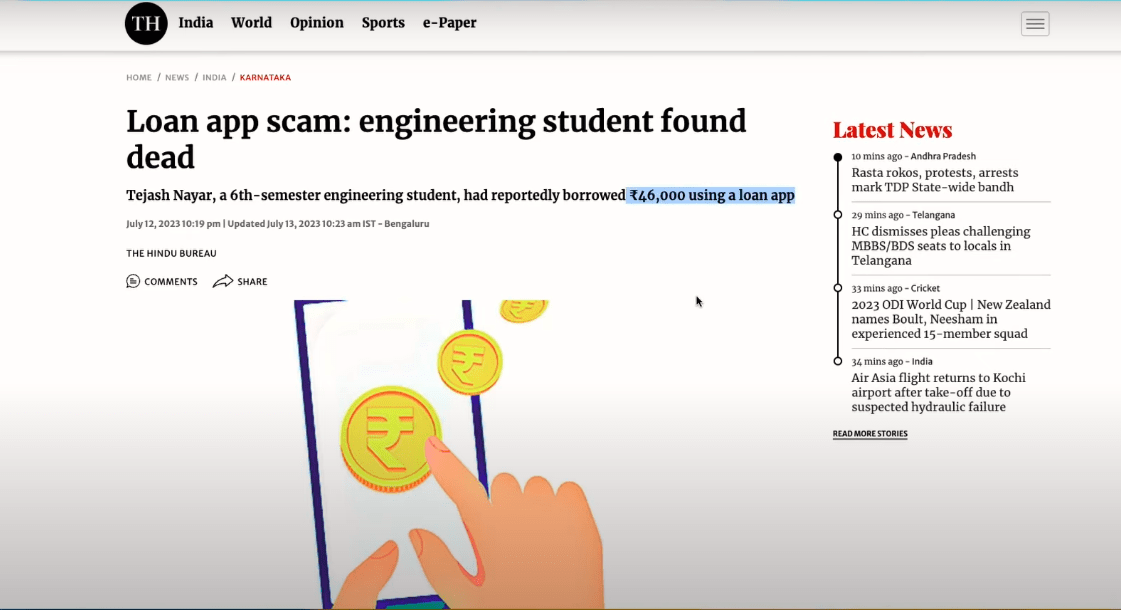

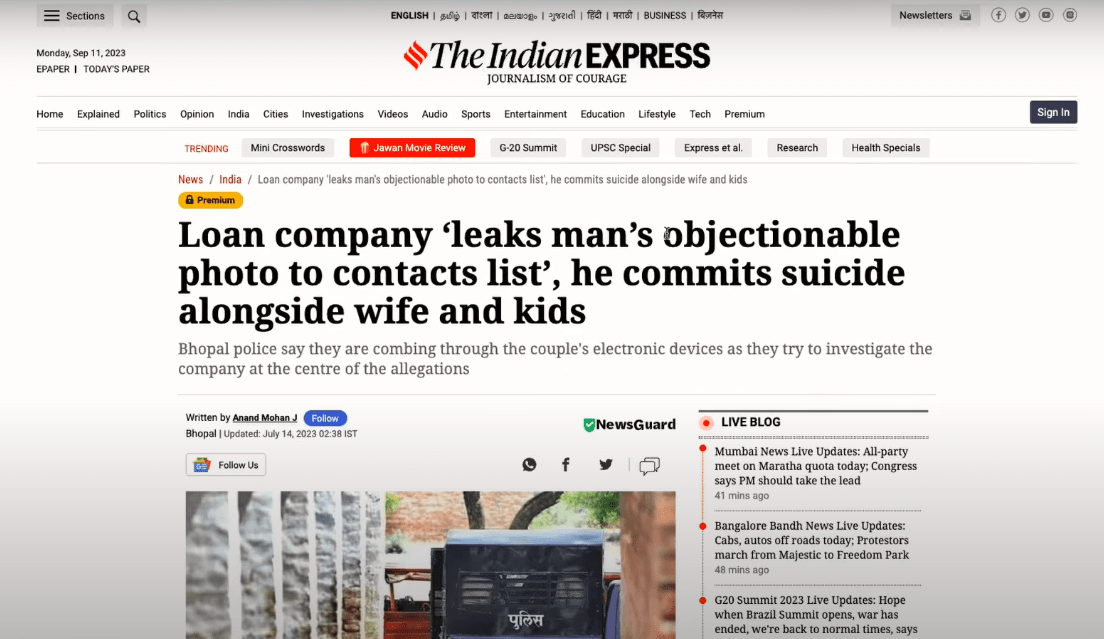

We think that you will definitely be aware of the scams happening day by day because of these Instant Loan apps.

Now the way of working of banks is different because they work in a genuine manner, hence if you take a personal loan or any other loan from any bank, it takes time because the bank does the work by following all the rules. . Now, this work is made a little easier by NBFCs (Non-Banking Financial Companies) which come after banks. These NBFCs make this paper work a little easier and there are many such RBI Approved NBFCs in the market that provide you loans.

But now people do not take loans from these NBFCs either. Now many such Instant Loan apps have come, many of which neither have any connection with any bank nor any NBFC nor are they approved by RBI and people still take loans from them. And the only reason for taking loan from these apps is that they give you the loan immediately.

In the past few times, many such Chinese loan apps have been caught which used to provide instant loans to people and then steal all the data of your phone and blackmail you and grab a lot of money in return. When you install these apps in your mobile, it asks you for permission to access your phone’s gallery and contacts, which we allow and at the same time, all our personal data goes to them and this company does not come with the intention of providing any loan but their only job is to scam. We show you a glimpse of their exploits in the image below –

Therefore, it is better for you not to become a victim of this accident that even if you take a loan from Instant Loan Applications, then first get complete information about it and know on what basis it is providing the loan to you.

Now let us know whether Money View Loan App is real or fake?

Money View Loan App Real or Fake: A Deep Analysis

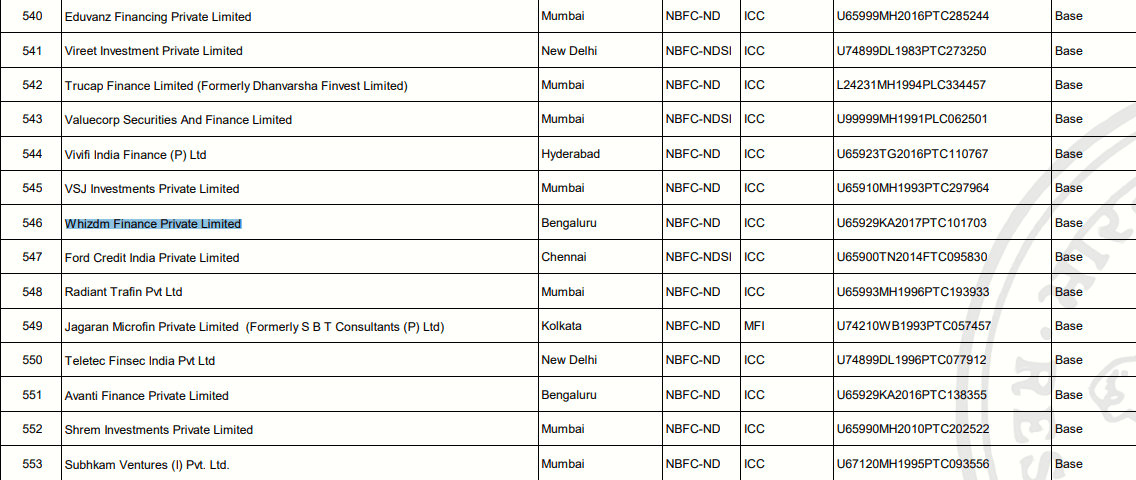

Money View Loan App is regulated by a company named Whizdm Innovations Pvt Ltd and it is an NBFC and it is also present in the list of RBI Approved NBFCs, a screenshot of which we are sharing with you below or you can also find it in this NBFC List of RBI.

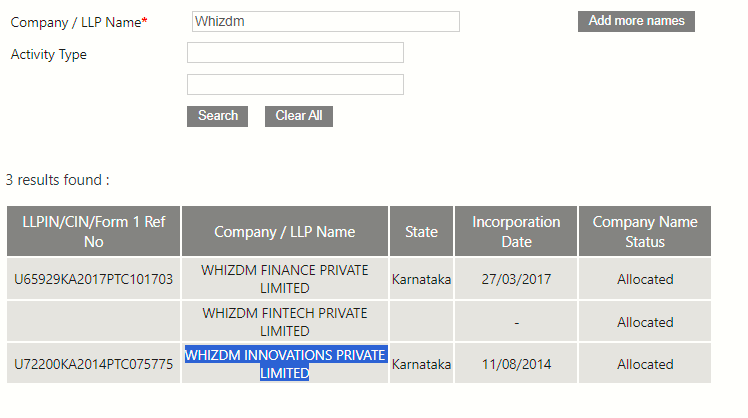

With this, Whizdm Innovations is a private company and you can find the complete details of any private company on the official government website of MCA (Ministry of Corporate Affairs). We ourselves checked about it and found this company registered on this portal, which gave us some confidence in it.

Along with this, Money View Loan App also provides you the facility of opening savings accounts. So, they have mentioned on their website that they work in partnership with a bank called Suryoday Small Finance Bank Private Limited and provide the facility of savings accounts on its behalf.

Which companies fund ‘Money View’ Loan App?

Now, maximum trust is placed on a loan giving company by seeing who is funding this company, that is, where is the money that this company is giving us on loan coming to this company from? So we checked this thing with Moneyview also and found that many well-known companies are funding this company, the complete list of which you can access from here. The Moneyview loan app is funded by many companies like Clix, Credit Saison, SMFG India Credit, Piramal Finance, Incred, IDFC First Bank, Aditya Birla Capital and Whizdm Finance.

Now here we have discussed some such things so that you can know whether we can trust Money View or not. Related to this, we have presented some facts before you which make it clear that this is not a fraud company and you can take loan from it.

But now this company is not a fraud and there are many genuine organizations and settled companies working behind it, so it does not mean at all that you should blindly take a loan from it. From the proofs shown above, it has been proved that this company is not a fraud or scam but still there are many things which we have to know about any application or company before taking a loan like – Interest Rates, Late Payment Fee etc.

Therefore, before taking a personal loan from Moneyview Loan app, we must know about its charges.

Interest Rates of Money view Loan App:

Feature | Highlights |

Maximum Loan | 10 lakhs |

Tenure | 3 Months to 5 years |

Rate Of Interest | 5.96% onwards (on sites its mentioned 1.33%per month onwards) |

Processing Fee | 2% - 8% |

Min Age | 21-57 |

Playstore Rating | 4.7% |

Now Money view Loan app has written in bold letters on its website that we provide you loan at the rate of 1.33% per month onwards. Now, many people become happy seeing that they are getting a personal loan at a very low rate of interest. However, they do not understand that their loan is starting at an interest rate of 1.33% per month, and if we multiply it by 12, it becomes 15.96%. That means their interest rate is starting at 15.96% annually, and it can go even higher from there.

Now here we would like to tell you that if you are getting a personal loan from anywhere online at an interest rate higher than 30% annual interest rate, then never take a personal loan from there. Because nowadays loans are available in the market even from moneylenders at an interest rate of about 25% per annum, so it is better that you take a loan from there.