Whenever we transfer money online, we use services like NEFT, RTGS, and IMPS, so the first thing to think about is why they are different and what are the differences in them and what was the shortcoming in them due to which NPCI had to build UPI and as soon as UPI came, it started being discussed all over the world. Now whether India has to come on No. 1 or come forward in Digital Transaction or it is a matter of taking forward Digital India, UPI is being talked about everywhere.

The QR code that you see outside every small to big shop, by scanning which you pay, has made UPI a game changer. Now in fact why there was a need to bring UPI and what UPI is doing because of which India is getting fame, then we will discuss all these in detail in this article.

What Is UPI ID And How It Was Developed?

When it comes to making payments in India, various systems cater to different needs. If you need to transfer more than 2 lakh rupees, RTGS is the go-to option. For transactions below this amount with a 30-minute wait time, NEFT is suitable. If you require an immediate payment of less than 2 lakh rupees via mobile, IMPS is the solution. However, these options posed challenges, such as the need to add beneficiaries and the time-consuming process involved in Net Banking transactions.

In 2016, the National Payments Corporation of India (NPCI) introduced a groundbreaking solution known as UPI (Unified Payments Interface), spearheaded by Raghuram Rajan and Dilip Asba. UPI, an advanced version of IMPS, operates on the same architecture and technology. What sets UPI apart is the introduction of a Virtual Payment Address (VPA) instead of the traditional IFSC Code and account number, ensuring seamless and secure money transfers.

With UPI, users can make payments without sharing their details by using a VPA, commonly referred to as the UPI ID. UPI is a QR Code-based system that not only facilitates fund transfers but also serves as a Merchant Payment system for convenient goods purchases. Unlike previous systems, UPI allows users to make Payment Requests, providing a streamlined process for requesting and receiving money.

The question may arise as to why RTGS, NEFT, IMPS, and UPI are separate systems instead of being integrated into one. These payment systems operate on distinct architectures with millions of users enrolled, making integration challenging. UPI has successfully integrated these systems to a considerable extent, allowing users to link multiple bank accounts to a single UPI ID for easy transactions. The infrastructure cost for shopkeepers using UPI is significantly lower than other payment systems, as it only requires a QR Code, eliminating the need for additional swipe machines.

NPCI aimed to make UPI technology accessible to a wider audience, leading to its integration with popular payment apps like Google Pay, Phone Pe, Amazon Pay, and Paytm. Unlike RTGS or NEFT, these apps now feature UPI technology, enabling secure transactions. However, NPCI has imposed a limit, allowing third-party apps to have only 30% of their user base through UPI to maintain security and control.

Why UPI Is a Game Changer?

See, earlier when someone had to transfer money, either you used to give cash or you went to the bank and transferred money to him and the bankers used to maintain huge registers for this, in which there was a Folio Number in which all your Transactions were maintained and your Verification was done by going to three to four Counters, you also had to maintain your Passbook and Minimum Amount. Due to all these reasons, people used to consider transferring money through banks as the last option.

And the people who lived far away from home also had to face a lot of difficulties in sending their money from one place to another and whether the money of the Government Schemes used to reach the people or not, this too could not be tracked correctly.

ECS (Electronic Clearing System)

In India, in the time of 1990, RBI (Reserve Bank of India) had brought ECS System. In this, payments like salary and pension used to happen in bulk. Now, according to the technology of that time, all this was fine, but this system was not that advanced.

RTGS (Real Time Gross Settlement)

Due to not so much advance of ECS, RBI had brought RTGS system in 2004. RBI had got RTGS developed from IDRBT (Institute for Development and Research in Banking Technology). With the help of RTGS, the money of the people was transferred immediately without going round the bank. Now crores of rupees are spent in making and maintaining such a system. Therefore this system is for those people who have to transfer more than 2 lakh rupees and have to transfer immediately.

In this, some charges were also taken from the customer per transaction. Below you can see how much money you had to pay on Per Transaction for RTGS. This system can be used by any citizen of India and the bank can also use it.

NEFT (National Electronics Fund Transfer)

After RTGS, RBI has realized very quickly that there should be a system for people with Transactions less than Rs 2 lakh. That’s why RBI brought NEFT system in 2005 itself. In NEFT, you can transfer as much money as you want, even you can transfer even one rupee.

Now there is a lot of costing to do such small Transactions in real time, so a rule has been applied in it that all the banks will complete these Transactions in Batches. That is, there will be a wait of 30 minutes, in the meanwhile all the requests for NEFT fund transfer that will come to the bank will have to be verified and transferred together in the group. Earlier this waiting time was 1 hour but now it is 30 minutes. This is the reason that when you do NEFT, then after thirty minutes money reaches the account. NEFT is done in a day by making 48 batches.

By the way, RBI has suggested that Per Transaction charges should not be taken on savings accounts, but this is the amount which has to be paid per transaction. Whether it is NEFT or RTGS, earlier they used to do transactions in the working hours of the bank only because there was not much trust in the system. Therefore, if there is any issue, it can be resolved only in working hours. But as soon as there was trust in the system and technology, these transactions started happening 24*7*365. But still this system was not handy for people.

IMPS (Immediate Payment System)

The government knew that if people have to be connected more with the digital payment system, then this system will have to be made easier. After this in 2010 IMPS came. With the help of IMPS, you could transfer money instantly by pressing a button from your mobile without waiting. In this the option of less than 2 lakhs and immediate transfer was opened. To use IMPS, you needed a mobile and MMID (Mobile Money Identification).

In IMPS, your verification is completed by making the SIM in your mobile as the base and the SIM should be the one which is linked to your bank. That’s why you must have seen that if you insert a SIM in your mobile which is not linked to the bank, then mobile banking apps will not work in your mobile. The same architecture is used in UPI as well. About this we will discuss further.

NPCI (National Payments Corporation of India)

Initially, the limit for fund transfer through IMPS was two lakhs and later it was increased to five lakhs. The way RBI runs NEFT and RTGS, in the same way NPCI runs IMPS. In 2008, RBI made NPCI like a non-profit company. The same NPCI came with IMPS and the same NPCI has brought UPI. NPCI has Association of many banks. Earlier there were 10 banks in it but in 2013, 13 Public Sector Banks, 15 Private Banks, 1 Foreign Bank, 10 Cooperative Banks and 7 Regional Rural Banks were added to it.

Whether it is RTGS or NEFT or IMPS, with the help of all these you can transfer money from one bank to another, but even after this, when you are transferring money for the first time, the bank makes you add Beneficiary so that your security can be maintained. After adding the Beneficiary, the bank takes time, which is called the Cooling Period. In this cooling period, the bank notifies the person who has an account through SMS, Email and in different ways, so that it can be confirmed that the same person who has the account is doing the transactions.

Bank-to-Bank Money Transfer Process:

Now it is not that whatever money has been transferred from one bank to another in a day, the bank fills it in a vehicle and transports it to the other bank at night, in this only the numbers are changed from here to there. When you transfer money to someone, then the numbers in your account decrease and the numbers in the account of the person to whom you transferred the money increase. The way we all have our accounts in the bank, similarly all the banks have their accounts in RBI. Banks can do Digits from here to there but in the end RBI calculates.

Now here another question arises that the numbers have gone from here to there, that is fine, but when we withdraw cash from check or ATM, how is it maintained –

For this, RBI maintains currency chests in different areas in which cash is kept. If more cash comes in the bank, then it deposits that cash in the currency chest and on the contrary, if a bank needs cash, it takes cash from the currency chest. This Currency Chest sends a daily report to RBI that how much money has come from which bank and how much has gone.

One more thing to be understood here is that no matter what the bank is, all are competitors of each other and none of these banks share any of their customer’s data with other banks and neither gives any access. But even after this, if any customer wants to send money to any other bank’s customer, it is done immediately, let us now know how it becomes possible?

Let us understand this with an example that suppose your account is in HDFC Bank and you want to transfer money to Axis Bank account, then for this you will give a request to online or offline bank. Now this request will go to the system created by RBI and RBI will check whether the customer who is sending money has money in his account or not and on the other hand, it will also check whether the account of the person in whose account the money is going is present or not. Now after this, when RBI will verify all this, it will transfer the money and for this you have to pay some charge of Per Transaction.

The charges that you pay while doing NEFT and RTGS are charged for the same thing from you. Basically RBI works like a Mediator in between all these banks. By the way, all these banks are each other’s competitors, but they all have faith on RBI that RBI will not move the details of any of our customers from here to there.

How UPI Has Affected Visa And Mastercard?

Because of UPI, the market shares of USA companies like Mastercard and VISA are also decreasing very fast. Now why is this happening, let’s understand this also-

A long time ago, when the ATM was new, then you could withdraw money from the ATM of the same bank which had an ATM card, while the technology of ATM machine and Debit card is the same. If the banks wanted, they could have allowed each other’s ATM to be used, but even after that they would not have allowed them to use it. They did not share their ATMs with each other because for this they had to share the details of their customers with each other and if this had happened then the details of the customers of one bank would have gone to their competitor.

Now see, by the way, every bank has a loss in this because if they do not allow their ATM machines to be used by the customers of other banks, then for this each bank will have to install many ATM machines in India. Now the solution to this problem has been found by the Network Companies. These are companies like VISA and Mastercard, they are called network companies.

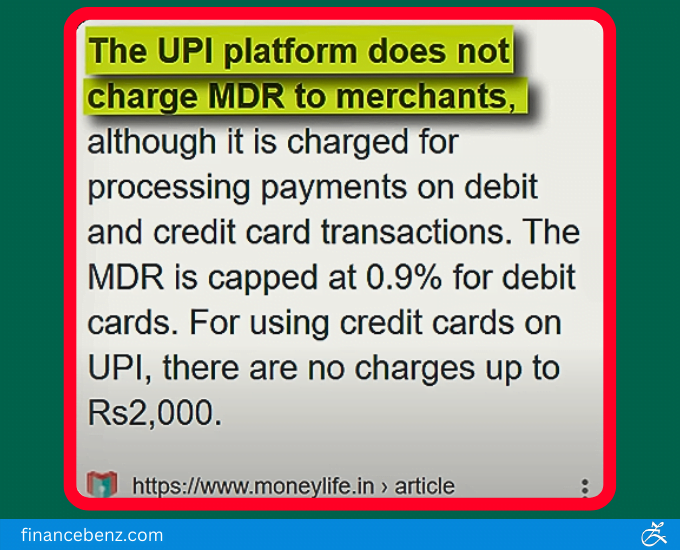

These network companies told the banks that you should not share the details of your customers with each other, rather you give their details to us and we will verify them ourselves when someone brings the ATM and as soon as we verify its details, you allow each other to perform Transactions. And they also promised the banks that we will keep your customers’ details secure. But in this, these network companies take money for every transaction, whether it is money transaction from ATM or buying any goods from a merchant. It is called MDR (Merchant Discount Rate) but in the case of UPI, the government has already cleared that there will be no MDR charges on UPI transactions.

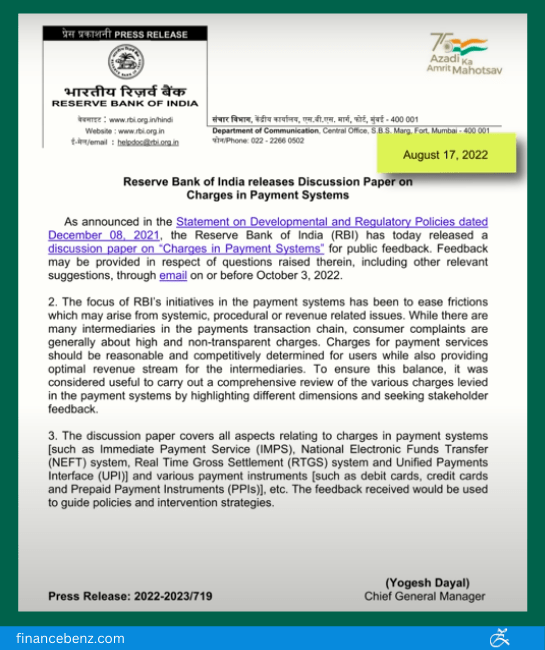

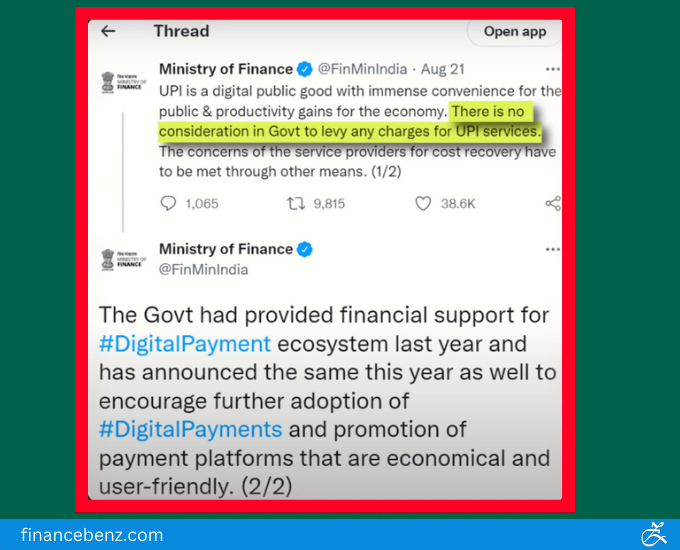

This is the reason that UPI is rapidly pulling down the market share of network companies like VISA and Mastercard. On August 17, 2022, RBI released a Discussion Paper, from whose language it seemed that UPI might start taking charges later.

There was a lot of hue and cry about this, but the Finance Ministry put an end to this fear four days after that on 21 August 2022 itself. The Finance Ministry made a tweet on Twitter, in which it was told that the government has no intention of taking UPI through Charges.

See, a transaction of Rs.800 on UPI costs Rs.2. Now in this case, when UPI is not Chargeable, then how do the companies and banks with UPI platforms earn money. According to a report by PWC, The Remarkable Rise Of UPI In 2020, these companies are collecting payment data and then selling them as Specific Insights to Telecos and NBFCs.

Why Is UPI Going Global?

UPI is growing very fast at the global level as well. Whenever you have to do any transaction outside the country, then you have to use SWIFT (Society For Worldwide Interbank Financial Telecommunications) Code because all the banks of the world are connected through it and because of Swift Code, we can do transactions outside the country as well. Just like we use IFSC code inside India, similarly when we have to do transaction outside India, we use SWIFT code instead of IFSC code.

Just now in Russia-Ukraine War, USA had banned Russia’s SWIFT, which means that all Russia’s banks were out of the SWIFT payment system. And because of this Russia was completely cut off from the international market due to which people were facing problems in doing business.

Therefore, if UPI is implemented all over the world, then India will be safe from all these things. NPCI has launched a subsidiary named NIPL (NPCI International Payments Limited) which has taken UPI to international level. UPI is being implemented in Singapore, Nepal, Bhutan and Dubai and India’s vision is that UPI should operate across the world.

UPI is now being integrated with credit cards as well. Till now we could go to a shop and scan the QR code and make payment through UPI and with this, we could also pay through UPI with our debit card, but now we can pay through UPI with our credit card as well. This will further increase the base of UPI all over the world.

Basically, when a new technology comes, the name of USA or China comes, but at the time when everyone was talking about block chain and WEB 3, at the same time India made a system called UPI. In UPI, we get the facility of No Transaction Cost, No Middle Man and payment successful in two to three seconds and 24*7 availability.

Seeing the success of UPI, Google has also suggested to USA that we too should have a system like UPI. The Federal Reserve System in the US had to bring FED NOW for real time payments through Inspire from UPI. Now US is not so much happy with the growth of UPI because all companies like VISA, Mastercard and SWIFT are from USA.

What Challenges Are Coming In Front Of UPI?

The way UPI transactions are growing so fast, its infrastructure is not growing accordingly. There has been a lot of growth in UPI, but there has not been any major change in its infrastructure, which has increased the risk that its existing infrastructure may not handle its volume.

Along with this, there is another drawback in UPI that it has a policy of zero percent charge, which is not benefiting the UPI service provider and the banks. Therefore, they do not promote UPI in the same way that credit cards and debit cards do.

Still nothing has been done for the Accountability of Failed Transactions in the UPI payment system. UPI does not have any detailed data on failed transactions and type. Along with this, multiple players are involved in it, because of which the accountability of its failed transactions is not fixed on any one person. But the good thing in this is that steps are being taken to control the UPI’s failed transactions.

RBI is going to create a UDIR (Unified Dispute & Issue Resolution) system which can be addressed to UPI’s failure rates. The system will help the users to launch their complaints and track their resolutions.

Final Words:

If you also use online payments, then you must also use UPI because this will increase the accessibility of UPI and it is a very secure and fast way for your transactions. Hope with the help of this article, you must have got to know a lot about UPI. If you find this article informative then do share it.