If you are also a customer of HDFC Bank and want to connect yourself with digital payments, then HDFC Payzapp can be a better option for you. And even if you are not a customer of HDFC Bank and you are looking for a trusted UPI app which provides more cashback points, then in that case also HDFC Payzapp application is very useful for you. Because Payzapp UPI app gives you more rewards and cashback points on all your transactions compared to other UPI apps, which we can use for shopping, bill payments, and purchasing vouchers etc.

In this article, we are going to know about HDFC Payzapp in detail, what is HDFC Payzapp and how it works and how can it prove beneficial for you? So, if you are an HDFC Bank customer then this app is going to provide you a lot of amazing features and even if you are a non HDFC Bank customer then this app can provide you more benefits in the world of rewards and cashback points. Therefore, if you do not know much about HDFC Payzapp, then before finishing this article, you will become an advanced user of this app, but for this you will have to read this article completely.

What is PayZapp?

HDFC PayZapp is a mobile payment and financial services app provided by HDFC Bank, one of India’s leading private sector banks. It offers a wide range of services and features, including: Digital Payments, Online Shopping, Travel Booking, Money Transfers, Prepaid Card, Bill Management, Grocery Shopping, Discounts and Offers.

HDFC PayZapp is designed to provide a comprehensive and convenient digital payment and financial management solution for users in India. It aims to streamline various financial transactions and make them easily accessible through a mobile app.

How to Register and Login to PayZapp?

To register and log in to HDFC Payzapp, follow the steps given below –

- First of all install HDFC Payzapp in mobile.

- Now you have to click on ‘Let’s get Started‘ and now you have to enter the mobile number linked to your bank account. (If you have two SIM cards in your mobile then you will select the SIM card which is linked to your bank account)

- Now to verify your mobile number, an SMS will be sent from this number and this process will be automatic. (To verify your mobile number, you must have a valid recharge in your mobile)

If you are a non-HDFC Bank customer then you can register in this app by completing your basic KYC. But if you are an HDFC Bank customer, then as soon as you enter the mobile number, it will automatically fetch all the details of your bank account, the information of which will be shown to you on the screen. Now it is necessary for HDFC Bank customers to verify their identity.

- HDFC Bank customer can verify his identity in three ways, which include credit card, debit card and HDFC Bank Customer ID. These three options will be visible on the screen from which you can select any. To verify with debit card and credit card, you will have to enter the last 4 digits of your card and after that you will click on ‘Verify Account and Link Cards’

- All the cards you have linked with your Payzapp account will also be visible to you and you can delete any card by swiping. Similarly, you can also link your other cards from here. After this you will click on proceed.

- Now after this you will have to add your bank account, here you can also add your Rupay Credit Card. To add a bank account, you have to select your bank name after which it will verify it with your number.

- Now you will have to select one of your UPI numbers and here you can also add the mobile number linked to your bank account. Anyone can make payment to you through any UPI app with this UPI number.

- After completion of KYC and registration, your wallet will be automatically activated for which you will also get a virtual debit card.

In this way, you can register in the app and if you have already created your account in it, then after entering the mobile number, it will automatically fetch the previous details of your account.

What features and facilities are available in HDFC PayZapp?

Now we will know about the features and benefits you get on the UPI (Unified Payments Interface) platform PayZapp launched by HDFC Bank –

Digital Payments:

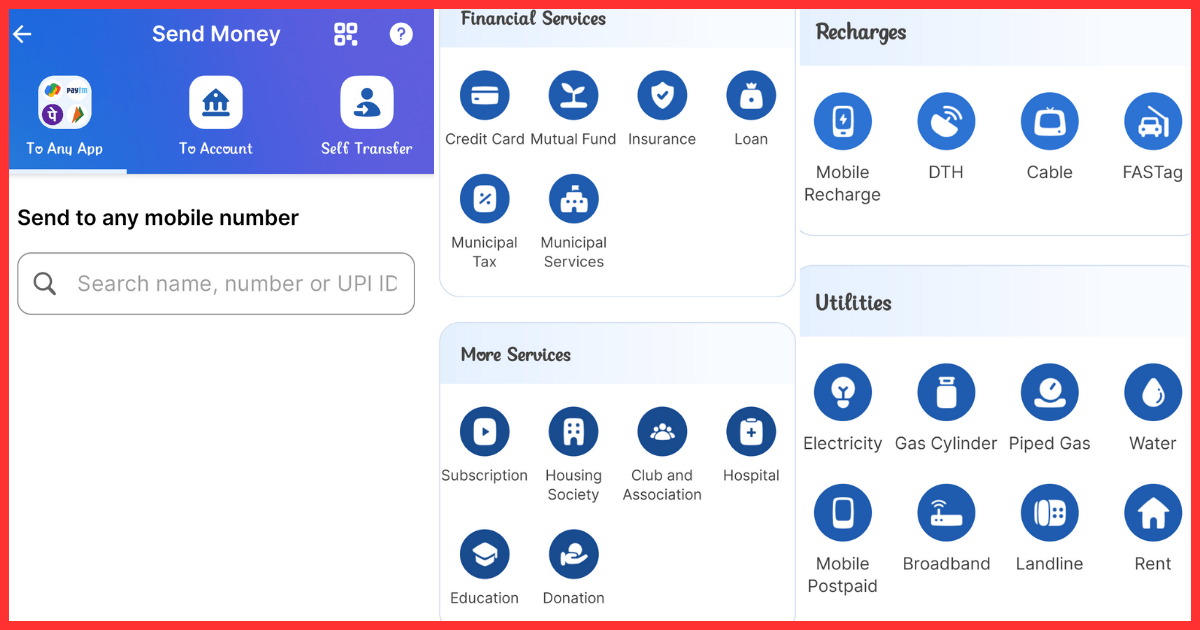

PayZapp allows users to make a wide range of digital payments, including mobile recharges, utility bill payments (electricity, water, and gas), DTH recharges, and data card recharges. When you make any UPI payment or pay your utility bill using PayZapp application, you get good cashback points on it. The user interface of PayZapp application is quite user friendly and all these options are available to you on its home page itself.

SmartBuy Integration:

In Payzapp, you can also directly use HDFC Bank’s SmartBuy feature, with the help of which you can buy Gift Vouchers of top brands and also shop on some selected brands. Through HDFC SmartBuy, when you do any flight booking, hotel booking, rail ticket booking or shopping on their partner brands, you get more points than the normal rewards points. And on PayZapp you can directly avail this service.

Travel Booking:

Users can book flights, hotels, bus tickets and cab rides through SmartBuy on the app, making it a convenient tool for travel planning.

Money Transfers:

Users can send money to friends and family using their mobile phone numbers, even if the recipient doesn’t have the PayZapp app installed.

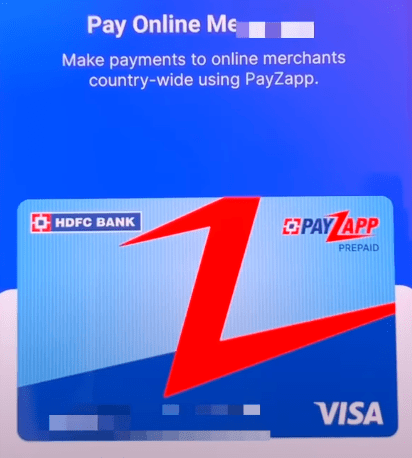

Wallet and Prepaid Card Facility:

PayZapp’s wallet feature lets you deposit money into a virtual wallet within the app. This wallet balance can be used to pay for mobile recharges, bills, online shopping, and more. This gives you more flexibility and makes it easier to manage your finances and make digital transactions.

You are also provided with a virtual debit card for PayZapp Wallet, which you can use for online and in-store purchases. When you make any payment using PayZapp Wallet, you get more rewards and cashback points on that.

Bill Management:

Bill Management through PayZapp provides users with a streamlined and hassle-free way to handle their utility bills. Users can conveniently access and pay their various bills directly from within the app, eliminating the need to visit multiple payment portals or handle paper bills.

PayZapp also assists users in keeping tabs on due dates. It sends reminders or notifications, ensuring that users are alerted to upcoming bill payment deadlines. This proactive approach helps prevent late payments and associated penalties, making it easier for users to stay on top of their financial responsibilities.

Investments:

PayZapp also offers investment services, allowing users to invest in mutual funds and track their investments.

Security:

HDFC PayZapp prioritises security, using encryption and authentication measures to protect users’ financial information and transactions.

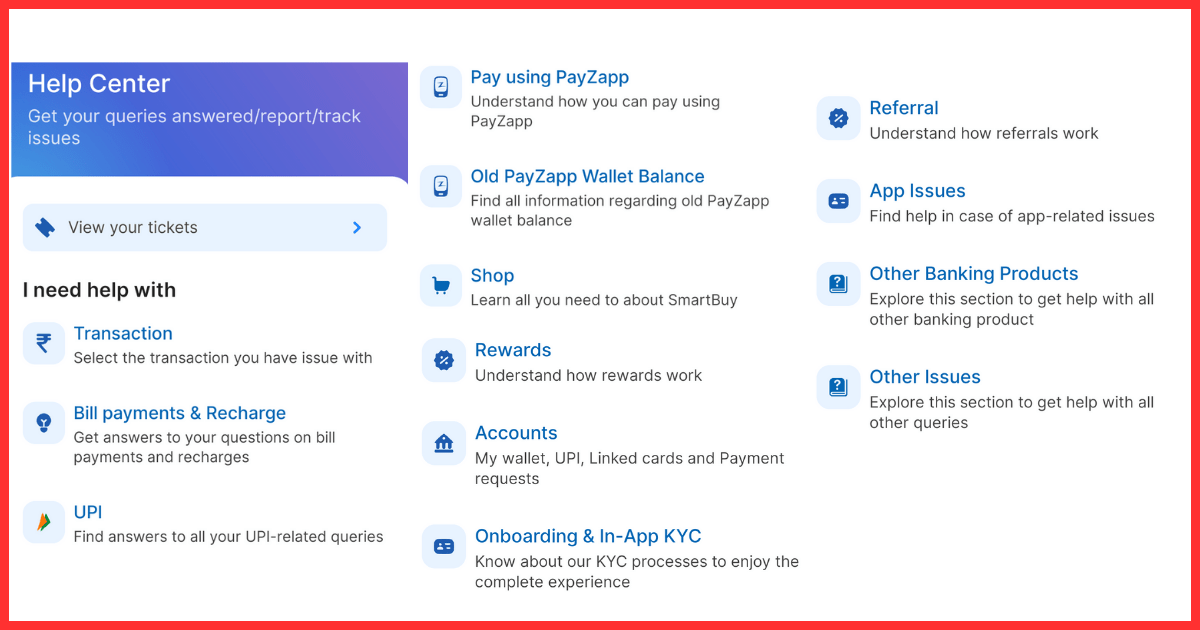

Customer Support:

PayZapp provides a dedicated customer support section within the app, allowing users to get assistance, resolve issues, and seek information about their transactions or account.

What Is A Passcode in PayZapp?

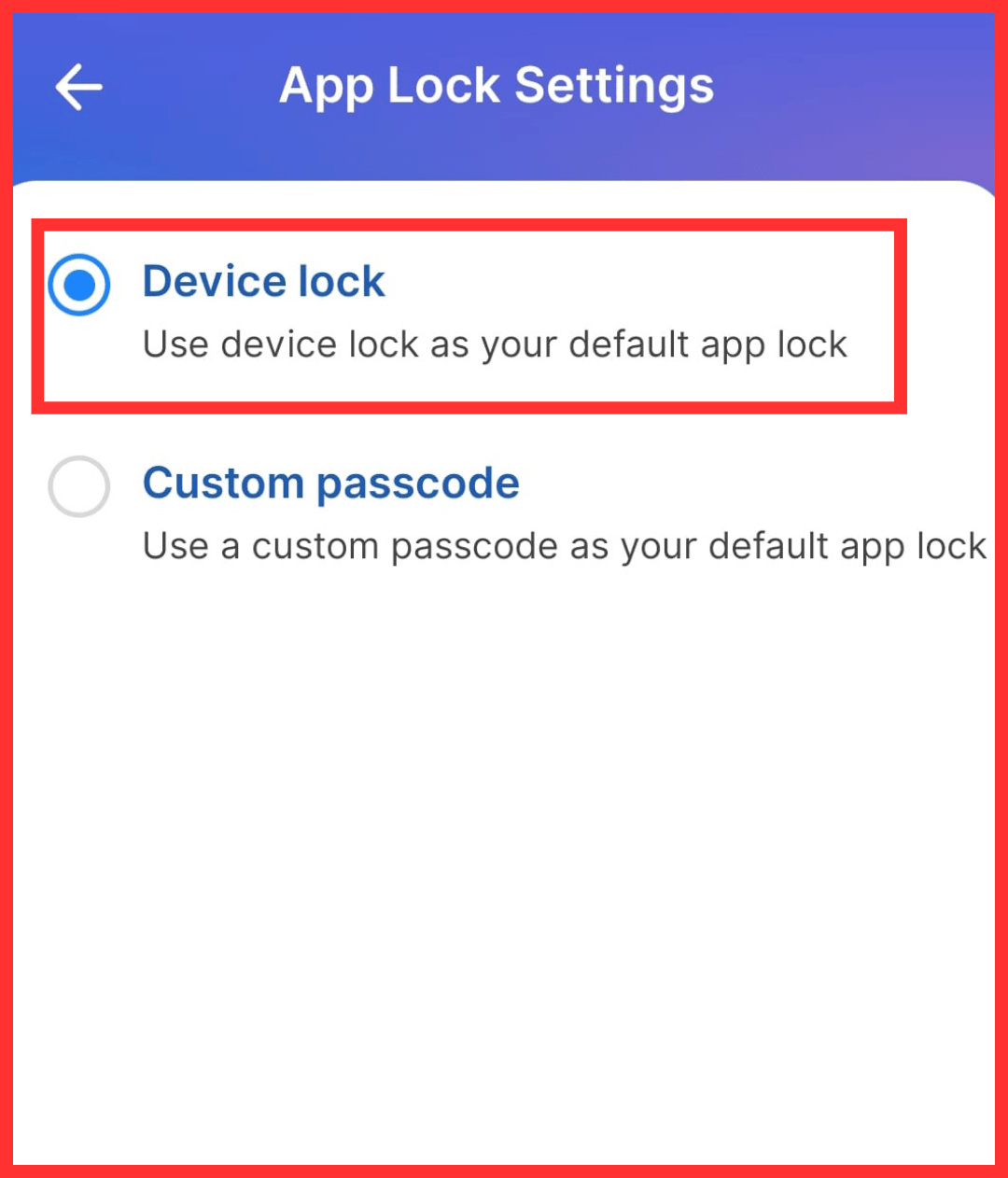

When it comes to PayZapp, a passcode is a 4-digit code that you can set to unlock the app. You can set the passcode after completing the PayZapp registration process.

How to set a passcode for PayZapp?

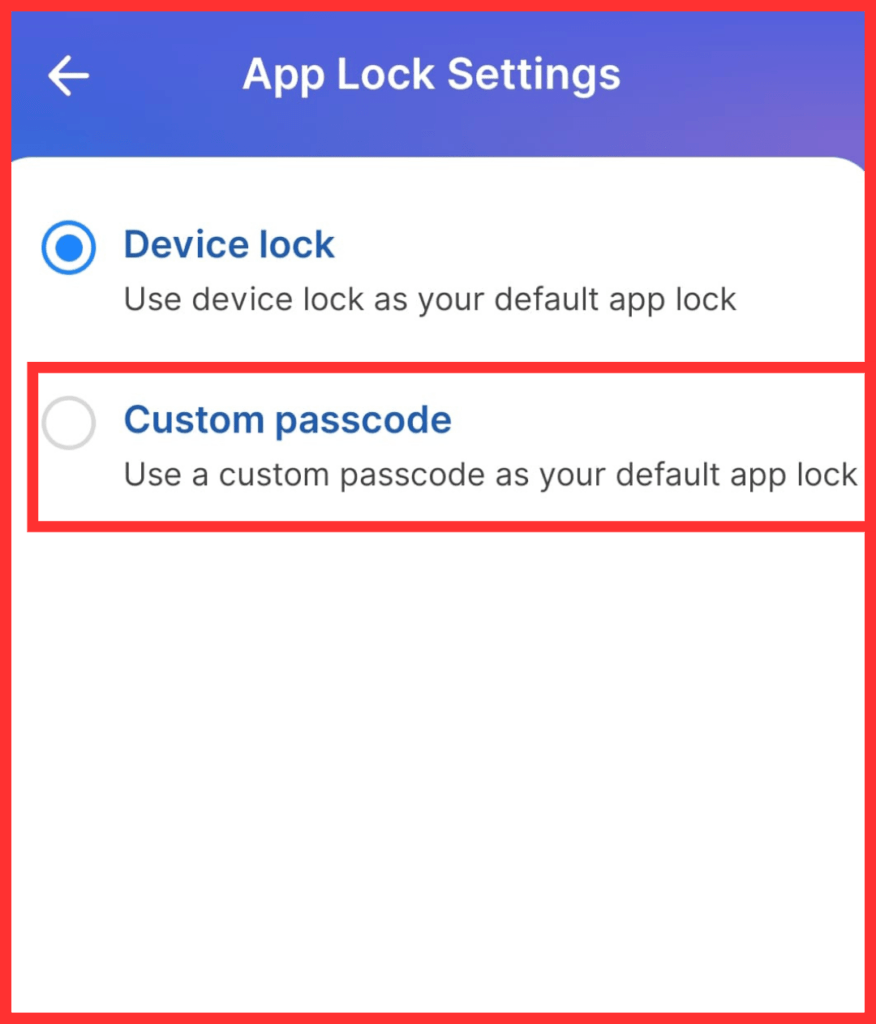

In HDFC PayZapp, you are given two options to set a Passcode, the first of which is Device Lock and the second is Custom Passcode. If you want to unlock your PayZapp app from the lock on your device (Including all the passwords, fingerprints and PIN set in your device) then you can select Device Lock here and if you want to set a separate 4 digit PIN or Passcode for this, then you can do it with the help of Custom Passcode.

We will learn about the ways to set both these types of passcodes –

Follow these steps to set up a Device Lock passcode:

- Go to the hamburger menu on the top left corner of the PayZapp homepage

- Select ‘App Settings & Info’ and go to ‘App lock settings’.

- Now here you will select ‘Device Lock’

Follow these steps to set up a Custom passcode:

- For this you again have to go to the hamburger menu on the top left corner of the PayZapp homepage.

- Select ‘App Settings & Info’ and go to ‘App lock settings’.

- Now here you have to select ‘Custom Passcode’.

- Now you have to enter your desired 4 digit passcode.

- You have to re-enter this Passcode and confirm it.

Now whenever you open PayZapp on your phone, you will have to enter this passcode.

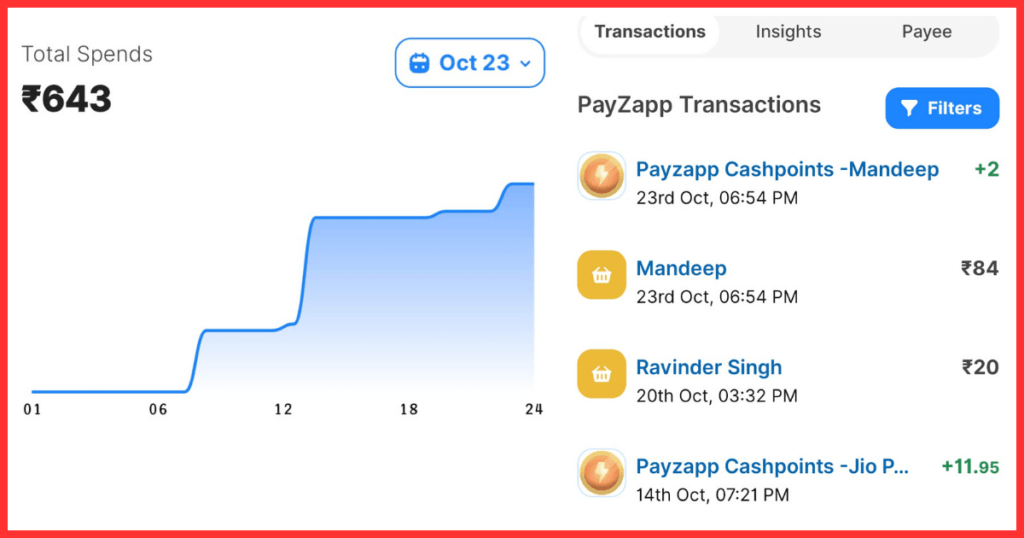

What is Passbook in PayZapp and its features?

A passbook is traditionally linked with banks, serving as a record of transactions in a bank account, showing credits, debits, deposits, and withdrawals, along with transaction dates and account balance. Updating it involved visiting a bank branch and using a passbook printer machine.

Digital Option – PayZapp Passbook

HDFC Bank’s PayZapp app offers a digital passbook, consolidating transaction details such as payments, money transfers, utility bills, and mobile recharges. It provides a personalised financial record for easy transaction tracking.

Access to PayZapp Passbook

Accessing the PayZapp passbook is straightforward. Users need to log in to the PayZapp mobile app and tap on the passbook button on the dashboard.

Key Features of PayZapp Passbook

Transaction Filters: Users can employ filters like transaction type (merchant payments, money received, refunds, self-transfers), amount, and payment method (UPI, PayZapp wallet, or card). Sorting options by amount or date are available, along with filtering transactions for custom dates. Failed, pending, and completed transactions can also be filtered.

Insights: Users can categorise transactions for better understanding and analysis of payment behaviour, aiding budget management.

Payee Details: The passbook also displays transaction details, including the number of transactions with specific payees, giving a comprehensive view of the payment history.

The PayZapp passbook simplifies transaction tracking, offers insightful analysis, and makes it easier to manage financial expenditures, all within the convenience of a digital platform.

Other important highlights of HDFC Payzapp:

Is HDFC PayZapp safe?

HDFC PayZapp prioritizes the safety of its users. The login process is fortified with both a Personal Identification Number (PIN) and biometric authentication, ensuring a robust layer of protection. Furthermore, all transactions require a password for authorization, adding an extra level of security to thwart unauthorized usage. Crucially, sensitive card details are neither stored on the device nor shared, enhancing overall security.

To ensure your personal information remains secure, it is advisable to commit your username, password, and security question responses to memory. Avoid noting them down on devices like your personal computer, tablet, or mobile phone. Users are entrusted with the responsibility of safeguarding the confidentiality of their login credentials. Any losses incurred due to unauthorized use are not the responsibility of HDFC, and, depending on circumstances, the card issuer may hold the user accountable for such unauthorized transactions.

What is the PayZapp limit?

For non-KYC (Know Your Customer) customers, the monthly transfer limit on PayZapp is Rs. 10,000, whereas KYC-verified customers enjoy a higher cap of Rs. 50,000. This distinction ensures flexibility in usage while adhering to regulatory requirements.

Eligibility Criteria:

To access HDFC PayZapp, individuals must meet specific eligibility criteria. Users should be at least 18 years old and either the primary cardholder or authorized user of one or more Eligible Cards issued by any Indian bank. Additionally, individuals should maintain good standing with respect to their Eligible Card accounts. All PayZapp registered users holding an Indian bank account with a member bank, allowing UPI facility usage, can register for UPI on the PayZapp platform.

Fee Structure:

Registering for PayZapp UPI and conducting transactions directly from bank accounts do not incur additional fees. PayZapp does not impose charges for UPI payments. However, it’s important to note that bank account transfers from the PayZapp wallet will attract transaction fees, amounting to 2.5% along with an 18% Goods and Services Tax (GST). Users should be mindful of these fees to make informed financial decisions when utilizing the platform.

Final Words:

HDFC PayZapp is a very good UPI app and by using it you can make your world of digital payments more easy and rewarding. In this article we have learned a lot about PayZapp and we hope that you will be able to use PayZapp well with the help of this article. But if there is still any point or question which we have not been able to cover in this article, then you must tell us with the help of the comment section.