Friends, if you have also taken a new SBI (State Bank Of India) Credit Card and you also want to know that What Is SBI Credit Card Billing Cycle? If you are completely new to credit card and do not know anything about its Billing Date or Billing Cycle or even if you know, then there is no proper knowledge, So in this article, you are going to know all the questions like Billing Date, Due Date of SBI Credit Card.

First of all, we know that what is this Billing Cycle of SBI Credit Card-

What Is SBI Credit Card Billing Cycle?

SBI Credit Card Billing Cycle means that when you do any Purchasing or Shopping with SBI Credit Card, then after a few days, a bill is prepared by the bank on the basis of all the Transactions done by your Credit Card, In which a Due Date is also given. There is a gap of about 20 days between the Bill Generating Date and this Due Date and within this time you have to pay your bill, this process is called SBI Credit Card Billing Cycle.

What is Due Date in Credit Card Bill?

When your credit card statement is generated or when your credit card bill is generated, even after that you are given a few days’ time by the bank, which mostly lasts for 20 to 25 days and after 20 to 25 days, a date is set for you which is called Due Date and you have to pay your Credit Card bill at the same time, otherwise the bank charges you Late Payment Fee Interest.

How to Know Billing Date of SBI Credit Card?

You can adopt many methods to know the Billing Date of your SBI Credit Card. But in this article, we will tell you about only two methods through which you can find out the Billing Date of your SBI Credit Card.

Even if you have a bank account with SBI Bank, you can also know the billing date of your credit card by these methods and even if you do not have an account with SBI Bank even then, by following these steps, you can easily find out the Billing Date of your Credit Card.

Steps to know Billing Date of SBI Credit Card

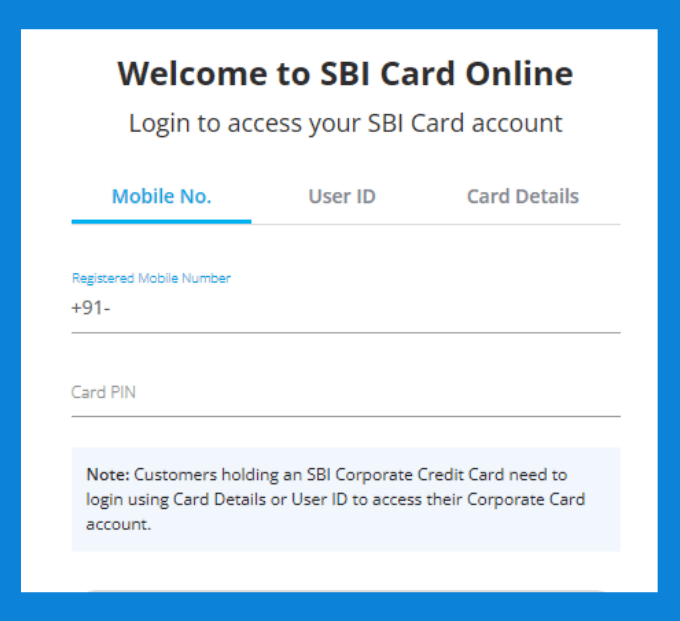

- First of all, you have to register on Sbicard.com or if you are already its existing user then you can login here.

- You can also do this from the official website of SBI Card and you can also manage your SBI Credit Card easily from their application named SBI Card. The method will remain the same in both the website and the application.

- To register, you will have to enter your credit card number, CVV number and date of birth on the SBI Card website. After this an OTP will be sent to your registered mobile number for authentication.

- After entering OTP, create a password of your own. Now you have got a User Id and a Password through which you can login to their website or application.

- Here you can login in three ways – firstly you can login here with your mobile number and credit card PIN, secondly you can login here with the help of your User Id and Password, and thirdly, you can also log in here by entering the details of your credit cards.

By following all these steps, you have to login to the website or application of SBI Card and after logging in, what process you have to follow, let us know –

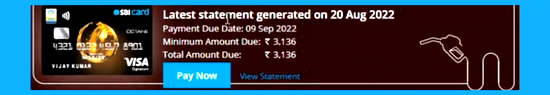

- After login, if you have done any shopping or purchasing from your SBI Credit Card and your statement has been made, So in the top itself, it gives you information about your Billing Date, Due Date, Payment Due Date and Minimum Amount Due.

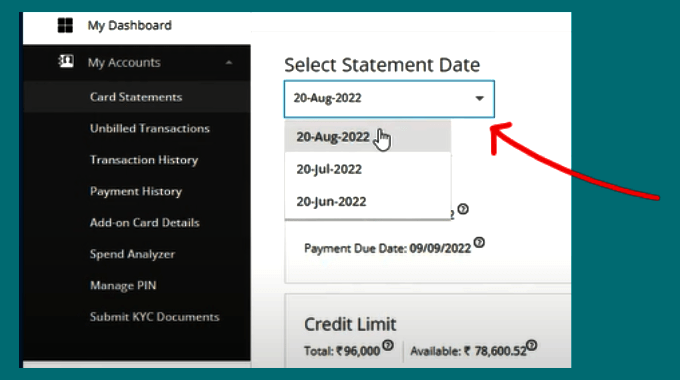

- If you have done any shopping with your credit card and your statement has not yet been generated, then you can see your details by coming here in My Accounts-Card Statements and selecting your statement date in Select Statement Date.

- Remember, whatever date is mentioned here, your statement will be generated on the same date every month. This date is fixed. Here you can see the date of generation of your statement, till 20 days after that you can make payment of your SBI Credit Card.

Friends, in this way you can find out the Billing Date or Statement Generating Date of your SBI Credit Card and if you face any problem in this, then you can adopt another method which is very easy.

But in this way you will not be able to manage your Credit Card completely, by following this method you can know the Billing Date, Last Due Date of the Credit Card and Pay your bill.

But in this way you will not be able to manage your Credit Card completely, by following this method you can know the Billing Date, Last Due Date of the Credit Card and Pay your bill.

For this, you keep checking the inbox of that email from time to time, which you put on there while getting your credit card issued.

Whenever the bill or statement of your credit card is generated, now that credit card may have been issued by any bank, then the information and details of its bill are sent to your Email Id.

You can also find out what is SBI credit card billing cycle from your email ID. You have to check your email daily because whenever your statement is generated, after a day or two that statement is sent to your email as well.

Along with this, the bank also sends you a PDF file in this mail, in which your credit card’s complete spending of that month and all the information like Payment Date, Bill date is Mentioned. This PDF file is Password Protected, which cannot be opened by everyone.

The password for your SBI Credit Card PDF Statement file is your full Date of Birth and the last 4 digits of your 16 digit credit card number.

In this way you can know the Billing Date of your SBI Credit Card without logging into any App or website. Both these methods are absolutely genuine methods.

Apply SBI Cashback Credit Card before the exclusive offer ends

How Many Days Do I Actually Get to Pay SBI Credit Card Bills Without Any Late Fees?

Generally, most of the credit cards have a free credit card bill payment period of 45 to 50 days from the last billing date. Your bill will mention the last bill payment date and the minimum amount payable. If you pay the minimum amount before the due date, then you will not be charged any kind of Late Fees Interest.

But here I will give you suggestion that you should always make full payment of your credit card, never pay minimum amount because by doing this you will have to pay a lot of interest on the remaining amount next time.

Can We Change SBI Credit Card Bill Cycle?

If you are worried about the billing date provided to you or that billing date is not convenient for you, then you can get your billing date changed by contacting the bank. It is much easier when you have a strong reason for it.

You cannot change the Billing Date of your SBI Credit Card whenever you want. To change the Billing Date of your credit card, only some specific dates are provided to you by the bank, out of which you can select the date as per your wish.

RBI (Reserve Bank of India) has now made it mandatory that every Credit Card issuing company or bank will give the option to its users to change the Billing cycle. All Credit Cards users will be given the flexibility to change the Billing cycle of their credit cards.

How Do I Change The Payment Date of SBI Credit Card?

When your SBI Credit Card bill is generated once, then it may be difficult for you to change your payment date at that time, but by contacting the Bank or Customer Care, you can get them to change your next payment date or all the upcoming payment dates.

But to change the payment date of your credit card, you must also have a solid reason for it. For example, if your salary receipt date has changed due to which you are facing problem in payment of your credit card, then now you have a genuine reason to change the billing date of your SBI Credit Card.

Apply SBI Simply Click Card before the exclusive offer ends

Similarly, if you have any other strong reason other than this, then you can contact your bank or branch to change your Billing Date.

Final Words:

So Friends, it is expected that with the help of this article, you would have got a detailed information about What Is SBI Credit Card Billing Cycle. , Friends, it is very easy to take a credit card, but it is very difficult to manage it properly, and the only thing that is lacking here is Proper Guidance or Proper Knowledge.

Therefore, if you are a credit card user, then it becomes necessary for you to get accurate information about credit card, only then you will be able to manage your credit card properly.

In this article, we have tried to target almost all the main questions related to the Billing Cycle of SBI Credit Card. But if still there is any such question related to Billing Cycle of SBI Credit Card which we have not covered in this article, then you must tell us in the comments.

Your Feedback is useful for us.