Friends, in this article we will know in detail all the features of HDFC Infinia Credit Card. Because you will get a lot of such content on the internet which will make you aware of all the features of this credit card but how you can avail all those features and what steps you have to follow for that, you will hardly get to see it in any content. Now if you want to know only about the features of a credit card, then you can check it out by visiting the official page of that bank. For this, you do not need to read any separate blog.

But if you want to know all those features in detail and want to know the method of using them, then you can take the help of the blog. Therefore, in this article, we will not only tell you about the features of HDFC Infinia Credit Card, but will also tell you how you can use them and whether it is beneficial for you or not. Because in these credit cards you get to see many such features which look amazing when read and seen but we do not know how to use them and we do not even know well what terms and conditions apply to them.

Our objective behind writing this article is that you should be able to use all the features of this HDFC Infinia Credit Card and if you are thinking of applying for this credit card, then you should also be able to know what benefits you get in it so that you can easily decide whether this credit card is beneficial for you or not.

For whom HDFC Infinia Credit Card is best?

Here we would like to tell you that this HDFC Infinia credit card is best for those who like to travel a lot. Because this credit card mainly provides the two biggest benefits – Lounge access and Hotels and restaurants bookings. Now it is certain that lounge access and hotels are used frequently only by those who travel a lot because this credit card saves you a lot of money on hotel booking and flight booking.

Quick Overview Of HDFC Infinia Credit Card Features:

[wptb id=3233]

All features of HDFC Infinia Credit Card are described in detail:

Now we will know all the features of HDFC Infinia Credit Card in detail one by one –

ITC Hotels benefit In HDFC Infinia Credit Card:

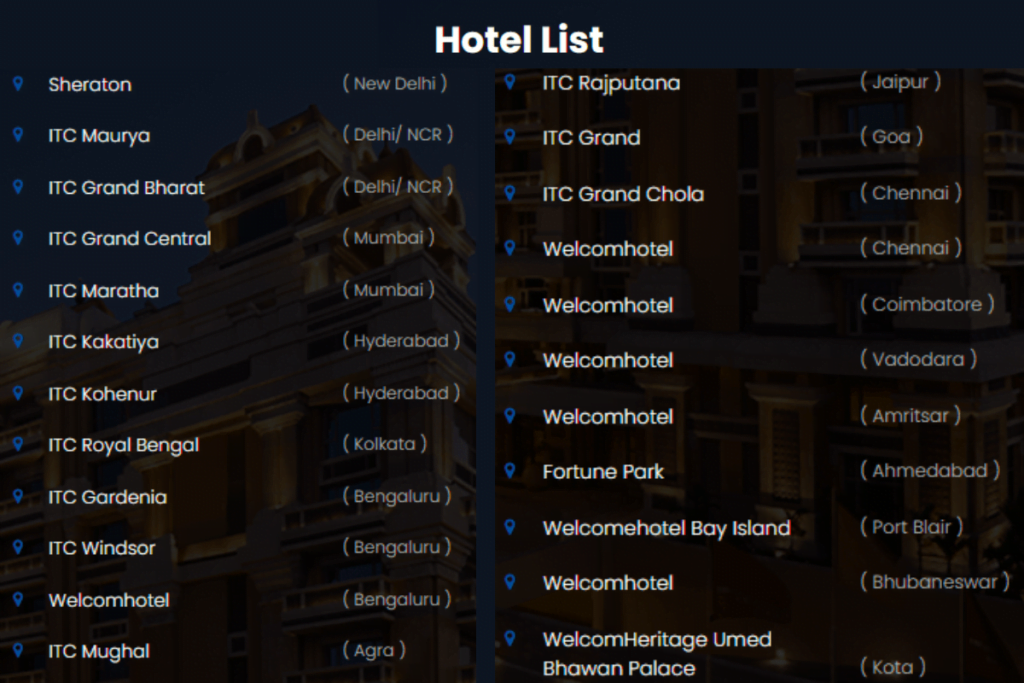

Due to HDFC Bank’s tie-up with ITC Hotels, they provide you ITC Hotels related benefits on some of their credit cards. Now in the image below you will see all those ITC hotels which are available in India and with which HDFC Bank has tie-up.

If you stay in any of the above mentioned ITC hotels for 3 nights and if you make your payment there through this credit card, then you have to pay only for 2 nights and one night will be provided to you for free on this credit card of HDFC Bank. That means, in a way, it is a system of one night free (2+1) on two nights.

Experience the benefits of HDFC Bank’s premier credit card

Apart from this, you also get discount on buffet system present in these ITC hotels on this Infinia credit card. In buffet system, you have to pay a certain cost once in the beginning and after that you can eat as much food as you want there. So under this credit card you are provided 1+1 complimentary Buffet benefit in these ITC hotels. That is, if someone else is accompanying you there, then you have to pay only for one person, the buffet cost of the other person is waived off if you pay through this credit card. So this is also a wonderful benefit provided to you on this credit card.

What is Club Marriott membership in HDFC Infinia Credit Card?

On this credit card you are also given membership of Club Marriott for one year. Like ITC, Club Marriott also provides the facility of many premium hotels and restaurants. Through this credit card, you will get to see the benefits of this card at all the Marriott hotels and restaurants in Asia and Pacific. Altogether, they have around 350 hotels and 1000 restaurants.

Now we understand step by step how Club Marriott membership works and how you can use it –

- Now suppose you do not have this HDFC Infinia credit card and you book any of their hotels through Club Marriott’s app, then for that you will first have to install their official app.

- After installing, you will signup in it. And after this, it will show you all their Marriott hotels or restaurants near you.

- When you book any of these hotels for a night for the first time and pay for it, you immediately become a member of the Club Marriott property. And by becoming a member of Club Marriott you get 5 benefits which we will discuss further.

- After payment, they will give you a 5 page voucher book. It is like a check book but in it you only get five pages and these five are different gift vouchers which you can use five times.

- Now next time whenever you book any Club Marriott hotel or restaurant, you will be able to use these five vouchers one by one and you are provided different discount offers in these five vouchers.

Now in this credit card, the entire role is of these five gift vouchers. If you do not have this credit card, then to get these five gift vouchers, you have to stay at least once in any Club Marriott hotel or restaurant, only then these gift vouchers are provided to you. But if you have this HDFC Infinia Credit Card, then you do not need to do hotel booking and it directly makes you a member of Club Marriott and provides you these five vouchers.

Now let us know what benefits these five gift vouchers provide you –

What are the benefits provided to you in Club Marriott’s 5 Vouchers?

- Next time whenever you book a Marriott Hotel or Restaurant, you can get upto 20% discount on Food and Beverages with the help of this first voucher.

- In the second voucher, this room will be provided to you at the rate which has been the lowest price out of whatever ups and downs have happened in the hotel room prices for the entire week and on that too you will get upto 20% off.

- In the third voucher you are given 20% off on SPA services in their hotels.

- The fourth voucher provides you free upgradation of your booked room level to the next level room. That is, if you have booked a basic level room, then they will provide you a room of the next level for the same money. But you will get this facility only when the rooms in the next level are vacant, otherwise you will have to use it next time.

- In the fifth voucher you get 30% off on basic level rooms. That means, if you book a basic level room then you get 30% discount on this voucher.

Lounge Access In HDFC Infinia Credit Card:

HDFC Bank says that you can avail the facility of unlimited time lounge access at more than 1000 airports across the world. So this is the best benefit of this card because it provides you the facility of unlimited lounge access which you may not see in any other credit card.

Reward points on this card:

In this credit card, you are given 5 reward points on spending Rs 150. Now you will get these 5 reward points on Insurance, Education and Utility Bills also. Apart from this, if you spend on travel or shopping using HDFC’s SmartBuy platform, it will provide you up to 10 times reward points.

But here you get up to 10x reward points, so it is not that you will get 10x reward points on every single spending on Smart Boy rather you will be given category wise reward points, out of which in some categories you may be given 5X RP and in some categories you may be given 8X and in some categories you may be given 10X reward points. So it will depend on your spending category how many reward points you will be given. It will tell you on the spot how many reward points you will get on each category.

Redemption Value of Reward Points:

- If you book a hotel or flight through SmartBuy, then the value of 1 reward point will be equal to Rs 1.

- If you buy any product of Apple or Tanishq on SmartBuy, then there too you are given the value of 1 RP at Rs 1.

- If you convert these reward points into Air Miles, using which you can later book flights, then in that case you get the value of 1 RP equal to 1 Airmile.

- If you buy any product or voucher using HDFC Netbanking, the value of 1RP will be equal to Rs 0.50.

- And if you convert your reward points into cash, you will get the value of one reward point at Rs 0.30.

So we will not recommend you anywhere to convert your reward points into cash because during this time you get to see very little value of your reward points. Instead, you can use your reward points for shopping or hotel booking or purchasing any gift voucher because there you get more value for your reward points.

Golf benefit in Infinia Card:

Through this credit card, you are given free access to all their selected Golf games available in India and wherever coaching facility is available in these Golf Games Institute, you can avail that coaching also for free through this credit card.

Experience the benefits of HDFC Bank’s premier credit card

Apart from this, the bank also provides you free of cost access to some International Golf Games Courses on this credit card, where you can play golf for free through this credit card.

You can access the list of all the Golf Courses on which this credit card offers you discount from here. And you can find out whether this Golf Course is in your city or not.

Fee & Charges Of this Card:

This credit card is given to you with a joining and annual fee of Rs 12500. Now, the fee here is Rs 12500 but the bank provides you reward points in return of this value. When you initially activate this credit card, you get 12500 reward points as welcome benefit. And as we have seen above, the value of one reward point also goes up to ₹1.

Therefore, you get reward points equivalent to the joining fee of this card. Apart from this, when you renew this credit card after seeing the fee of Rs 12500, at that time also you are gifted 12500 reward points. Therefore, if seen this credit card has become like lifetime free for you from both the sides.

And if you spend Rs 10 lakh or more from this credit card in a year, then your annual fee is automatically waived off.

Final Words:

Now as you must have seen that you get to see many amazing features on credit cards. Therefore, if you are fond of traveling and most of your travel is by flight, then this credit card is best for you. Now talking about its fees, you get reward points in return equal to its joining and renewal fees and in return you are getting so many benefits, so what more do you want.

Therefore, we highly recommend that if you are being invited for this credit card, then you should definitely take this credit card. Now, although not everyone gets this credit card, but if you are a lucky person and you are selected for it, then do not let such an opportunity go by hand.