Today in this article we will learn about HDFC Bank’s internet banking, how to Register for HDFC Netbanking? Today in this article we will learn about how a beginner or new HDFC Bank holder can register or activate his internet banking. We assure you that before finishing this article, you will activate and register your HDFC net banking. Let’s know this process step by step –

What is Net Banking/Internet Banking?

Netbanking, also known as online banking or internet banking, is a digital financial service that allows individuals and businesses to access and manage their bank accounts, conduct financial transactions, and perform various banking activities over the internet through a secure website or mobile app. This convenient method offers features such as checking account balances, transferring funds, paying bills, and more, all from the comfort of one’s computer or mobile device.

How Can I Register for HDFC Netbanking?

To login or register in HDFC Bank’s net banking, the two most important things you need are customer ID and its password. Now you can check our detailed article on how to find or create your HDFC Bank customer ID and password from here, in which you can find your customer ID and its password by following the steps mentioned. After getting the customer ID and password, you can follow the further process from here.

- First of all, you have to open the official website of HDFC Net Banking in your mobile or laptop.

- Now here first of all you have to fill up your customer ID and click on Continue.

- Now you will be asked for your password, you have to fill it up and continue.

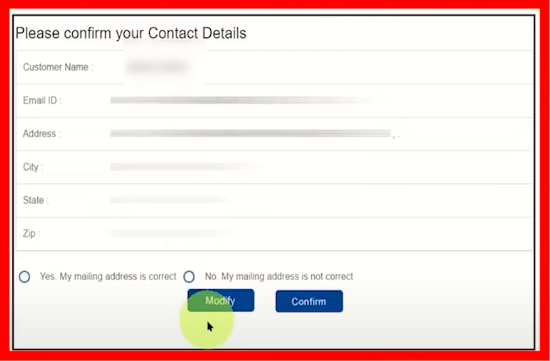

- Now a pop up may appear in front of you with some of your contact details and bank guidelines which you have to confirm.

- Now you have successfully registered in HDFC Bank Internet Banking from where you can do all the online tasks related to your account.

Now when you register your HDFC net banking in the beginning, all your services like statement download, transaction history, modify personal details, account details get automatically activated. But an important service of your fund transfer is not activated until you enable it yourself. Without enabling this setting, you cannot send any money to anyone with the help of your internet banking, therefore it is very important to enable it. So now we know how you can activate this fund transfer service.

How to activate fund transfer service in HDFC Netbanking?

- For this you will have to login to your HDFC Net Banking again.

- After login, you have to click on the option named ‘Fund Transfer’ in the menu section.

- Now you have to click on ‘Register Now’.

- After this, you have to accept some terms and condition and confirm it. (Please read these terms and conditions once to familiarize yourself with the new policies and security purposes of the bank)

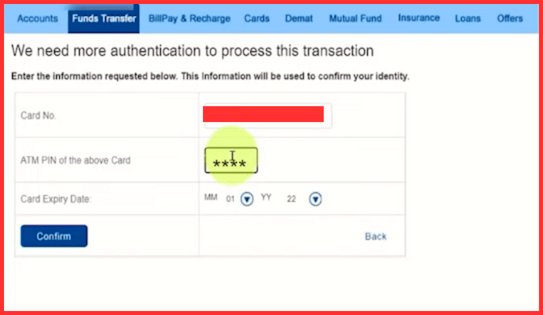

- After this, whatever debit card is active on your account, it will be visible on the screen, you have to select it.

- In the next step, you have to confirm it by entering your debit card PIN and expiry date.

- You will have to confirm your mobile number with an OTP for Security Access.

- Now you will see some information regarding authentication which you have to continue.

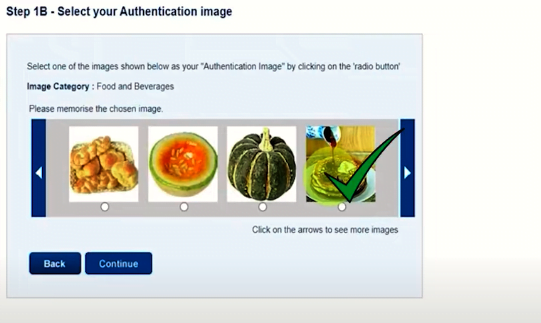

- Now you have to select any one of the categories given for image authentication.

- Now you have to select an image related to your selected category and remember it.

- Now you have to write something about this image and click on ‘Proceed To Step 2’.

- Now you have to set some security questions for recovery of your account. If you ever forget your password, then these questions come in handy. After this you have to click on ‘Proceed To Step 3’

- Now you have to review all the details you have entered once and confirm it.

- Once you confirm all this, the fund transfer service will be activated on your account and your HDFC Netbanking will be completely activated.

By following all these steps, you can activate your HDFC Netbanking and access your account right from your device.

What Are The Benefits of HDFC Netbanking?

With HDFC Netbanking, you’ll experience a world of convenience at your fingertips:

Money Transfer – Easily manage your financial commitments by paying your maid or driver’s salary, society maintenance, and transferring funds to friends and family through NEFT, RTGS, or IMPS.

Pay Bills – Streamline your life by swiftly settling electricity, mobile, gas, water, and DTH bills. You can also recharge your prepaid mobile number hassle-free.

Shop Online – Embrace the joy of online shopping in the realms of fashion, food, travel, and entertainment, with Netbanking as a secure and seamless payment option.

Upgrade Your Lifestyle – Take control of your financial well-being with a range of tailored loan and credit/debit card options designed to suit your unique needs and aspirations.

Invest Wisely – Build wealth and secure your future by investing in monetary assets like Fixed Deposits, Mutual Funds, Shares, and Insurance through the convenience of HDFC Netbanking.

Account Management – Enjoy peace of mind as you efficiently manage, monitor, and maintain your bank account and expenses, all in one place. Your financial well-being is just a click away.

FAQs:

HDFC Netbanking is indeed safe, with multiple layers of security:

Two-factor authentication: It requires a customer ID, IPIN, and a one-time password (OTP) sent to your mobile for each login and transaction.

Data encryption: All data is encrypted using industry-standard protocols, shielding it from unauthorised access.

Continuous monitoring: HDFC Bank maintains a vigilant security team that watches for any unusual activity and acts swiftly to safeguard your account.

Customers can enhance security by using strong, unique passwords, keeping their software updated, and avoiding public Wi-Fi networks. These measures collectively fortify the safety of HDFC Netbanking.

Yes, “Netbanking” and “internet banking” are essentially the same, both referring to online banking services that allow customers to manage their accounts, conduct transactions, and access financial services through the internet.