After Best Credit Cards 2024, now we will discuss about Best Lifetime Free Credit Cards In India in this article that is, in this article we will know about such lifetime free credit cards which are best in themselves, now we will know in detail what is best in them and what is not. Here we will cover all the important points of all these credit cards, which will give you an idea about what features you will get in this credit card and whether you should apply for this credit card or not.

Therefore, if you want to get a Best Lifetime Free Credit Card for yourself in 2024, then you must see all the credit cards mentioned in this article once and after reading this article, you can decide for yourself which of these credit cards is best for you as per your requirements. Now since here we are going to talk about Lifetime Free Credit Cards, it is obvious that it is difficult for you to get some special or premium features in these cards. But still there are some cards which, despite being lifetime free, provide you better features than other credit cards.

Best Lifetime Free Credit Cards In India 2024

Along with this, here we will also look at some such credit cards which may charge you some joining or annual fees and such credit cards actually provide you better features than Lifetime free credit cards and we will also discuss together how you can make these credit cards a lifetime free credit card for yourself.

ICICI Bank Platinum Credit Card:

This Platinum Credit Card from ICICI Bank is a very basic credit card. If you analyze this credit card well, you will find that this credit card does not have any special feature. This credit card neither gives you good reward points nor does it provide you any entertainment benefits. We have included this credit card in this list because this credit card comes from ICICI Bank and being an ICICI Bank credit card, this card can give you good cashback and discounts on online shopping.

You must have noticed that when there are sales on these online platforms like Flipkart, Myntra, Amazon, there is a mention on many products that you will get 10% or 5% cashback on ICICI Bank credit card. There you can utilize this credit card well and in such a situation, this credit card can get you a good discount.

This ICICI Platinum Credit Card gives you 2 payback points on every ₹ 100 spent and the value of one point is equal to ₹ 0.25, which means you get 0.5% cashback. Now we don’t think anyone will consider this 0.25% cashback.

Therefore, if your CIBIL score is very low or has not been generated yet, then in that situation you can take this credit card and you can use the limit available in this card for your expenses, otherwise there is not much sense in taking this credit card.

IndusInd Bank Platinum Aura Edge Credit Card:

This Platinum Aura Edge Credit Card from IndusInd Bank charges you a one-time joining fee of ₹ 500 but after this it does not charge you any annual fee, that is, then it becomes a lifetime free credit card for you. Now to say that you do not get any special features in this card, but now since this is a lifetime free credit card, we do not expect more premium features from these cards.

This IndusInd Bank Platinum Aura Edge Credit Card gives you four types of features/options which are -]

- Platinum Aura Edge Shop Plan

- Platinum Aura Edge Home Plan

- Platinum Aura Edge Travel Plan

- Platinum Aura Edge Party Plan

When you apply for this credit card, you have to select any one out of these four options and then features are provided to you according to this option and you get to see different features in these four options.

Now let us briefly know how many points you get in which categories in these four options and the only difference in all these four options is these categories and the reward points received on them –

Platinum Aura Edge Shop Plan

Spend Categories | Savings points on Rs 100 spent |

Shopping in departmental stores | 4 savings points |

Purchase of consumer durables or electronic items | 2 savings points |

Restaurant bills | 1.5 savings points |

Books | 1.5 savings points |

All other spends on your card | 0.5 savings points |

Platinum Aura Edge Home Plan

Spend Categories | Savings points on Rs 100 spent |

Grocery shopping | 4 savings points |

Cellphone bills | 1.4 savings points |

Electricity bills | 1.4 savings points |

Insurance premium | 1.4 savings points |

Medical spends | 1.5 savings points |

All other spends | 0.5 savings points |

Platinum Aura Edge Travel Plan

Spend Categories | Savings points on Rs 100 spent |

Hotel expenses | 4 savings points |

Airline tickets | 2.5 savings points |

Car rental expenses | 1.5 savings points |

Rail tickets | 1.5 savings points |

All other spends | 0.5 savings points |

Platinum Aura Edge Party Plan

Spend Categories | Savings points on Rs 100 spent |

Restaurant bills | 4 savings points |

Shopping in departmental stores | 2 savings points |

Payments in bars and pubs | 2 savings points |

Movie tickets | 1.5 savings points |

All other spends | 0.5 savings points |

AU Bank LIT Credit Card:

This LIT Credit Card of AU Bank is a Customizable Credit Card and AU Bank says that this is India’s first Customizable Credit Card in which you can add features to this credit card as per your choice. If you use this credit card very basic then it is a lifetime free credit card for you but if you use premium features in this credit card then you have to pay some fee.

In this credit card, you get all the features which are given to you in a premium credit card, but when you activate this card, none of these features are given to you at that time. And if you do not activate any of their premium features, then you are simply given 1 reward point on every ₹ 100 and the value of one reward point is equal to Rs 0.25.

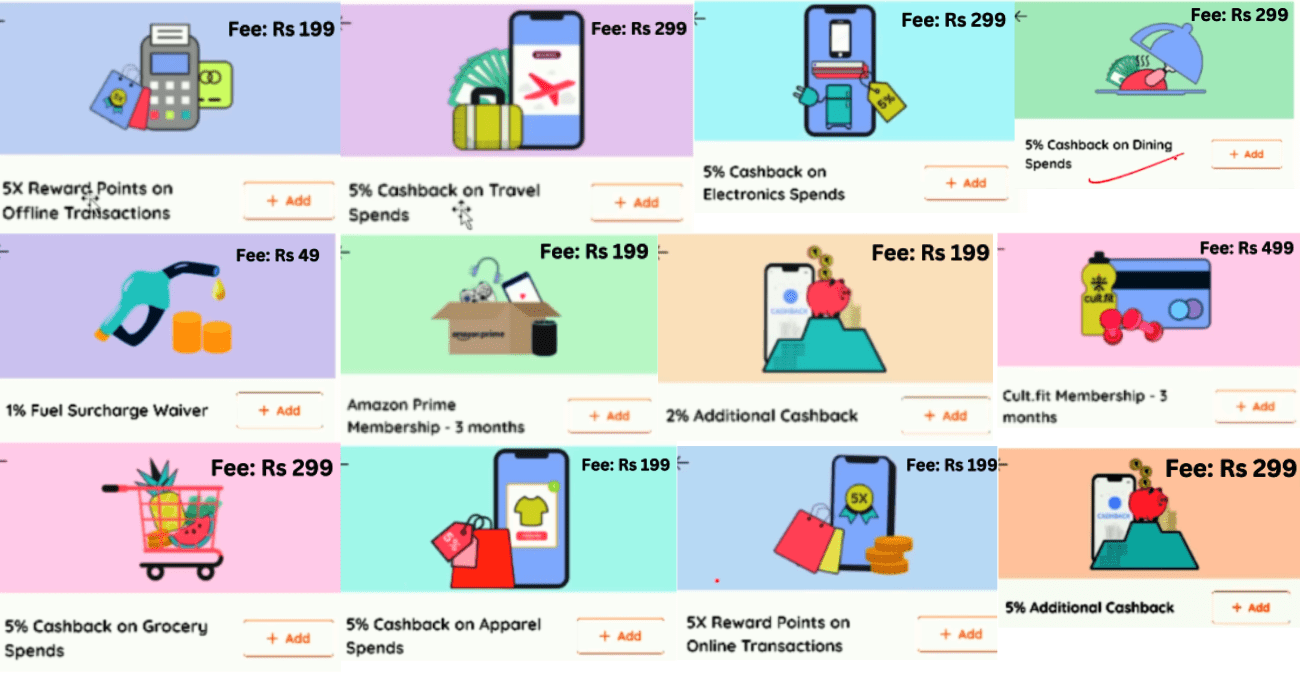

But if you want to add any of the below mentioned features to this credit card, then for that you have to pay some fee first and after that that feature gets activated in your credit card for 90 days –

- Airport Lounge Access 2 Visits

- Airport lounge access 1 visit

- 5% Additional Cashback

- 5X Reward points on online transactions

- 10X Reward points on online transactions

- 5% cashback on dining spends

- 10X reward points on offline transactions

- 5X reward points on offline transactions

- 5% cashback on Apparel spends

- 5% cashback on grocery spends

- Cult.fit membership – 3 Months

- 2% additional cashback

- Amazon prime membership – 3 months

- 1% Fuel Surcharge waiver

- 5% cashback on electronic spends

- 5% cashback on travel spends

Now you have to pay separate fees for all these features. Whatever benefit you activate for yourself, you will have to pay the same fee for it.

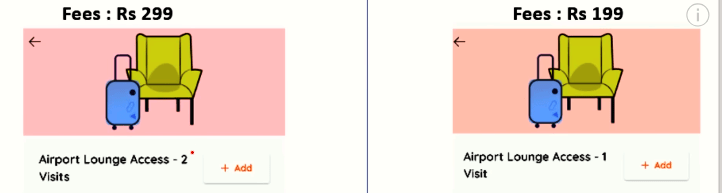

For example, if you want to avail the benefit of Lounges on this card, then what fee you will have to pay for it, you can see in the image below –

Similarly, below we show you an example of how much fee you will have to pay for which feature:

IDFC First Millennia Credit Card:

This IDFC Bank Millennia credit card gives you 6X reward points on every online transaction for every ₹150 spent. Each reward point is worth ₹0.25, so for every ₹150 spent online, you get a cashback of 6 * 0.25 = ₹1.5, meaning ₹1.5 cashback. Similarly, for every ₹150 spent offline, you receive a cashback of 3 * 0.25 = ₹0.75.

Now to say that this cashback of Rs 1.5 and Rs 0.75 is not much cashback but now what can we expect from a lifetime free credit card. If you spend Rs 15,000 with this credit within the first 90 days, you also get a Gift Voucher of Rs 500.

Reward Points Booster:

If you spend more than Rs 20,000 online in a month with this credit card, you get boosted reward points. You get 10X reward points on every transaction of Rs 150 you spend above Rs 20,000 in a month. This is 10*0.25 = ₹2.5

Along with this, you also get 10X reward points on whatever you spend from this credit card on your birthday. This credit card does not give any reward points on Fuel, EMI Transactions, cash Withdrawals and Insurances. Along with this, when you redeem your reward points, it also charges you a redemption fee of ₹ 99.

ICICI Bank Amazon Pay Credit Card:

Now everyone knows about this ICICI Amazon Pay Credit Card. The biggest feature of this credit card is that it provides unlimited 5% cashback on Amazon to Amazon Prime members and 3% cashback to Non-Prime members on shopping on Amazon. Apart from this, it gives you 1% cashback on all other online and offline spends.

So even if you do not use Amazon’s Prime membership, you still get 3% cashback on all products on Amazon and there is no upper limit. Apart from this, if you do any transaction on their 100+Merchants through their platform Amazon Pay, then you get 2% cashback there too and you can use Amazon Pay just like Paytm and Google Pay.

And apart from this, if you spend on flights and hotels on Amazon Pay, then in that case whether you are an Amazon Prime member or not, you will get a direct cashback of 5%.

HDFC Millennia Credit Card:

For HDFC Millennia Credit Card, you have to pay a joining and annual fee of ₹ 1000, but the features given to you are better than other credit cards and you can also make this card lifetime free for yourself, for this you will have to spend Rs 1 lakh in a year from this credit card. In such a situation, you will have to pay only the joining fee of this credit card.

Now the ICICI Amazon pay Credit Card which we have discussed earlier gives you 5% cashback only on shopping on Amazon. But apart from Amazon, this HDFC Millennia Credit Card also gives you 5% cashback on BookMyShow, Cult.fit, Flipkart, Myntra, Sony LIV, Swiggy, Tata CLiQ, Uber and Zomato and all the brands on which this Millennia Credit Card gives you 5% cashback are those brands which we use the most for shopping.

But one condition of this credit card is that you can earn maximum cashback of ₹ 1000 in a month. This means that in a month you will get cashback only on the maximum expenditure of ₹ 20,000 on this credit card because 5% of ₹ 20,000 is only ₹ 1000. Now if we talk about a common man, then it is a big deal for him to spend ₹ 20,000 in a month with just one credit card. Therefore, in a way we can consider it as unlimited cashback limit. Therefore, if you think that your monthly expenditure is less than ₹ 20,000 then you can apply for this credit card because in this you are getting many options to earn cashback.

Apart from this, this card gives you 1% cashback on all your offline spends. Along with this, this HDFC Millennium Credit Card provides you a gift voucher equal to your joining fee as welcome benefit. Now in a way your joining fee is also waived off. If you spend Rs 1 lakh in a quarter with this credit card, you are given free access to one lounge at some selected lounges.

If you think that you can get the joining and annual fees of this credit card waived off, then you can definitely take this credit card and I have already told you the way how you can get them waived off.