Today, whenever it comes to taking a new credit card in our mind, the idea of Flipkart Axis Bank Credit Card definitely comes in our mind because this credit card provides you a lot more benefits and it is also very popular in today’s time. In this article, we will learn deeply about how to get Flipkart axis bank credit card and what is its advantages and disadvantages.

When you talk to someone about taking a new credit card, they tell you some of the main advantages and disadvantages of that credit card but no one tells you the terms and condition of these credit cards, which you should first know. Today we will discuss all the questions related to this credit card and we will try to tell you everything related to this credit card which you should know before applying this credit card. Let’s start –

What Is The Flipkart Axis Bank Credit Card?

Flipkart Axis Bank Credit Card is a co-branded credit card offered by a Flipkart which is a very big e-commerce company in India. Flipkart has launched this credit card by partnered with Axis Bank. This credit card is mainly designed for a lot of offers for Flipkart and Myntra’s customers and in addition you can also use this card for general spending. This credit card is the best for shoppers who want to earn money on their online purchase and rewards.

Steps to apply for Flipkart Axis Bank Credit Card:

You can apply for the Flipkart Axis Bank Credit Card by following the steps given below –

- To apply for this credit card, first you have to visit the Flipkart Axis Bank Credit Card page of the official website of Axis Bank.

- After this you will click on Apply Now here above.

- Now you will be asked whether you are an existing customer of Axis Bank or not, if you are an existing customer of Axis Bank, then you will do Yes, otherwise you will do No

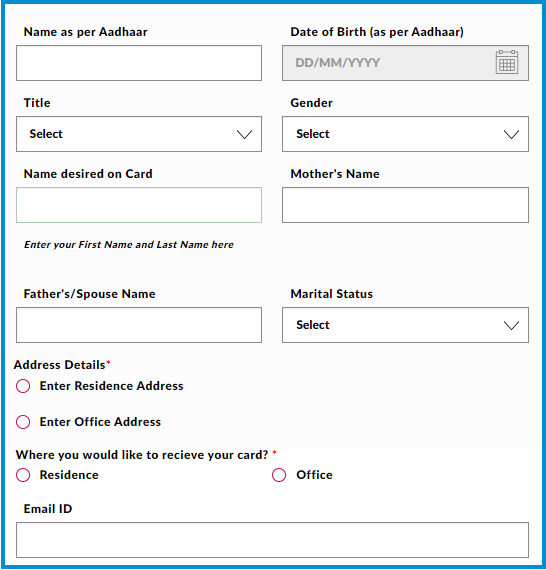

- After this you will Next it by entering your mobile number and PAN Number, after that it will ask you for some basic details, which you will fill according to your own and click on Next

- After this, you will select the Nature of your Employment from Salaried and Self-Employment.

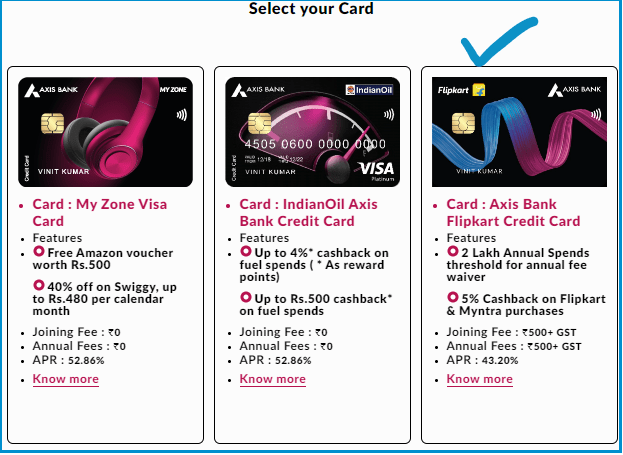

- Now a list of some Credit Cards will come in front of you, in which you have to select Axis Bank Flipkart Credit Card.

- After this, an OTP will be sent to your mobile number, which you will have to enter. Now your credit card application will be submitted and an Application Number will be provided to you which you have to save.

With this Application Number, you will be able to track the status of your application and you have to wait for the response from Axis Bank. Keep in mind that the approval of your application will depend on the eligibility criteria set by Axis Bank.

Apply Axis Flipkart Credit Card before the exclusive offer ends

Apart from this, you can also apply for this credit card through the official mobile app of Axis bank. Whose process is very similar.

How to check flipkart axis bank credit card application status?

To know the status of your flipkart axis bank credit card application, you can follow the steps given below –

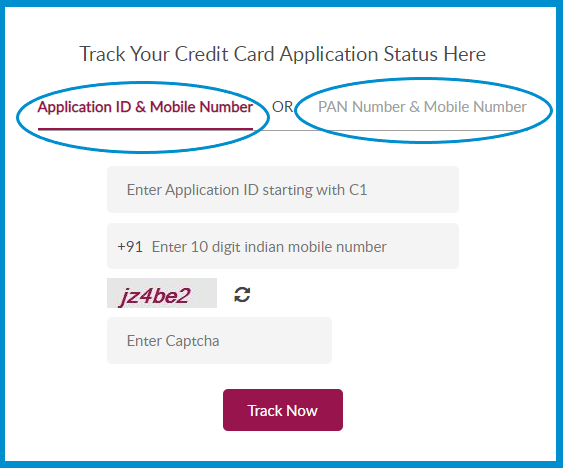

- For this, you have to first visit the Axis Bank’s CC Tracker page from where you can track the status of any Axis Bank credit card application.

- Here you can track your credit card status using your Application ID and Mobile Number or your PAN Number and Mobile Number.

Apart from this, you can also know the status of your credit card application by talking to Customer Care of Flipkart. For this you will have to give them your application reference number and some basic information.

How to activate flipkart axis bank credit card?

Once your credit card is approved, it will be sent to your registered mail address. After this you have to activate this credit card which you can do either online or offline. Both the methods are given to you step by step below –

Activate Your Credit Card Through Internet Banking –

- To activate your flipkart axis bank credit card through Internet Banking, you will need to visit Axisbank.com

- After this, you will login to Internet Banking using your login credentials.

- Now you will click on Accounts-My Credit Cards

- Here you will select Credit Card PIN Change under More Services and click on Go

- After this you will Next enter your desired PIN and a code will be sent to your Registered Mobile Number which you will have to confirm and your Credit card PIN will be set.

After this, you can use this credit card for online purchases anywhere.

Activate Your Credit Card Through Internet Banking –

You can also generate your credit card pin or activate your credit card using any Axis Bank ATM. For this follow the steps given below-

- First of all you go to any nearest Axis Bank ATM and insert your credit card in the machine.

- Now the option of Set Pin will appear in front of you on the ATM screen, you have to tap on it.

- If you are generating the PIN of your credit card for the first time, then you will have the option of Generate OTP‘ and if you already have a valid OTP then you will see the option of Set pin having an OTP on the ATM screen. Select them according to your convenience.

- Now it will ask you to enter some of your account details like Date of Birth, Card Expiry and registered mobile number which you have to enter and an OTP will be sent to your mobile number which you have to enter here.

- Now you will enter your desired PIN and after doing Next, enter this PIN again to confirm it and click on Next

- After this, after successfully setting your PIN, you will definitely receive a message from Axis Bank.

Activate Your Credit Card Through IVR-

You can also activate your credit card through IVR (Interactive Voice Response) with 2 Step Process, in which first you have to get PIN Activation Passcode from Customer Care and after that you can set your PIN by entering that code –

To get the PIN Activation Passcode –

- For this first you have to call Axis Bank’s Customer Care Number 1860 419 5555 or 1860 500 5555.

- Now navigate to the IVR on Credit Cards → Generate a PIN for Credit Card → Generate an Activation Passcode.

- After this, you have to provide some of your details like Credit Card Number, Expiry date, DOB & Registered Mobile Number to them.

- Now a PIN Activation Passcode will be sent to your mobile number, which you will have to use in the next process.

Using your Activation Passcode to generate your Credit Card PIN –

- Now you have to call again on Axis Bank Customer Care Number 1860 419 5555 or 1860 500 5555.

- Now you have to Navigate IVR on Credit Cards → Generate a PIN for Credit Card → I have an Activation Passcode.

- Now again you have to give them the details of your Credit Card Number, Expiry date, DOB & Registered Mobile Number and set your desired PIN.

- If the whole process is correct then you will get a Confirmation Message.

By following any of these processes, you can activate your credit card and use it.

Advantages and Disadvantages of Flipkart Axis Credit Card:

All credit cards have some advantages and disadvantages, and this credit card is also useful for you in many ways, but everything has some negative point as well, So we will tell you some of the main advantages and disadvantages of this credit card –

Advantages:

- On joining and activating the Flipkart Axis Bank Credit Card, a Welcome Bonus of Rs 1100 is provided to you.

- In this card you are given 5% cashback on Flipkart and Myntra and 4% cashback on their Preferred Merchants on every Transaction.

- Apart from these, you are given a cashback of 1.5% on every transaction on all other categories.

- Axis Bank gives you access to 4 complimentary airport lounges per year in this credit card.

- On this credit card, you get 1% Fuel Surcharge discount on all Fuel Stations present in the whole of India.

- You are given 20% off in Partner Restaurants of Axis Bank

- You can easily convert any purchase above Rs.2,500 into EMIs with this credit card.

- With this card, you are provided with very good Customer Support of Axis Bank.

- If you spend more than 200000 rupees in a year with this flipkart axis bank credit card, then your Annual Charge of this credit card is waived off.

Disadvantages:

- Flipkart axis bank credit card is a Co-Branded credit card, so sometimes it may not work on any other shopping site other than flipkart.

- If you do not pay the monthly statement of this credit card on time, you may have to pay heavy interest for that.

- Minimum income requirement is sought in this credit. If you are a Salaried Person then your Per Month Minimum Salary should be Rs 15000 and if you are a businessman / independent earner or professional then your per month minimum Salary should be Rs 30000.

- If you spend less than 200000 rupees per year with this credit card, then you have to pay 500 rupees for its Annual Fee.

- If you do cash withdrawal from ATM with this credit card, then you may have to pay heavy interest for this also.

Thus,, this credit card has its own advantages and disadvantages which may not suit everyone. Therefore it is important that before applying for this credit card, you read its Advantages and Disadvantages carefully.

Apply Axis Flipkart Credit Card before the exclusive offer ends

How to get the Welcome Benefit?

As we told you that when you activate this credit card, you are given a welcome bonus of Rs.1100 but this welcome bonus is not given to you directly in one go. This Welcome Bonus is given to you by shopping at three Preferred Merchants. These three Merchants commerce sites are – Flipkart, Myntra and Swiggy.

- When you do your first transaction on Flipkart within 30 days after the issue of this credit card, you are given a Voucher of Rs.500. This gift voucher is sent to your registered mobile number. You can see the rest of Axis Bank’s Terms & Conditions regarding this from here

- After this, when you make a purchase of above Rs.500 on Myntra with this credit card within 30 days of the issue of this card, you are given a cashback of 15%. For this you can see Terms & Condition from here

- Apart from this, when you make an order of more than Rs.100 on Swiggy with this credit card within these 30 days, then you are given a cashback of 50%. For this, you have to enter the code ‘AXISFKNEW’ in the coupon section while checkout the order on Swiggy and you will get 50% discount. For this, see the Terms & Conditions of Axis Bank from here

Fee And Charges Of Flipkart Axis Bank Credit Card:

| Description | Charges |

| Joining fee | Rs. 500 |

| Annual Fee | 2nd year Onwards: Rs. 500 Annual fee waived off on annual spends greater than Rs. 2,00,000. |

| Add-on card joining fee | Nil |

| Add-on card annual fee | Nil |

| Card replacement fee (w.e.f 10/10/20) | Nil |

| Cash payment fee | Rs.100 |

| Duplicate Statement fee | Waived |

| Charge slip retrieval fee or copy request fee | Waived |

| Outstation cheque fee | Waived |

| Mobile alerts for transactions | Free |

| Hot listing charges | Nil |

| Balance enquiry charges | Waived |

| Cash withdrawal fees | 2.5% (Min. Rs. 500) of the cash amount |

| Overdue Penalty or Late Payment Fees | Nil if Total Payment Due is less than Rs. 500 Rs. 500 if total payment due is between Rs. 501 – Rs. 5,000 Rs. 750 if total payment due is between Rs. 5,001 – Rs. 10,000 Rs. 1200 if total payment due is greater than Rs.10,000 |

| Over limit penalty | 2.5% of the over limit amount (Min Rs. 500) |

| Foreign currency transaction fee | 3.5% of the transaction value |

| Reward Redemption fee | No |

This data is taken from Axisbank.com

How can I increase my Flipkart axis Bank credit card limit?

If your credit card is eligible for increasing the credit limit, then you can enhance your credit limit through Mobile App and Internet Banking.

In Mobile App – In Mobile App, you have to check Credit Limit Eligibility of your credit card at Login> Credit Card> Select Card> Total Controls> Check for Limit increase. If your credit card is eligible, you can submit a request to increase the credit limit on your credit card.

In Internet Banking – In the official website of Axis Bank, you have to check the eligibility of your credit card under Login > Accounts > My Credit Cards > Limit Enhancement > Check for Limit increase and if your credit card is eligible, you can submit a request to increase your credit limit.

Apart from this, if your salary has increased or your employment status has changed, you can also increase your credit limit by contacting Axis Bank’s customer care service. For this, who are you, you will have to provide your salary slips, income tax returns or bank statements which will help you in increasing your credit limit.

Always keep in mind that regular usage of your credit card and timely payment has a significant impact on your card’s credit limit increase request. Based on your credit card usage and payment history, the bank decides your credit card limit.

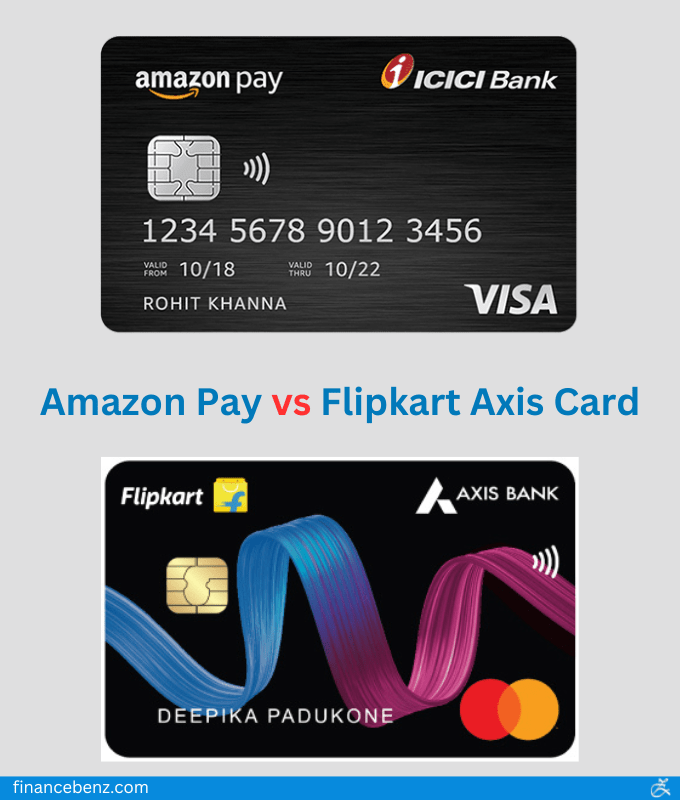

Amazon ICICI credit card vs Flipkart axis bank credit card?

Amazon ICICI credit card and Flipkart axis bank credit card both are co-branded credit cards offered by ICICI Bank and Axis Bank in partnership with Amazon and Flipkart respectively. Both of these credit cards provide different types of rewards and offers to the customers.

Some of the main differences between these two credit cards are listed below –

- Amazon ICICI credit card offers reward points on each of its purchases, but Flipkart axis bank credit card provides you good cashback only on selected categories.

- In Amazon ICICI credit card, you do not have to pay any kind of Annual Fee and Joining, but in Flipkart axis bank credit card, you have to pay Rs.500 as Joining Fee and Rs.500 as Annual Fee.

- The interest rates of Amazon ICICI credit card are cheaper as compared to Flipkart axis bank credit card.

- Your minimum age should be 21 years to apply Amazon ICICI credit card and 18 years to apply Flipkart axis bank credit card.

- The minimum income requirement for the Amazon ICICI Credit Card is lower compared to the Flipkart Axis Bank Credit Card.

What is eligibility for an Axis Bank Flipkart Credit Card?

- To apply for Axis Bank Flipkart Credit Card, you must be between 18 and 70 years of age.

- This credit card can be applied by both Resident of India and Non-Resident Indian.

- Your minimum monthly income should be Rs.15000 to apply for this credit card.

- You should have good credit score and CIBIL score.

- This credit card can be applied by both a salaried person and self-employed.

Flipkart Axis Bank Credit Card required documents:

The list of documents required for applying Flipkart Axis Bank Credit Card is given below –

- PAN card photocopy or Form 60

- Colour photograph

- Latest payslip/Form 16/IT return copy as proof of income

- Residence proof (any one of the following):

- Passport

- Ration Card

- Electricity bill

- Landline telephone bill

- Identity proof (any one of the following):

- Passport

- Driving licence

- PAN card

- Aadhaar card

Always keep in mind that this Criteria is only an indication. If you fall within the criteria given by them, then there is no guarantee that your application will be approved. The approval of your application completely depends on the bank and within 21 days you will get the answer to your application.

How do I pay Flipkart Axis Bank credit card bills?

You can pay your Flipkart Axis Bank credit card bill using any one of the methods given below –

Net Banking – You can pay your credit card bill from your savings or current account by login to your Axis Bank Net Banking. There you are also given the facility of auto debit, so that your credit card bill will be paid automatically on time.

Mobile Banking – You can also make your credit card payments using the official Axis Bank app.

Bill Desk – You can pay your credit card bill using the Bill Desk payment gateway.

NEFT / RTGS – You can make your credit card payment through NEFT or RTGS using any Savings or Current account in India.

Cash – Apart from this, you can go to your nearest Axis Bank branch and pay your credit card bill now by making cash payment.

Reduce the Flipkart Axis bank credit card annual charge:

If you spend more than ₹ 200000 from your Flipkart Axis bank credit card in 1 year, then your annual charge of ₹ 500 is waived but if you spend less than ₹ 200000, then you have to pay ₹ 500 Annual Charge Pay of your credit card.

FAQs –