Friends, today in this article we will talk about Moneyback Credit Card, a very famous credit card of HDFC. You must have heard the name of this credit card sometime or the other because it is a very popular credit card of HDFC Bank.

Now, if not more, HDFC Bank has 20 to 25 Multiple credit cards, so before taking any credit card it is very important for us to know its terms and conditions. Along with this, it is also important for us to know what are the features of the credit card we are going to select and whether this credit card is really beneficial for us or not. So in this article we will talk about all the features, advantages and disadvantages of HDFC Moneyback Credit Card and its Fee Charges.

According to your requirement, after reading this entire article, in the end, you have to decide whether this credit card is beneficial for you or not. I will try to give you complete in-depth information about this credit card from my side so that you can easily analyze whether this credit card is best for you or you need to apply for another credit card. Let’s start –

A Quick Overview Of HDFC Moneyback Credit Card:

HDFC Moneyback Credit Card is a credit card that works on cashback and reward points, offered by HDFC Bank. On this credit card, you are given some reward points on each online and offline transaction. For customers who want to get a simple and rewarding credit card from HDFC Bank, this credit card can be a great option. Apart from this, this credit card also has many unique features of its own, which we will discuss further.

Key Highlights of HDFC Moneyback Credit Card:

| Best Suited For | Reward Points And Cashback |

| Age Requirement | Min. 21 Years & Max. 60 Years |

| Minimum Income | For Salaried: Rs. 25000/Month For Self-Employed: ITR > ₹6.0 Lakhs per annum |

| Joining Fee | Rs. 500 + Applicable Taxes |

| Renewal Fee | Rs. 500 + Applicable Taxes |

| Welcome Bonus | 500 Cash Points |

| Contactless Payment Facility | Yes |

Features And Benefits Of HDFC Moneyback Credit Card:

Some Key Features and Rewards Points

Here you have been told about all the important features of this credit card and its Rewards Points, how it works –

Earn 2 Rewards Points – FiRs.t of all, HDFC Bank says that if you spend ₹ 150 from this credit card on any retail shopping or offline shopping, then in that case you will get 2 Rewards Points. The value of 1 Reward Point from HDFC Bank is Rs. 0.20.

If you want to get these Rewards Points in the form of cashback or HDFC Bank has Tie Up with Smart Buy, then you can book Hotel Tickets and Flight Tickets from these Rewards Points on Smart Buy.

Please Pay Attention

• HDFC Bank has announced that from 1st January 2023 no Reward Points will be given on Rent payments and Govt. Related transactions.

• Along with this, HDFC Bank has also announced that from 1st January 2023, you will not be able to earn more than 1000 rewards points in a month on grocery transactions.

Earn 2X Rewards Points – With this, if you spend ₹ 150 online anywhere with this credit card, you will get 4 Rewards Points. Now here HDFC Bank is giving you double rewards points on online spends as compared to offline spends, but here the bank applies a condition that we will give you maximum 500 rewards points on online spends on every statement.

If you make an online purchase with this credit card even after getting 500 Rewards Points, then you will get only Rewards Points ie 2 Rewards Points, which you get on offline spends.

Quarterly Voucher – HDFC Bank says that if you purchase goods worth 50000 with this credit card in a quarter, then we will give you a gift voucher of Rs. 500 and the validity of this gift voucher is 60 days. If you do not use this voucher within these 60 days, then it will also send you two reminders, in which the fiRs.t reminder will be sent after 30 days and the second reminder will be sent after 45 days.

But here HDFC bank has applied a condition that you can use this Rs. 500 gift voucher only for shopping at their selected Merchants. These partner merchants are as follows – Dominos, Book My Show, Big Bazaar, Bata, Levis, Woodland, Mainland China, and Myntra.

Experience the benefits of HDFC Bank’s premier credit card

This list of partner merchants changes from time to time, which you can see on the official HDFC website.

Some Additional Features

Zero Lost card liability – If for some reason your credit card is lost and you report it to the bank within 24 hours and after that someone makes a fraudulent transaction with your credit card, then you do not have to pay for it. .

Interest Free Credit Period – In this credit card, you get an interest free period of 50 days from the purchasing date, within which you can pay your credit card bill without any interest.

Fuel Surcharge Waiver – On this credit card, you get 1% Fuel Surcharge waiver on Fuel Transaction, whose minimum transaction should be Rs. 400 and maximum transaction should be Rs. 5000. And in this you get maximum waiver of Rs. 250 on Per Statement.

Renewal Offer – If you spend more than ₹ 50000 in 1 year with this credit card, then your renewal fee is waived.

Smart EMI – HDFC Moneyback Credit Card gives you the facility to convert your large purchases into EMIs. The following purchases are included in these big purchases –

- Insurance

- Groceries

- Medical

- Petrol

- Utility

- Apparel

- Education

- Electronics

- Travel

Keep in mind that you cannot convert Transactions related to Gold and Jewelry into EMI as per their guidelines.

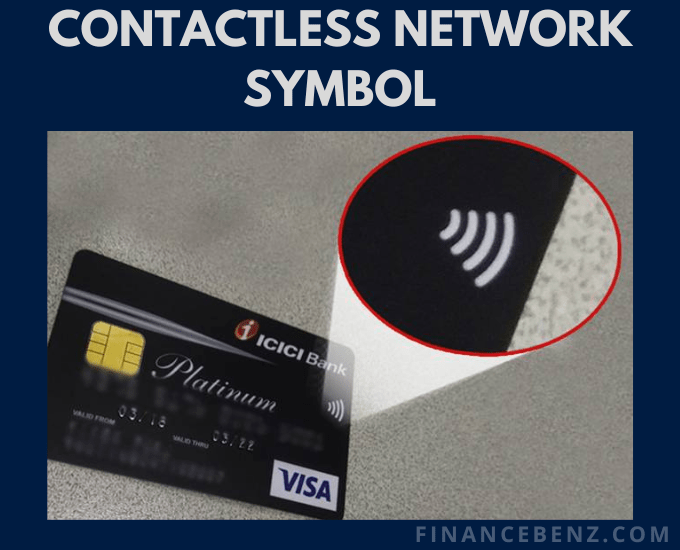

Contactless Payment – HDFC Bank Moneyback Credit Card is enabled for contactless payments to facilitate fast, convenient and secure payments at retail outlets. To check whether the contactless payment facility is available on your credit card, look for the contactless network symbol on the back of your credit card.

Please note that as per the RBI guidelines in India, you cannot make contactless payments more than ₹ 5000 on a single transaction. If you do a transaction of more than ₹ 5000 on a single transaction, then due to Security Reasons you will have to enter your Security Pin.

HDFC Moneyback Credit Card Eligibility For Salaried Person – If you are a salaried pers.\on then your minimum age must be 21 years and maximum age must be 60 years. Along with this, your monthly income should be more than ₹ 25000 to apply for this credit card.

For Self-Employed Person – If you are a self-employed person then your minimum age should be 21 years and maximum age should be 65 years. With this, it is necessary that your minimum income ITR should be > ₹ 6.0 Lakhs per annum.

What is the HDFC Moneyback Credit Card limit?

The credit limit offered on HDFC Moneyback Credit Card can vary depending on several factors, such as your credit score, credit history, income and other financial obligations. Hence, it is difficult to tell a specific credit limit for HDFC Moneyback Credit Card.

It is important to note that credit limits are not fixed and may increase or decrease over time depending on various factors such as your credit utilization, payment history and credit worthiness.

Pro and Cons of HDFC Moneyback Credit Card:

Here you are told about some of the main advantages and disadvantages of HDFC Bank –

Pros:

Cashback Rewards – HDFC Moneyback Credit Card offers cashback rewards on every purchase made using the card, making it a great way to save money on daily expenses.

Zero Liability – The card comes with zero liability protection, which means that you will not be held responsible for any unauthorised transactions done using your card. If this credit card of yours is lost and someone makes a fraudulent transaction with it, then no charge of any kind is taken from you.

Interest-Free Credit – The card also offers interest-free credit for up to 50 days, which can help you manage your finances better.

Fuel Surcharge Waiver – HDFC Moneyback Credit Card offers fuel surcharge waiver of up to Rs. 250 per statement cycle, making it a great option for frequent drivers.

Easy Redemption – Reward points earned on the card can be easily redeemed for cash back or other rewards.

Experience the benefits of HDFC Bank’s premier credit card

Cons:

Annual Fee – HDFC Moneyback Credit Card comes with an annual fee of Rs. 500, which could be a drawback for some users.

Limited Reward Points – The card Offers only 2 reward points on every Rs. 150 spent, which may not be enough for frequent big spends. Apart from this, this credit card gives you 4 rewards points on every online transaction of Rs. 150, but in this you get maximum 500 reward points.

Reward Point Expiry – Reward points earned on the card expire after 2 years, which can be a disadvantage for users who do not use their card frequently.

Foreign Transaction Fees – The card charges a foreign transaction fee of 3.5%, which can be a drawback for users who travel abroad frequently.

Limited Acceptance – HDFC Moneyback Credit Card may not be accepted at all merchants, especially those that do not accept credit cards from HDFC Bank.

FAQ:

Final Words:

Hopefully, in this article, you would have got to know a lot about HDFC’s Moneyback Credit Card and with this you would also have been able to know whether this credit card is beneficial for you or not. Before applying for any credit card, we should know its Pros & Cons and its Terms and Conditions very well so that we do not face any kind of problem later.