Friends, if you also have a credit card and you also want to increase your credit card limit, then this article is going to be very beneficial for you because in this article we are going to know How to Increase Credit Card Limit? If you follow the steps mentioned in this article, you can easily increase the credit limit of any credit card you have.

But when you want to increase the limit of your credit card, it can also affect your CIBIL score, because if we repeatedly request the bank to increase the limit for our credit card and if for any reason the bank does not increase your credit card limit, then it may impact your CIBIL score. So if you want to increase your credit card limit without affecting your CIBIL score, read this article carefully.

In today’s time, a huge market is dependent on credit cards and everyone also needs a high credit card limit. In this article, we will know what are the things you have to keep in mind to increase your credit card limit and also know on the basis of which factors the bank accepts your request for higher credit limit.

What is Credit Limit on a credit Card?

This is a limit that is set by the banks when they issue credit cards to the customers. You cannot spend with your credit card more than the approved limit.

A credit limit is the maximum amount that the credit card issuer will allow a card holder to borrow on its credit card. It represents the total amount of credit available to the card holder at any time.

The credit limit determines that the cardholder can spend on its credit card. If a cardholder tries to make a purchase that exceeds their credit limit, the transaction will be rejected until the cardholder has earlier arranged for an over-the-limit transaction

How to Increase Credit Card Limit?

To increase your credit card limit, you have to contact your card issuer, but if your credit score and your credit history are good, then offers to increase the credit limit are given to you automatically by the bank. Every bank decides the spending limit of the customer only after seeing the capacity. Many factors are considered to increase the credit card limit, which are discussed below.

To increase the limit of your credit card, along with Patience and Discipline, it is also necessary to follow all these things –

Timely Pay Your Dues – In order to increase the credit limit, you have to pay your Dues Timely because if there is any fault in the Pay of your Dues, then your credit score may decrease. And the best try is that we should pay all our Pending Dues before the Due Date as this will increase your Credit Worthiness and seeing your repayment ability the banks will trust you.

Do Not Spend Above Your Credit Limit – To enhance your credit card limit more, never spend more than your credit limit. By the way, credit card should always be used only for emergency and if you have to spend, then you should spend only 30% to 40% of your credit card limit. This is the biggest Brahmastra to increase the limit of your credit card.

Clear All The Existing Loans – Before giving request to your bank to increase your credit limit, all your Personal Loans, Home Loans or any other pending loans must be cleared first. All the banks check your current debt and only then approve your request and if your debt is high then your credit limit will not increase.

Give Your Income Proof – The most important factor to increase your credit card limit is your income because your income decides your credit limit, so submitting your income proof is very important. You must show your bank all the active sources of your income so that you can get your desired limit from your bank.

Improve Your Credit Score – Your credit score also has a huge impact on your credit limit, so improve your credit score too. In order to enhance your credit score, you should make timely payment of your dues and EMIs and use your spending limits carefully.

Many people have a main question that we always make timely payment of our credit card dues but still we are not getting offers from the bank to increase our credit card limit.

Now its main reason is that once you think from the perspective of the bank that whatever repayment you are doing for your credit card, you are doing it when you have fully utilized the credit card which shows the dependency on your credit card more. Now banks will not increase your credit card limit in such a situation.

Therefore it is necessary to have low credit utilization for the first 6 months so that the bank can trust you. The bank can trust you on the point that your dependency on the credit card is not much. Apart from this, if your income increases in the meantime, then you can ask the bank for an enhanced credit limit.

On the contrary, if your regular income does not increase and your expenses are the same as they were before, then you should keep low credit utilization. These were some of the important factors that you should keep in mind before submitting your request for increasing your credit card limit.

What is the benefit of increasing the limit of credit card?

There are many benefits to increasing your credit card limit, some of which are listed below –

Long Run Benefits – Increasing your credit card limit gives us Long Run Benefits because banks trust you. According to the bank’s records, if your credit card limit is good, then you are a reliable customer, so that you can easily get personal loans, home loans, car loans or any type of credit limit at a very cheap rate of interest.

Easily Negotiate With Bank – While applying for a loan from the bank, you can easily negotiate with them because if you have a good credit score, the bank approves your loan quickly.

Helps in Medical Emergencies – Your credit card’s higher limit will help you in medical emergencies. Nowadays medical emergencies are quite common at a young age, so higher limit of your credit card will keep you safe and secure in case of medical emergencies.

Credit Utilization Ratio Decreases – Higher limits on your credit cards reduce your credit utilization ratio. Like if we understand this with an example, then if someone’s earlier credit limit was ₹ 10000 and if he follows the formula of 30% to 40% of the credit limit, then he will be able to use only ₹ 3000 to ₹ 4000. .

Here, if his credit card limit is increased from ₹ 10000 to ₹ 50000, then now if he follows the formula of 30% – 40% usage, he will now be able to use his credit card from ₹ 15000 to ₹ 20000. Now by doing this, his CIBIL Secure will also increase continuously because there are many benefits of Low Credit utilization which we have already discussed.

Apart from these, there are other benefits of increasing your credit card limit such as –

- Gets airport lounge access

- Rewards Points on Flight Tickets

- Offers on shopping

CIBIL SCORE

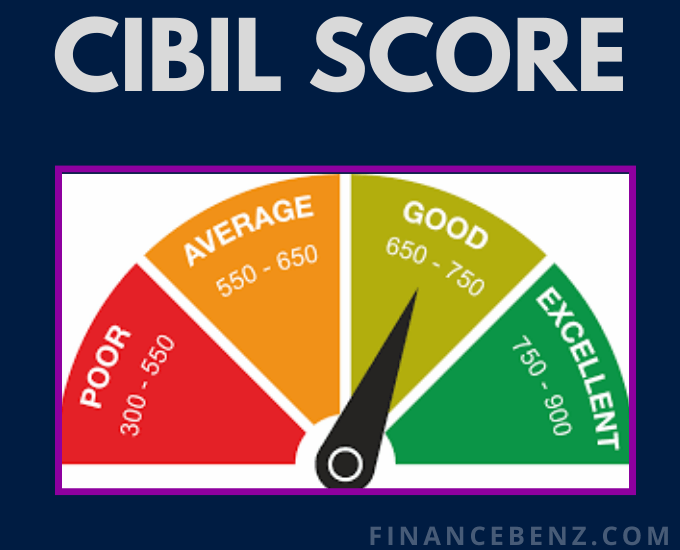

CIBIL score is a very important factor for your credit card and any type of loan. It tells an individual’s credit history across all the parameters of loan taken from any financial institution. CIBIL score is a three digit number which is between 300 to 900 where 300 CIBIL score is considered very poor whereas if your CIBIL score is between 750 to 900 then it is considered a very good CIBIL score.

What is Credit Utilisation Ratio?

The credit utilization ratio is the percentage of a person’s total credit range that they are currently used. It is calculated by dividing the total amount of credit card balance by the total credit limit.

Credit utilization Ratio is an important factor in determining a person’s credit score. A low ‘credit use ratio’ is generally considered better, as it indicates that the individual is responsible using the credit and has not been oversees. It is generally recommended to have a credit utilization ratio below 30% to 40% to maintain a good credit score.

How to calculate the credit card limit?

Now there are some main eligibility criteria which all the banks look at while issuing the credit limit, let us now know about them –

Bank checks the following things to check your Individual Credit Worthiness –

- Your Income

- Employment Status

- Age

- Debt

- Card History

- Credit Card History

If you are taking a credit card for the first time, then you will not have any credit score, because of which the bank will give you a low credit card limit and banks have to trust these new customers. Now over time, whatever credit card limit has been given to these new customers, the bank will track that limit and at the same time the bank will also track whether are these customers making Timely Payment of their bills or not?

Along with this, the bank will also track whether their Against Expense against credit card limit is under 30%-40% Ratio. You can understand this 30%-40% Ratio in such a way that suppose the bank has given you a limit of one lakh rupees and out of that you use only thirty to forty thousand rupees.

So this is a great use of your credit card. So if you use only 30% to 40% of your credit card limit, then the bank will start increasing your credit card limit gradually. So this is a great use of your credit card. So if you use only 30% to 40% of your credit card limit, then the bank will start increasing your credit card limit gradually.

How credit card limit works?

When a credit card holder purchases using his credit card, they are essentially borrowing money from the credit card issuer. Credit card issuer determines a credit limit, which can borrow the maximum amount to the cardholder. If the cardholder spends to its credit limit, they will not be able to make any additional purchases until they pay their remaining amount.

Credit card issuers can also determine other limitations on the use of credit cards, such as daily or monthly transactions boundaries. These boundaries are placed to protect against fraud and is to ensure that the card holders do not overspend.

Cardholders can track their spending, make payments on time, and keep their credit utilisation ratio low. This can help them maintain a good credit score and potentially qualify for higher credit limits in the future.

When does credit card limit reset?

The credit card limit typically resets at the beginning of each billing cycle. The billing cycle is the period of time between the last statement date and the current statement date.

During the billing cycle, the cardholder can use their credit card up to their available credit limit. At the end of the billing cycle, the card issuer will send a statement detailing the transactions made during the cycle and the amount owed. The cardholder must then pay at least the minimum payment due by the due date to avoid late fees and interest charges.

Once the payment is made, the credit card limit is reset to the full amount of the credit limit, and the billing cycle starts over again. It is important to note that any unpaid balance from the previous billing cycle will be carried forward to the next billing cycle and will accrue interest charges until it is paid off.

Final Words:

Hope with the help of this article you would have been able to know very well that How to Increase Credit Card Limit? If we get a brief out of this entire article, then it would be that to increase our credit limit, we have to maintain all the credit records, which includes all the factors like Credit Score, Credit History, CIBIL Score, Debt.

Therefore, to keep your credit record good, pay attention to all these factors and how to maintain them, we have already discussed in this article. If you find this information helpful, then definitely share it.