Friends, at one time HDFC diners club Black credit card was considered to be the best credit card in India, but due to continuous devaluation of the features of this credit card by HDFC Bank, this credit card lost its top position. But despite this, this credit card is still in high demand and everyone wants to get this credit card. One of the reasons behind taking this credit card is that people believe that this HDFC diners club Black credit card is available only to premium people because the fee of this credit card is also higher than other HDFC credit cards.

Now it is also true that this Diners Club Black credit card comes under the premium category cards of HDFC Bank.

Therefore, in this article, we will know all the features and benefits of this card in detail and see whether this credit card is beneficial for us in 2024 or not?

Key Points Of HDFC Diners Club Black Credit Card:

HDFC Diners Club Black Credit Card  | |

Joining Fee | ₹10,000 + Taxes |

Annual Fee | ₹10,000 + Taxes |

Annual Fee Waived Off | Spend ₹5 Lakhs in previous year |

Eligibility |

|

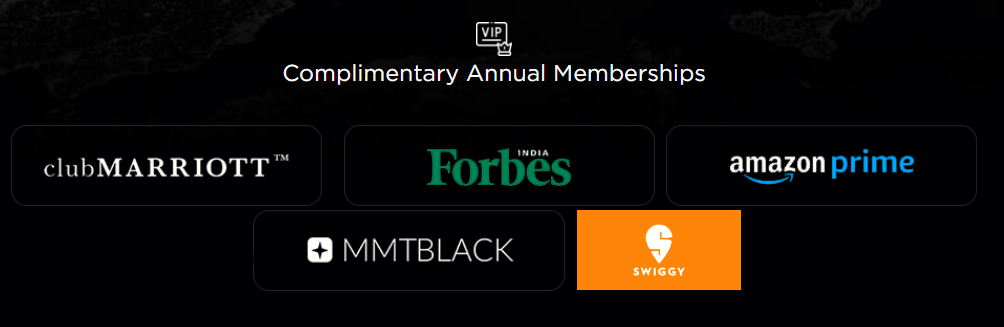

Welcome Benefit | Annual memberships of Club Marriott, Forbes, Amazon Prime, Swiggy One, MMT BLACK |

Milestone Benefit | Ola cabs, cult.fit Live, BookMyShow, TataCliQ vouchers on spends of over Rs. 80,000/month |

Smart Buy Offer | Up to 10X Reward Points |

lounge Access | Unlimited Airport lounge access for primary and add-on card members |

Reward Points | 5 Reward Points for every Rs 150 |

Spend Based Benefits | Get free annual memberships to Club Marriott, Forbes, Amazon Prime, Swiggy One, and MMT BLACK by spending Rs 8 lakhs annually. |

Other Benefits |

|

Features & Benefits of HDFC Diners Club Credit Card:

Welcome Benefit:

In this credit card, you get annual membership of Forbes Digital Subscription, Club Marriott, MakeMyTrip Black Elite Tier, and Amazon Prime as a welcome bonus. And along with this you also get membership of Swiggy One for 3 months. But you will get these benefits only if you have either paid your joining fee of ₹ 10000 or have spent ₹ 1.5 lakh in the first 90 days on this card. Therefore, if for some reason you get this credit card without joining fee, then to claim this welcome offer, you will have to spend Rs 1.5 lakh within 90 days from your Diners Black Credit Card, only then you will be eligible for it.

Annual Benefits:

Whatever benefits are given to you as welcome benefit, you can get them next year also, but for this you will have to spend Rs 8 lakh in a year from your Diners Black Credit Card. If you spend ₹ 8 lakh in a year with this card, then you are given membership of all the services mentioned above free of cost.

Milestone Benefit:

If you spend more than Rs 80,000 in a calendar month with this credit card, you can avail either a 1-month subscription of Cult.fit Live or vouchers worth Rs 500 from BookMyShow, TataCLiQ, or Ola cabs – any two benefits of your choice.

Non spend & Travel Benefits:

In this credit card, unlimited Domestic and International lounge access facility is provided for the primary and add-on card holder. You can access the list of all its Domestic Lounges from here and you can access the list of International Lounges available in this card from here.

Apart from this, you can make bookings for more than 150 airlines and hotels through HDFC Bank’s SmartBuy portal.

Along with this, you get 6 free complimentary Golf Games per quarter in Golf Courses around the world in this card. You can see all its Domestic Golf Courses from here and you can see all its International Golf Courses from here.

Experience the benefits of HDFC Bank’s premier credit card

Spend Based Rewards:

The base reward structure of this credit card is to give 5 reward points on every Rs 150. But you do not get these reward points on categories like Rent, Government Related Transactions, Fuel, Wallet Reloads and EMI. On grocery related transactions you have an upper cap of 2000 reward points per month and on insurance transactions you have an upper cap of 5000 reward points per day. Apart from this, you can see some important capping for its rewards points below.

Rewards Points Capping On This Card:

Max. Reward Points on Grocery Transactions | 2000 RP/Month |

Max. Reward Points on Insurance Transactions | 5000 RP/Day |

Maximum Monthly Points Cap | 75,000 |

Reward Points Validity | 3 Years |

Flight/Hotel Redemptions Cap | 75,000 RP/Month |

Accelerated Rewards:

- In this credit card, you get 2X i.e. 10 reward points for every Rs 150 spent on dining during weekends.

- When you spend with this Diners Black Credit Card on IGP.com and hotels through Smart Buy, you get upto 10X i.e. 50 reward points on every Rs 150 spent.

- And if you spend on Flights and Redbus on Smart Buy then you get upto 5X i.e. 25 reward points on every Rs 150 spent.

- Apart from this, when you spend on IRCTC and Apple Tresor on Smart Buy, you get upto 3X i.e. 15 reward points for every Rs 150 spent.

- When you spend on Flipkart through Smart Buy, you get upto 2X reward points i.e. 10 reward points on every Rs 150 spent.

There is a cap on the reward points you earn through shopping or booking through HDFC Smart Buy with this credit card. By spending through Smart Buy, you can earn a maximum of 2500 reward points in a day and a maximum of 7500 reward points in a month.

Reward Points Redemption:

All the reward points you earn from this credit card can be redeemed against booking hotels, flights and Airmiles, Product Catalogue, Vouchers and statement credit.

- When you book hotels and flights through SmartBuy, you get one reward point worth Rs. 1. Now here you have to keep in mind that you can pay only 70% of the booking amount through reward points and the remaining amount will have to be paid through your credit card. And in a month you can redeem a maximum of 75000 Reward Points for booking hotels and flights on SmartBuy.

- If you redeem your reward points against product catalog and brand vouchers, you get the value of one reward point at Rs 0.50.

- If you redeem your reward points against cashback, then you get the value of one reward point of Rs 0.30. And you can redeem maximum 50000 reward points in a month through cash back only.

- If you redeem your reward points against Air Miles then you get the value of one reward point equal to 1 Airmile.

Fee and Charges of Diners Club Credit Card:

The joining and annual fee of this card is ₹ 10,000 + taxes and if your last year’s expenditure is ₹ 5 lakh or above, then your annual fee is waived.

Late Payment Charges:

Outstanding Amount | Late Payment Charges (Excluding GST) |

Less than ₹100 | Nil |

₹100 to ₹500 | ₹100/- |

₹501 to ₹5,000 | ₹500/- |

₹5,001 to ₹10,000 | ₹600/- |

₹10,001 to ₹25,000 | ₹800/- |

₹25,001 to ₹50,000 | ₹1100/- |

More than ₹50,000 | ₹1300/- |

Other Benefits:

Now, besides these, you also get several benefits with this credit card. However, we won’t consider them as highly effective benefits because some of these benefits are rarely used, and for some, it requires significant effort to avail. Nevertheless, let’s take a look at them –

- Get credit liability cover of Rs. 9 lakh.

- Enjoy 2X rewards on weekend dining.

- Get up to 25% savings on restaurant bills via Swiggy Dine Out.

- Foreign currency markup is 2% on all foreign spends.

- Access exclusive 24/7 concierge services.

- Get 1% fuel surcharge waiver at fuel stations across India.

- Get air accident insurance cover of Rs 2 crore.

- Emergency overseas hospitalization covers up to Rs. 50 lakhs.

- Get travel insurance cover of up to INR 55,000 for baggage delays.

- Enjoy the fast track airport experience.

- Access special rates at some of the finest spas in India.

- Get Small Medium Enterprise (SME) benefits

Now here we have known all the features and benefits of this HDFC Diners Club Black Credit Card. Now let us talk about our opinion whether we should buy this credit card in 2024 or not.

Our Opinion:

Now let’s talk about our opinion, according to us the fees of this card are high as welcome and renewal benefits are available on this card, however the non-spend benefits are decent.

Now talking about the spend base benefits of this card, it has become quite disappointing. In the beginning of this article we had said that this card was once one of the best cards in India. Before Feb 2020, on Smart Buy you used to get 10X reward points on flights, hotels, Amazon, Flipkart and instant vouchers and there was no daily cap and on top of that the monthly cap was also 15000 reward points. So by spending ₹ 45000 on brands and catalog in a month, I used to get a return of ₹ 15000 which was awesome.

There were many such purchases on this card on which 33% return and overall return was above 20% but now those days are long gone. Now if we look at the 33% return, it is available only on hotels and that too only for very limited expenses and earlier the entire booking amount could be paid through points, which has been increased to 70% some time back. The only positive that has come in this card is that many airline and hotel partners have been added but still if you spend on some accelerated categories then you can expect only 5 to 6% returns from this card.

Experience the benefits of HDFC Bank’s premier credit card

→ Repeated devaluation in HDFC over the last 3 years has lowered the card’s return from 22%-23% to 5%-6%. However, when compared to cards like Axis Magnus and HDFC Infinia in the same category, this card falls short.

→ Infinia has also gone through a lot of devaluation but in terms of fees, its fees are easily recovered from the annual benefits. Infinia is marginally better in non-spend benefits and if we talk about returns then still 9 to 10% returns can be obtained from Infinia. Now if we talk about Axis Magnus, its fees are also recovered from the annual benefits and the non-spend benefits are also better than DCB (Diners Club Black) according to us.

→ Among all these cards, the top recommendation will remain Axis Magnus. However, if you cannot get Magnus for some reason and also cannot get HDFC Infinia, you can opt for the Diners Club Black card. If you are getting this card as a lifetime free offer, then definitely go for it. If you already have the Magnus card and need another one, and HDFC Infinia is also not available, then go for the DCB card.