HDFC Millennia Credit Card has been counted among the top cashback credit cards for the last many years and the reason for this is the exclusive features available in this credit card. This HDFC Millennia Credit Card, which is counted in the list of top credit cards, has been greatly liked by the people. Now today in 2024, we have many options for credit cards, even today we get many Lifetime free credit cards which provide us good features even though they are lifetime free. Now keeping all these things in mind, today in this article we will do a deep analysis of this Millennia Credit Card and know whether this credit card is still beneficial for us or not?

Recently, HDFC Bank had devaluation in its Millennia Credit Card and updated its features, hence it is very important to know whether it still makes sense to buy this credit card or not. Also, in this article, we will also know about an alternative to this credit card and see which credit card will be better for you?

Highlights Of HDFC Millennia Credit Card:

HDFC Millennia Credit Card  | |

Joining Fee | ₹1000 + Taxes |

Annual Fee | ₹1000+ Taxes |

Annual Fee Waived Off | Spend ₹1 Lakhs in previous year |

Eligibility |

|

Welcome Benefit | Gift Voucher equivalent to joining Fee |

Milestone Benefit | Get ₹1,00,000 gift voucher quarterly |

lounge Access | 1 Domestic Airport lounge access per quarter |

Reward Points |

|

Dining Privileges | Upto 20% discount on partner restaurants via Swiggy Dineout |

Other Benefits |

|

Deep Analysis Of HDFC Millennia Credit Card:

Fee/Charges And Eligibility:

The joining and annual fee of this HDFC millennium credit card is ₹ 1000 + Taxes, which in total costs you around ₹ 1180. And if you spend one lakh rupees or more in a year through this credit card, then you can get the annual fee of this credit card waived off. And as far as the joining fee of this card is concerned, you are given gift vouchers of BookMyShow, Pizza Hut, Uber, PVR and Big basket equal to that fee. So in this way you can make this HDFC Millennia Credit Card a lifetime free credit card for yourself.

If you want to take this credit card, then your minimum age should be 21 years and maximum age should be 40 years. If you are a salaried person then your monthly salary should be ₹35000 but even if your salary is less than this and your relation with HDFC Bank is good then you can easily get this credit card. And if you are a self-employed person then your per annum ITR should be Rs 6 lakh.

HDFC Millennia Credit Card Reward Points:

HDFC Millennia Credit Card provides you 5% cashback on 10 most popular online sites. These 10 popular sites include big brands like Amazon, BookMyShow, Cult.fit, Flipkart, Myntra, Sony LIV, Swiggy, Tata CLiQ, Uber and Zomato. But you can earn only a maximum of 1000 cashpoints in a month. The most interesting thing about this card is that it is giving you 5% cashback on all the popular sites which we use the most for online shopping.

Apart from this, you get 1% cashback on all online and offline spending and here also you can earn a maximum of 1000 cashpoints in a month. And in this credit card, you get reward points even on those transactions on which other banks do not give any reward points.

Experience the benefits of HDFC Bank’s premier credit card

In this credit card, you also get 1% cashback on EMI, Wallet reload, Insurance, Education transaction, Utility Bills, Jewelery and Gift Cards. And very few credit cards give you the facility of cashback on these categories. Only you do not get any cashback on transactions related to Government Payment, Fuel and Rent.

HDFC SmartBuy Offer:

If you purchase Hotels, Flights, Bus & Train Tickets, Nykaa, Zoom Car, Apple Products and Gift cards of popular brands with this HDFC Millennia Credit card on HDFC SmartBuy, then you get additional 5% reward points. That is, you normally get 1% reward points (cashback) and by including the additional 5% reward points available on SmartBuy, you get a total of 6% reward points on spending on HDFC SmartBuy, which is amazing.

Apart from this, when you spend on IGP.com and Jockey products at HDFC SmartBuy with this HDFC Millennia Credit Card, you get additional 10% reward points. That means here you get total reward points of 1% + 10% = 11%.

Reward Points Redemption:

You can redeem the reward points or cash points earned from this card against Statement credit, Hotel and Flights Booking through SmartBuy, Gift Vouchers and Air Miles. You will find the value of reward points different at all these places.

- If you redeem these reward points against statement credit, you will get the value of one reward point equal to ₹1.

- If you book hotels or flights on HDFC SmartBuy through these reward points, then you get the value of one reward point equal to ₹0.30.

- If you use these reward points to purchase Product Catalog or Gift Vouchers on HDFC SmartBuy itself, then you get the value of one reward point equal to ₹0.30.

- Along with this, if you redeem these reward points against air miles, then you get the value of one reward point 0.30 air miles.

Now when you redeem these reward points at these different places, you also get to see some capping in it.

- If you redeem these reward points against real cashback or statement credit, you can redeem a maximum of 3000 reward points in a month. And the minimum Cash Points balance required for redemption against the statement balance is 500 Cash Points.

- Along with this, if you redeem these reward points against hotels or flights through HDFC SmartBuy, then you can earn a maximum of 50,000 reward points in a month.

- When you redeem your reward points against hotels and flights on HDFC SmartBuy, you can pay a maximum of 50% of the total amount through these reward points and you will have to pay the remaining amount from your card only.

- When you spend these reward points on Gift Cards or Product catalog on SmartBuy portal, you can pay maximum 70% of the total amount through your reward points and you will have to pay the remaining amount from your card only.

Welcome Benefit:

If you pay the joining fee of this HDFC Millennia Credit Card, you get a gift voucher of Rs 1000 from popular brands like Big basket, BookMyShow, Uber, Pizza Hut and PVR. But you will get this welcome benefit only if you pay its joining fee.

We are saying this because many people get this Millennia Credit Card without any joining fee and they just have to pay the annual fee of this card. Therefore, such customers cannot avail of this welcome benefit.

Milestone Benefit:

Apart from this, if you have spent ₹ 1 lakh or more in any calendar quarter with this credit card, then you get a gift voucher of Rs 1000 from brands like Big basket, BookMyShow, Uber, Pizza Hut and PVR.

HDFC Millennia Credit Card Lounge Access Facility:

In this credit card, earlier you could easily get 8 airport lounge access in a year, but some time ago, HDFC Bank had done devaluation in this card, in which they have almost removed the lounge access features of this credit card.

Although the facility of lounge access is still present in this credit card, HDFC Bank has put a huge condition to make it available. If you spend ₹1 lakh or more in a quarter, you are given a complimentary lounge access at some selected airports. You can see below the list of Airport Lounges available in HDFC Millennia Credit Card.

State | City | Lounge | Terminal | Terminal No. |

Delhi | New Delhi | Enclam Lounge | International T3 | Terminal 3 |

Delhi | New Delhi | Enclam Lounge | Domestic T3 | Terminal 3 |

Maharashtra | Mumbai | (MALS) Travel club lounge | Domestic T2 | Terminal 2 |

Maharashtra | Mumbai | Loyalty Lounge (Clipper) | International | Terminal 2 |

Tamil Nadu | Chennai | Travel Club Lounge B | Domestic | Terminal 1 |

Tamil Nadu | Chennai | Travel Club Lounge A | Domestic | Terminal 1 |

Tamil Nadu | Chennai | Travel Club Lounge | International | Terminal 2 |

Tamil Nadu | Chennai | Travel Club Lounge | Domestic | Terminal 4 |

West Bengal | Kolkata | Travel Club Lounge | Domestic | Terminal 1 |

Karnataka | Bangalore | BLR Domestic Lounge | Domestic | Terminal 1 |

Telangana | Hyderabad | Enclam Lounge | Domestic | Terminal 1 |

Telangana | Hyderabad | Enclam Lounge | International | Terminal 1 |

In our opinion, there is no need to spend ₹1 lakh a quarter to avail the facility of lounge access. Naturally, if you ever spend ₹ 1 lakh from your card in any quarter, then you can avail this facility, otherwise there are better options available for lounge access.

How to get HDFC Millennia Credit Card for lifetime free?

If you apply for this credit card online, then depending on your profile it is possible that you may get this credit card either first year free or lifetime free. We are saying this because many customers have got this credit card either lifetime free or first year free depending on their profile.

But if for some reason you do not get this credit card lifetime free, then you can apply for it by paying its joining fee. After this, after using this credit card regularly for four-five months, you can call the customer care of HDFC Bank and request to make this credit card lifetime free for yourself. And in many cases such requests are easily accepted. Apart from this, you can also request it through email to HDFC Bank.

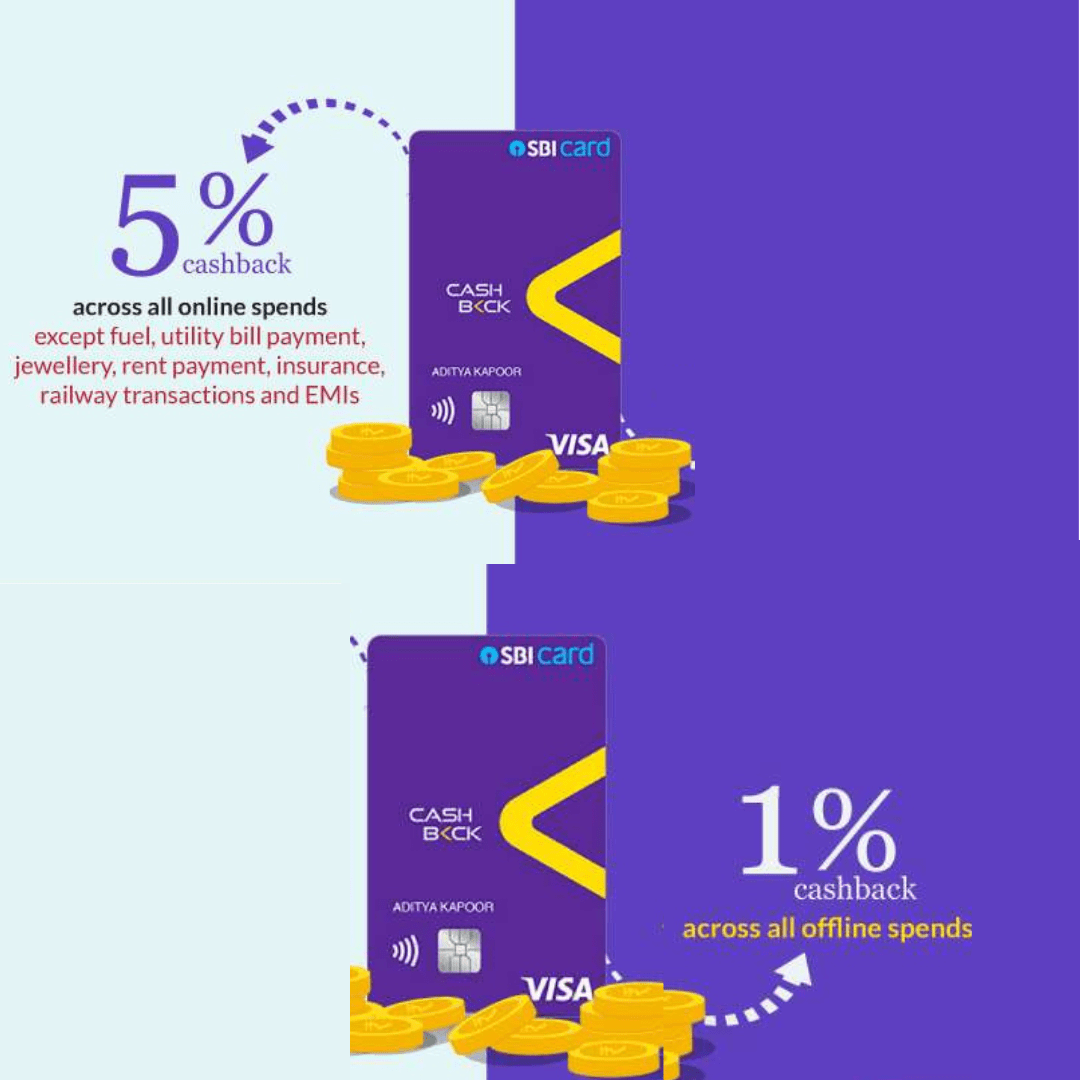

Best Alternative:

Now here comes the question that if we do not get HDFC ‘millennia’ credit card or we do not want to get it, then which other credit card should we apply for in its place? Friends, in today’s time, one of the best alternatives to HDFC Millennia Credit Card is SBI Cashback Credit Card. This SBI Cashback Credit Card also provides you 5% cashback on online shopping and 1% cashback on offline spending. In this card, you can earn maximum cashback of up to ₹ 5000 in 1 month by combining both online and offline spendings.

With this SBI Cashback Credit Card, you also get joining and annual fee of ₹ 999 + Taxes and if you spend Rs 2 lakh in a year with this card, then its annual fee is also waived off.

Apply SBI Cashback Credit Card before the exclusive offer ends