In this article, we are going to talk about HDFC Times Platinum Credit Card, a very popular co-branded basic level credit card of HDFC Bank. This credit card comes with an affordable fee and you get to see many premium features in it. HDFC Bank has two co-branded credit cards with Times Group – HDFC Times Credit Card and HDFC Times Platinum Credit Card and both these credit cards are multiple award winning credit cards. These two credit cards have received many awards.

On both these credit cards, you get amazing benefits on categories like shopping, dining, entertainment. But today in this article we will learn about this Times Platinum Credit Card of HDFC and describe its features one by one.

A Quick Overview Of HDFC Times Platinum Credit Card:

HDFC Times Platinum Card Key Highlights  | |

Joining Fee | Rs. 1000 + Taxes |

Renewal Fee | Rs. 1000 + Taxes |

Renewal Fee Waive Off | Previous Year Rs. 2,50,000 Spend |

Eligibility | For Salaried: Age: 21 years to 60 years Net monthly income: Rs 35,000 & above For Self Employed: Age: 21 years to 65 years Annual Income should be Rs 6,00,000 & above |

Cashback & Reward Points |

|

Reward Points Validity | valid only for 2 years |

Lounge Access Benefits | No |

Dining Benefits | Extra discount of Rs1500 on Eazydiner upto 30% discount at selected restaurants |

Additional Benefit |

|

Contactless Payment Technology | Enabled |

Detailed Explanation of HDFC Times Platinum Credit Cards features:

Now let us know all the features in detail –

Welcome Benefits:

On this HDFC Times Platinum Credit Card, you will get complimentary Times Prime annual membership for one year, which is worth Rs 999. If you want to avail this benefit on your credit card, then you will have to do at least one transaction with this credit card in a calendar quarter, only then you can avail this benefit.

Along with this, you get a gift voucher of ₹ 5000 as a welcome benefit on this credit card, which you can avail from different categories. For example, if you want, you can take gift vouchers for shopping or gift vouchers for apparel or you can take gift vouchers for dining. Apart from this, you can select your favorite gift vouchers from different categories.

Entertainment and Dining Benefits:

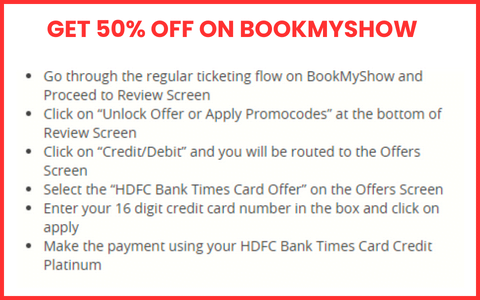

If you purchase any movie ticket from BookMyShow app or website using this credit card, you will get 50% off upto Rs 600 and you can avail this offer 4 times in a month. If you take full advantage of this benefit, you can get a maximum benefit of ₹ 2400 in a month on BookMyShow alone. But now HDFC Bank has paused this offer on BookMyShow indefinitely, which will probably be resumed after some time.

Apart from entertainment, you also get some dining benefits on this credit card, with the help of which you can get a discount of ₹ 1500 on Eazydiner. Because on this credit card you get six months membership of Eazydiner. So, if you make payment through PayEezy App anywhere on Eazydiner with this credit card, then you get additional 15% off.

If you spend on dining by visiting some selected restaurants of HDFC Bank and you pay for your bill through Dineout App, then you get a discount of up to 30%.

Experience the benefits of HDFC Bank’s premier credit card

Reward System of This Credit Card:

In this credit card, you get 3 reward points for every Rs 150 spent in every category. And if you spend on dining on weekdays using this credit card, you will get 10 reward points for every Rs 150. Along with this, if you pay any utility bill or do any shopping through SmartBuy or SmartPay using this credit card, then you get direct 5% cashback.

If you spend on grocery category using your credit card, you can earn maximum 1000 reward points in a month. With this, if you do any fuel transaction using your credit card or you reload any of your wallet or if you convert any of your transactions into EMI, you will not get any reward points on all these categories.

You get to see a very important benefit on this credit card, which is insurance benefit. That means, if you pay your insurance premium using this credit card, you are given reward points on it too, but you get to see a capping on this. If you pay the premium of any insurance using your HDFC Times Platinum Credit Card, you can earn a maximum of 2000 reward points in a day. Now if seen, this limit is a very big limit.

You get this benefit in very few credit cards because most of them do not provide any reward points or cashback on paying insurance premium through credit cards. So, if you want a credit card that will provide you good reward points on paying your insurance premium, then you can consider this credit card. Along with this, if you do any transaction related to your rent through this credit card, then you get a charge of 1% on it.

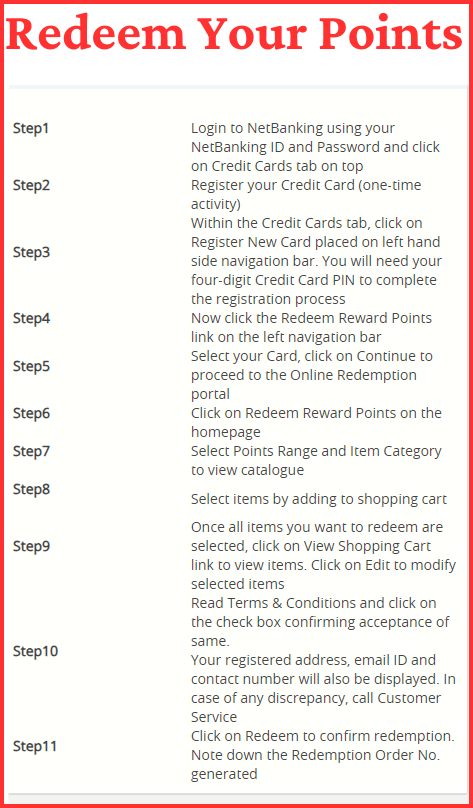

Reward Points Redemption Process:

The validity of all the reward points you get on this credit card is 2 years, that is, you have to redeem your reward points within 2 years, otherwise they will expire. If you want, you can redeem all the Rewards points you earn from this credit card against different categories by going to the product catalog of HDFC. Now if you redeem your reward points in different categories, you will also see different values of your reward points.

You can also redeem your reward points by logging into your HDFC net banking and you can also redeem your reward points through post.

Additional Benefits:

If you fill fuel in any fuel station in India with this credit card, you get a waiver of fuel surcharge of 1% but we will not consider this benefit as a very unique benefit because you can find this facility on almost all credit cards. For this 1% fuel surcharge waiver, your transaction value should be between Rs 400 to Rs 5000. And you can get maximum fuel surcharge waiver of only Rs 250 in a month.

But the biggest drawback of this credit card is that it does not provide you any travel benefit or any kind of lounge access, even HDFC Bank provides you four complimentary lounge access in its Millennia Debit Card. But it is a debit card and here this facility is not being given to you even in a credit card, now only HDFC Bank knows the reason behind this.

What is the Charges of HDFC Times Platinum Card?

The joining fee and annual fee of this Times Platinum Credit card is exactly the same which is Rs 1000 + Taxes. Now in exchange of joining fee you get welcome gift vouchers worth Rs 5000. And if you want to get your annual fee waived off, then you will have to spend Rs 2.5 lakh or more on this credit card in a year, only then you will be able to get your annual fee waived off.

Eligibility And Guidance For Applying:

If we talk about the eligibility criteria of this credit card, then if you are a salaried person then your age should be between 21 years to 60 years and your monthly income should be Rs 35000 or more. And if you are a self-employed or businessman then your age should be between 21 years to 65 years and your annual income should be Rs 6 lakh or more, only then you will be able to apply for this credit card.

Now since it is a co-branded basic category credit card of HDFC Bank, the chances of it getting approved are high. For this, your CIBIL score should be 750+ so that the chances of your application being rejected will be greatly reduced.

Final words:

Now as we have told you that HDFC Times Platinum Credit Card is a basic revolutionary co-branded credit card and despite that the credit card is very popular, there is only one reason for this and that is the amazing features of this credit card. The joining fee of this credit card is also returned to you in the form of welcome gift vouchers. According to its features, it is an all-rounder credit card because this card provides you multiple benefits, so if this credit card suits you according to your requirement, then you can apply for it.